Best Penny Stocks To Buy Now? 7 Hot Reddit Stocks To Watch

Some of the best penny stocks to buy now may not even be ones that you’ve seen before. Sure there are plenty of trends that keep certain stocks in the spotlight. But with the new month, there seems to be an entirely new crop of cheap stocks to watch. Regardless of what may have happened in broader markets, stocks under $5 typically move independently of general trends.

There’s no lack of momentum in the stock market today, with small- and mid-cap stocks gaining ground thanks to retail interest. The critical part to remember, especially with all of this excitement, is setting some goals. Let’s face it; there’s a lot of noise out there. Platforms like Webull or social and discussion board sites like StockTwits and Reddit can make it difficult to focus. That’s especially true during weeks like this where a lot is going on.

Should you focus on electric vehicles stocks because Tesla (NASDAQ:TSLA) is in the spotlight? Are alternative energy, solar, and ESG stocks “next,” and you should get ahead of the curve? What about Bitcoin prices surging? Oh, and who can forget the random, low float penny stocks take dramatically shift attention even for a fleeting moment? There’s a lot of noise out there, as I’m sure you’ve seen.

– Robinhood Hacked in Massive Data Breach Exposing Millions of Customers

So, yes, as mundane as it may be, having a strategy in place before deciding on penny stocks to buy can help cut through any confusion. In this article, we’ll look at seven stocks gaining attention on popular message board sites, what could be a catalyst, and any recent events that could be important to make a note of. Once you’ve got the info, then you can decide for yourself if they’re the best penny stocks to buy now or avoid entirely.

7 Penny Stocks To Buy [or avoid]

- CBAK Energy Technology Inc. (NASDAQ:CBAT)

- Liquidia Corporation (NASDAQ:LQDA)

- Inspira Technologies (NASDAQ:IINN)

- CarLotz Inc. (NASDAQ:LOTZ)

- Metromile (NASDAQ:MILE)

- Innoviz Technologies Ltd. (NASDAQ:INVZ)

- Powerbridge Technologies (NASDAQ:PBTS)

1. CBAK Energy Technology Inc. (NASDAQ:CBAT)

Electic vehicles stocks are hot at the start of the week. Most companies with some exposure to the entire supply chain saw a spark on Monday. In CBAK Energy’s case, the company’s “exposure” comes from lithium-ion battery manufacturing and electric energy solutions provided to its customers.

In addition to the overall sector sentiment, CBAT stock has gained ground thanks to anticipation of its next round of earnings. This week on November 12, the company delivers results before the market opens.

The fact that the $1.2 trillion infrastructure bill calls for $7.5 billion of funding to create EV infrastructure, it makes sense as to why this niche has gained ground. The big question is what will CBAK’s quarterly results show, and will this stock’s momentum continue?

2. Liquidia Corporation (NASDAQ:LQDA)

On a completely different side of the coin, Liquidia Corporation gained ground after the biotech company announced a big development involving the FDA. Specifically, Liquidia was granted tentative approval for its YUTREPIA inhalation powder by the Administration. What does this do for the company?

According to Liquidia’s Chief Medical Officer, Dr. Tushar Shah, “The tentative approval for YUTREPIA is another step toward providing an important option for patients with PAH in the U.S. We believe YUTREPIA can improve the limitations of current nebulized therapies by allowing the administration of an expanded dose range of inhaled treprostinil using a proven, convenient, palm-sized device.”

If you recall, a few days ago, LQDA stock was on the list of penny stocks to watch following the FOMC meeting. One of the key highlights centered on the company’s LIQ861 treatment for pulmonary arterial hypertension, known as YUTREPIA. Since this news came out, LQDA stock has tested 2021 highs to start the week. Analysts including Needham responded to this milestone, raising its target to $8.

3. Inspira Technologies (NASDAQ:IINN)

Another one of the penny stocks analysts have grown bullish on recently is Inspira. If you’re a trader, you likely caught word of this stock late last month. Shares exploded from under $3 to over $9.50 within a single session. The primary catalyst originated from the news that the company entered the European market through a new strategic agreement. This was with Waas Group to deploy Inspira’s ART Systems. These act as Artificial Lungs for patients suffering from severe respiratory issues.

Just as quickly as the penny stock jumped, it came back down during the days to follow. However, heading into the middle of the month, IINN stock has begun rebounding. This comes just a few days after Aegis Capital adjusted its price target on the stock to $10 from $9. The firm also maintains a Buy rating on the stock.

Providing services to more than 40 companies and devices globally, it will be interesting to see how the deal with Waas unfolds. According to Inspira’s October PR, Siemens Healthineers (OTC:SMMNY) and Dragerwerk are among the list of companies included WaaS Group’s service network.

– 5 Penny Stocks To Watch Right Now With High Short Interest

4. CarLotz Inc. (NASDAQ:LOTZ)

With earnings season in full swing, I couldn’t go the entire article without mentioning at least one penny stock with results out. CarLotz Inc. has been in and out of focus thanks to numerous trends in the stock market recently. The big breakout of Avis/Budget (NASDAQ:CAR) last week sent sympathy momentum into the market for LOTZ stock. Shares briefly spiked to highs of $4.75 before pulling back with the rest of the niche.

Heading into the week, LOTZ stock could be on the watch list for a different reason. The company reported its Q3 earnings after the bell on Monday. CarLotz reported a net revenue increase of 128% compared to Q3 2020. It beat earnings per share estimates by a wide margin as well.

