Penny Stocks To Buy: 6 Insider Picks Before 2023

Penny Stocks To Buy According To Insiders

Whether you’re trading higher-priced or penny stocks, the year-end trends are mixed in 2022. While some may presume tax-loss selling is going to weigh heavier, others are loading up on their current holdings. In this article, we look at a few notable insiders who are doing the latter. It also extends the list of penny stocks from our article, “3 Top Penny Stocks To Buy According To Insiders Before 2023.”

With less than two weeks left before 2023, it may be interesting to see insiders buying stocks instead of selling. Will this be the right choice in the face of higher inflation and a pending recession? Time will tell.

But for now, sentiment is a bit more upbeat in a few of these penny stocks thanks to a vote of confidence from some of the people closest to the underlying operations. I’ll also include an overview of how you can find insider trading and institutional buying activity on your own so that you, too, can identify this type of data.

Insider Trading Penny Stocks To Watch

Astra Space Inc. (ASTR)

Space stocks haven’t “gone to the moo,n” as the FinTwitters will say. Many of the most-anticipated, intergalactic-related stock IPOs have fallen on deaf ears since their public debuts. A good majority are also trading at a fraction of their IPO price,s with plenty now trading as penny stocks. Astra Space is one of the previously hot space stocks to watch last year that now trades well below $1. Does this mean it isn’t worth watching? That’s something I’ll let you decide on. But there are a few things that some focus on in terms of developments.

The most recent update highlighted management transitions for Astra Space. The moves come just a few weeks after it reported third-quarter earnings results, which included a much-awaited business update. In it, CEO Chris Kemp explained, “We continue to focus on executing our long-term strategic plan. Specifically, a successful test flight of Rocket 4 and scaling delivery of our Astra Spacecraft Engines™ are our primary near-term objectives. We have completed the build-out of our rocket production facility in Alameda, CA, including the provisioning of test infrastructure for the development of Launch System 2. We are also excited to welcome Airbus OneWeb Satellites, Maxar Technologies, and Astroscale as Astra Spacecraft Engine™ customers, among others.”

– 10 Top Penny Stocks To Watch With High Short Interest This Week

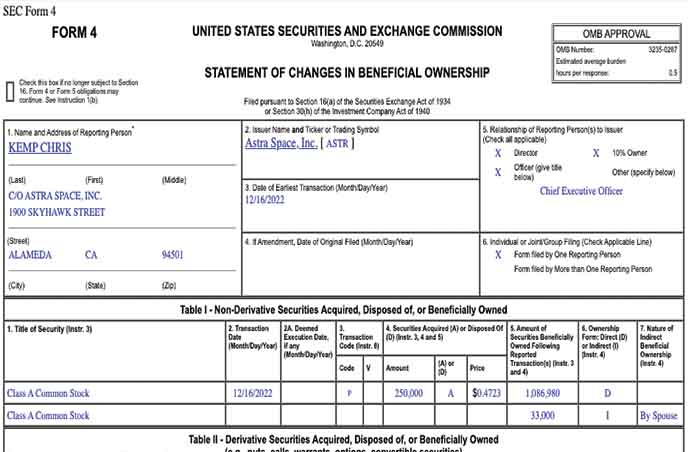

Kemp is also in focus this week, but it isn’t from any company press. The CEO filed a Form 4 this week showing his purchase of 250,000 shares of ASTR stock at an average price of $0.4723. This brought his direct holdings to more than 1.08 million shares.

X4 Pharmaceuticals Inc. (XFOR)

This month, X4 saw analysts at Piper Sandler initiate coverage on its stock. The firm gave an Overweight rating and set a $3 price target. The rating came right before X4 presented at the ASH 2022 meeting. The company outlined how it sees a clear opportunity for its mavorixafor in treating chronic neutropenia.

CEO Paula Ragan, Ph.D., also explained several highlights of its latest clinical trial results. In a December update, Regan said, “Our chronic neutropenia-related presentations at this year’s ASH meeting not only highlight continued positive clinical data but also strengthen our belief that there is a sizeable group of diagnosed patients in the U.S. who could benefit from an innovative, oral treatment. We look forward to continuing our advancement of mavorixafor in multiple chronic neutropenic indications and expect additional data in the first half of next year will inform the potential clinical path forward.”

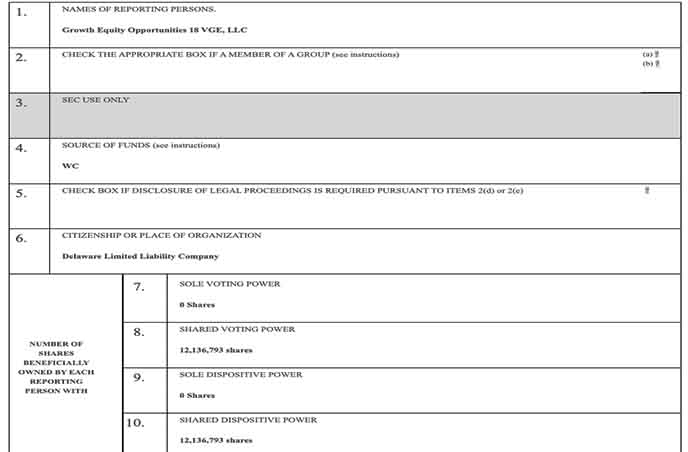

In light of this, it’s interesting that some institutional activity has started raising eyebrows. Specifically, an amended 13D filing came out this week, Growth Equity Opportunities showing it purchased shares in a recent financing round. The latest purchase brought Growth Equity’s holdings to more than 12.1 million shares of XFOR stock.

