The Best Penny Stocks For 2021? 4 Small-Cap Stocks Under $5 To Watch

Small Cap Stocks To Watch Right Now

Throughout 2020, penny stocks have seen widespread attention. There are several reasons why this is the case. For one, the massive-stay-at-home orders mean that more people stuck home looking for ways to make money. Combine this with the popularization of digital trading platforms like Robinhood, and we see that there are more retail investors than ever before.

In addition to this, the fact that penny stocks are all under $5, means that the barrier to entry is quite low. But, with so many stocks floating around, how can investors choose the best ones? Well, there are a few ways to go about this. The most important thing to consider is that the best investors are always the ones with the most information.

So, diligence is important. As they say “the more you know…” It can help mitigate potential short and long-term risks if applied correctly. Of course, one thing to keep in mind is that because penny stocks are under $5, they are subject to greater degrees of volatility than many other securities. This, however, can be used as an advantage by those who trade penny stocks vs others investing in blue-chip stocks. The long and short of it is that volatility lends itself to quicker percentage changes. In turn, this can clearly lead to a swing win in the market. With all of this in mind, let’s take a look at four penny stocks to watch before January 2021.

Penny Stocks To Buy Under $5

- Luokung Technology Corp. (LKCO Stock Report)

- Energy Fuels Inc. (UUUU Stock Report)

- Vislink Technologies Inc. (VISL Stock Report)

- Allied Esports Entertainment Inc. (AESE Stock Report)

Luokung Technology Corp. (NASDAQ:LKCO)

Luokung Technology Corp. is one of the biggest gainers of the day on December 23rd. During the trading day and into after-hours, shares of LKCO shot up by around 73%. While there wasn’t any announcement that made LKCO rise during the day, the company has made some big announcements in the past few months. On December 9th, the tech company reported that it will be working with Yiting to offer location-based marketing services for over 90,000 gas stations within China. For some context, Luokung works as a big data company providing IoT services as well as geographic information. With this, it is able to offer the capabilities of smart city infrastructure as well as all of the back end information to support it.

Read More

- 10 Electric Vehicle Stocks You Might’ve Missed & They’re Penny Stocks

- Top Penny Stocks to Buy Today? 4 Tech Stocks To Watch In December

In the deal mentioned above, the company will provide marketing services for a large range of gas stations that span mainland China. This includes offering services for each individual gas station to offer personalized marketing services, gas related products, and personalized landmarks.

This may sound complicated, but it is simply a large conglomeration of services that the company offers. Because it is so broad, some investors believe that Luokung Technology could stay competitive. With the half-day before the long weekend, will LKCO be on the list of penny stocks to buy or avoid right now?

Energy Fuels Inc. (NYSEAMERICAN:UUUU)

Energy Fuels Inc. is one of a large range of energy penny stocks that rose big on Wednesday, December 23rd. During the trading day and into after-hours, shares of UUUU stock shot up by over 11%. Energy Fuels Inc. works as a part of the alternative or clean energy market. The big news here comes as Congress announced that it would extend a $0.50 credit per gallon of fuel to those utilizing renewable gas or natural gas.

This is a big deal as it relates to the scale of how many gallons of fuel these companies are selling. While Energy Fuels doesn’t work in traditional fuel markets, it does produce and supply uranium. In the announcement made by congress, around $35 billion in subsidies will be utilized for nuclear energy. This includes roughly $6 billion that will go toward restoring old nuclear plants to up and running operations.

If all that wasn’t enough, on December 23rd, the government announced that it would be supplying $75 million in funding for the use of producing a large uranium reserve in the U.S. All of this means that Energy Fuels could have potential if all goes well. In the past six months, shares of UUUU stock are up by around 160%. With all of this in mind, will this be on your list of penny stocks before next year?

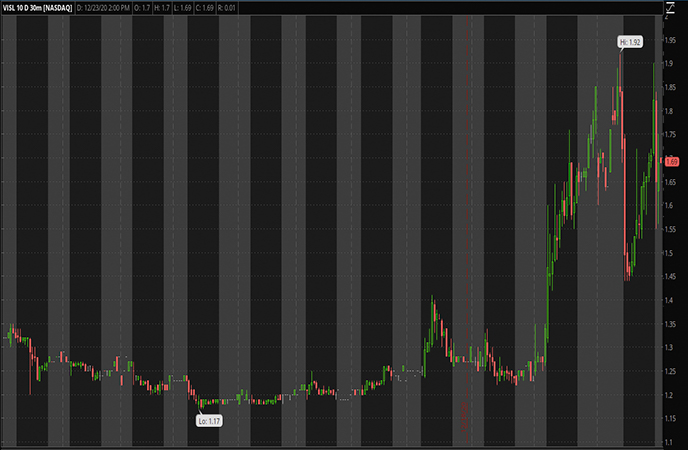

Vislink Technologies Inc. (NASDAQ:VISL)

Vislink Technologies Inc. is a company that provides live entertainment and high quality to a wide range of screens. The company states that its operations are global, as it provides everything from live news to sports and more. In addition to this, Vislink is also a provider of software to defense and surveillance markets. The company also notes that it has a long history of experience in everything from satellites to fiber optics and terrestrial microwave services.

Last month, Vislnk announced that it joined the Grass Valley Technology Alliance. Mickey Miller, the CEO of Vislink Technologies stated that “as the global pandemic continues to isolate viewers, fans and spectators, joining the GVTA allows Vislink to plug into a complete ecosystem of like-minded certified partners dedicated to bringing viewers closer to the action through rich, compelling content through immersive production and the proliferation of remote broadcasting.”

Vislink has stated that its product, the INCAM-HG Integral Wireless Camera Transmitter, can be put to use in a wide range of TV audiences. During the pandemic, the use of digital services has increased greatly. This means that Vislink has increased in popularity as well during the same period. But for the foreseeable future, it looks like Vislink may have carved out a solid niche for itself. Wednesday marked the continuation trend in a weeklong upswing in price.

Allied Esports Entertainment Inc. (NASDAQ:AESE)

Allied Esports Entertainment Inc. is another entertainment company. It provides a global network of sports entertainment to various providers around the world. This is done through community hubs and a large range of content production facilities. In addition to this, the company has a large holding of Esports facilities across North America, Europe, China, and more.

[Read More] Top Penny Stocks To Watch If You’re Looking For Biotech Stocks

This includes the HyperX Esports Arena in Las Vegas as well as many more. The company recently announced that it will be launching a 24-hour schedule to provide original content across its channels. In the pilot program of the new strategy, the company was able to bring in roughly 2 million live views. Since then, the company has stated that it will begin rolling out this system across its channels, competitions, and community-organized events.

This may seem like a new business model and that is because it has only existed for a few years. But in that time, the viewership of Esports entertainment has grown dramatically. In addition, the covid pandemic means that more people are at home viewing Esports products than in many years prior. On December 23rd, shares of AESE stock shot up by a solid 7.7% to end the day. In the past month, shares are up by around 70%. Of course, investors should wait to see what happens regarding the COVID pandemic and its effects on Esports. But for now, it looks like traders have continued following companies like AESE and others as the niche has experienced growth this year.