“While the chip shortage has caused a disruption to our consignment business model, we are focused on maximizing returns on the significant investments we have made this year…We firmly believe in our long-term consignment business model and the opportunity to provide value to our corporate sourcing partners and retail buyers and sellers.”

Michael Bor , Co-Founder and CEO of CarLotz .

The company also expects improved quarterly performance in retail units in Q4 compared to Q3. But this was the furthest the company was willing to go as far as guidance due to the ongoing chip shortages.

5. Metromile (NASDAQ:MILE)

One of the exciting things about penny stocks is that they usually have to do with early-stage or smaller companies. With this as a base case, the potential for buyouts or mergers & acquisitions isn’t uncommon. The important part is finding where the potential lies, which isn’t as easy as you might think.

Metromile is a company that we started following back in September. Its platform hinges on an auto insurance platform based on a pay-per-mile model. The company also licenses this technology to other insurance companies supported by Metromile’s cloud-based software-as-a-service.

This week MILE stock could be back in the spotlight for more than just its insurance technology. NYSE-listed Lemonade (NYSE:LMND) and a formerly popular meme stock broke the news that it plans on acquiring Metromile. According to the company, the all-stock transaction would suggest “a fully diluted equity value of approximately $500 million, or just over $200 million net of cash.”

What’s more, Metromile shareholders will receive Lemonade common shares at a ratio of 19:1. With the transaction expected to close by Q2 next year, regulatory approval still needs to be secured. There’s also a shareholder vote requiring approval by Metromile’s shareholders. Regardless, it could be something to keep tabs on if MILE stock is on your list right now.

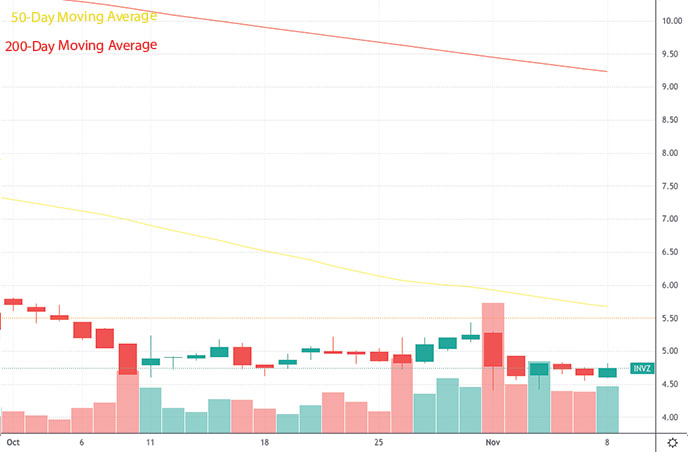

6. Innoviz Technologies Ltd. (NASDAQ:INVZ)

EV technology has spawned some incredible off-shoots in automotive technology. One of these has to do with self-driving vehicles. Innoviz specializes in LiDAR sensors, which are more frequently used in self-driving applications. Similar to MILE, INVZ stock has gained some attention after recent deal-making news with a bigger company. This week, it announced that it will collaborate with JueFX.

They are an AI tech company developing an LBS data engine and offering on-board applications for autonomous driving. InnovizOne LiDAR will be installed on traffic poles and bridges to monitor traffic activity in real-time. JueFX’s V2X technology will go on to share the data with autonomous vehicles on roads for enhancing safety for drivers as well as improving traffic flows.

In addition to this, Innoviz also inked a deal to support the NVIDIA (NASDAQ:NVDA) DRIVE platform designed for the transportation industry. “Our collaboration with NVIDIA allows customer access to Innoviz’s leading LiDAR solutions,” said Oren Rosenzweig, Chief Business Officer and Co-Founder of Innoviz, in a press release on November 9. “Our participation as an ecosystem partner marks another major step in our mission to integrate LiDAR with the most prominent software and driving infrastructure in the world.”

With this news, INVZ stock has gotten a bit more attention.

7. Powerbridge Technologies (NASDAQ:PBTS)

Finally, considering the surge in the price of Bitcoin and other cryptos, related stocks have also come into focus. Powerbridge aims to stake its claim in the growing digital ecosystem. This includes everything from purchasing Bitcoin and Ethereum mining rigs to offering Software-as-a-Service and blockchain applications.

– Best Metaverse Penny Stocks to Buy? 3 to Watch Right Now

The latest launch of its Hong-Kong crypto mining has put a bigger focus on its Bitcoin and Ethereum mining efforts. Its Powercrypto subsidiary plans on deploying 2,600 mining rigs. What’s more, is the focus of the company is on using environmentally-friendly green and sustainable energy to power its operations. Adding to this effort was Powerbridge’s new FXOS operating system, which is designed to increase mining efficiencies compared to other platforms.

Stewart Lor, the President of Powerbridge Technologies, explained in a press release, “As we are deploying our crypto mining machines, having our own mining OS is equally important in our efforts to develop a network of mining operations with higher-than-market ETH mining efficiency.”

Thanks to new all-time highs in BTC and ETH this week, cryptocurrency penny stocks like PBTS have come into focus.

Best Penny Stocks To Buy

There’s no definitive answer to the question, “what are the best penny stocks to buy right now?” Though there are certain things, you can do to define “the best” names to put on your watch list. It all comes down to your strategy and goals in mind. Whether you’re looking for a quick scalp or a multi-day swing, different techniques will help you determine which stocks may be the best based on your game plan.