SoFi Technologies inc. (SOFI)

Digital banking company SoFi Technologies has gone through what many growth stocks have faced this year. Heavy selling pressure and pessimism stemming from economic conditions brought shares to fresh lows. However, the latest action has seen shares trading slightly higher heading into the holidays. SOFI stock has bounced from lows of $4.24 on December 7th to as high as $4.97 last week.

One of the main focus points has remained SoFi’s recent earnings beat. The company posted a better-than-expected loss while also upping guidance. While the company remains under pressure due to the impacts of the student loan moratorium, SoFi is expecting momentum into 2023.

Specifically, SoFi stated, “Management now expects full-year 2022 adjusted net revenue of $1.517 1.522 billion (up from $1.508-1.513 billion previously) and full-year adjusted EBITDA of $115-120 million (up from $104-109 million previously). This marks the third quarter of a positive revision to full-year 2022 financial guidance despite extensions of the student loan moratorium throughout the year.”

– 5 Top Brokerages For Trading Penny Stocks In 2023 – Pros & Cons

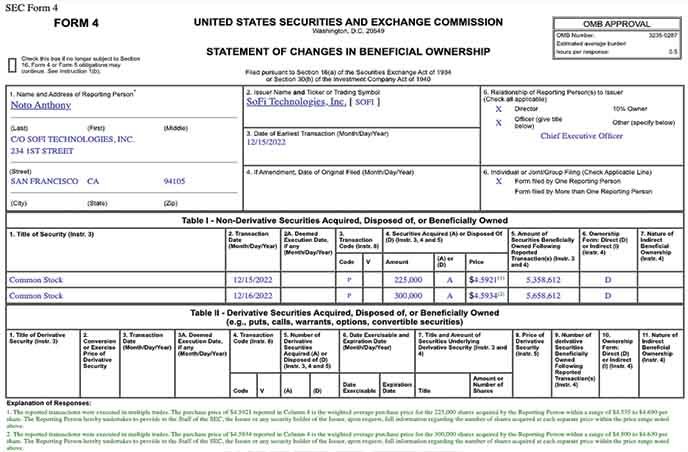

This month, CEO Anthony Noto has been loading up on SOFI stock. He first reported purchasing more than 1.134 million shares via trades conducted on December 9th, 12th, and 13th. Another Form 4 filed this week shows Noto purchasing another 525,000 shares of SOFI stock between December 15th and 16th. These trades brought his total direct holdings to more than 5.35 million shares from more than $7.4 million in buying.

List Of Penny Stocks To Buy (according to insiders)

- Astra Space Inc. (NASDAQ: ASTR)

- X4 Pharmaceuticals Inc. (NASDAQ: XFOR)

- SoFi Technologies inc. (NASDAQ: SOFI)

- VolitionRx Limited (NYSEAMERICAN: VNRX)

- Akebia Therapeutics (NASDAQ: AKBA)

- Exicure Inc. (NASDAQ: XCUR)

How To Find Institutional & Insider Trading Activity

If you want to find companies to add to your list of penny stocks with insider activity, the first step is knowing how to identify the activity in the first place. The short answer is to look at SEC filings. Due to rules set forth by the Securities and Exchange Commission, insiders and institutional investors must submit certain filings whenever they buy or sell specific stocks.

Below is a breakdown of a few different filing types to learn about, which will help you better identify insider activity:

Form 4 Filing

According to the Securities And Exchange Commission, Form 4 is a “statement of changes in beneficial ownership.”

It must get filed with the commission whenever a material change happens in the holdings of a company’s insiders.

Schedule 13D, Schedule 13G, and Schedule 13F Filings

These Schedules involve parties reporting ownership of stock over 5% of a particular equity class in a company. The SEC defines Schedules 13D and 13G as beneficial ownership reports: “The term ‘beneficial owner’ is defined under SEC rules. It includes anyone who shares voting or investment power directly or indirectly (the power to sell the security).”

These filings would be highlighted by traders looking for “Whale” trades as they generally connect to significant funds or investment trusts.

- A Schedule 13D gets filed by an “active investor” who owns more than 20% of a company’s outstanding shares.

- A 13G pertains to “passive investors” owning less than 20% of a company’s outstanding shares. Once a “passive investor” reaches over 20% of the OS, they must start filing 13D statements. These are important because we’ll see which large funds or investors are taking a more significant position in a company. These typically lift sentiment for a given company.

- Schedule 13F filings are where things get fun. 13Fs are quarterly reports required to be filed by institutional investment managers with at least $100 million in assets under management.

Read more about filings here: Penny Stocks & Due Diligence: Understanding Important SEC Filings.