Looking For Penny Stocks To Buy? 3 Names To Know Now

3 Penny Stocks To Watch This Week

Penny stocks can jump out of nowhere it would seem. But having a keen ability to monitor momentum and “read” a chart can help “follow the money”. Over the last few weeks, there’ve been several penny stocks to watch that climb, consolidate, then climb again. While these swings can be aggressively volatile, capturing profit is the most important.

Saying you were in a “winning trade” but holding past the initial breakout could be bad for your health in my opinion. What do I mean by this? Take a few of this month’s big movers. Many of them saw huge rallies followed by huge drops. Some bounced back after the “drop” but others didn’t. This is why it’s important to take some profit on the way up. Holding out for the home run every time can easily have you seeing more losses than wins, even if it was a winning trade at the start.

Read More

- Junior Gold Stocks Creating Massive Opportunity for Investors

- Top Penny Stocks To Watch Right Now; 4 With Big News

If you’re new to penny stocks, please keep this in mind. These cheap stocks can be exciting to watch. Remember, they are volatile and definitely high risk. However, if you understand how to make money with penny stocks, you’re already a step ahead. With this in mind, here’s a list of penny stocks trending higher right now.

Penny Stocks To Buy [or sell]: ReMark Holdings

Shares of Remark Holdings (MARK Stock Report) have been in rally mode again this week. MARK stock is one of those I was referring to in the introduction. We watched from the end of April until early last week a run of more than 530%. Did the stock drop? Yes and it dropped aggressively. While that pull-back didn’t negate all of the gains from earlier in the month, it was noticeable. From the $2.68 high to the May 15 low, MARK stock dipped over 50%. But this week, we’ve seen a rebound.

The biggest focus for the market with regard to MARK stock has been the company’s Twitter feed. It has been filled with image tweets about the company’s apparent implementation of testing out its technology. From an LA mall to a Miami Hotel on May 19, the company’s been tweeting out pictures of its thermal imaging set up in a number of places. The hype around this “progress” has grown. However, it’s also important to note that there haven’t been any formal updates or disclosure statements pointing to deals closing.

While I’m sure the market loves this momentum, emotions can start playing a role. The one thing we do know for sure (maybe the only certainty) is that it reports financial results on May 28th. Hopefully, for those with MARK stock on their list, the company can bring some clarity to this latest barrage of Twitter activity. Nevertheless, shares reached highs of $1.95, now up 61% from last week’s low. What do you think about Remark right now? Is it on your penny stocks to buy or sell list?

Penny Stocks to Buy [or sell]: MicroVision

Similar to MARK stock, MicroVision (MVIS Stock Report) has captivated traders for the last month or so. Since mid-April, MVIS has been one of the penny stocks to watch amid a flurry of speculation and market momentum. At the time, MVIS stock traded around $0.21 and had just retained Craig-Hallum Capital to help it explore “strategic alternatives”. This includes the possible sale of the company or a merger.

Over the weeks to follow, many thought that a merger would be the next big “thing” for MicroVision. Leading up to certain presentations from tech industry leaders, those speculative notions ended up fizzling a bit. In light of that, MVIS stock dipped back to around $0.59 from a high of $1.82. It was an impressive run by any stretch of the imagination. But again profit-taking and speculation not coming to fruition added to the pullback.

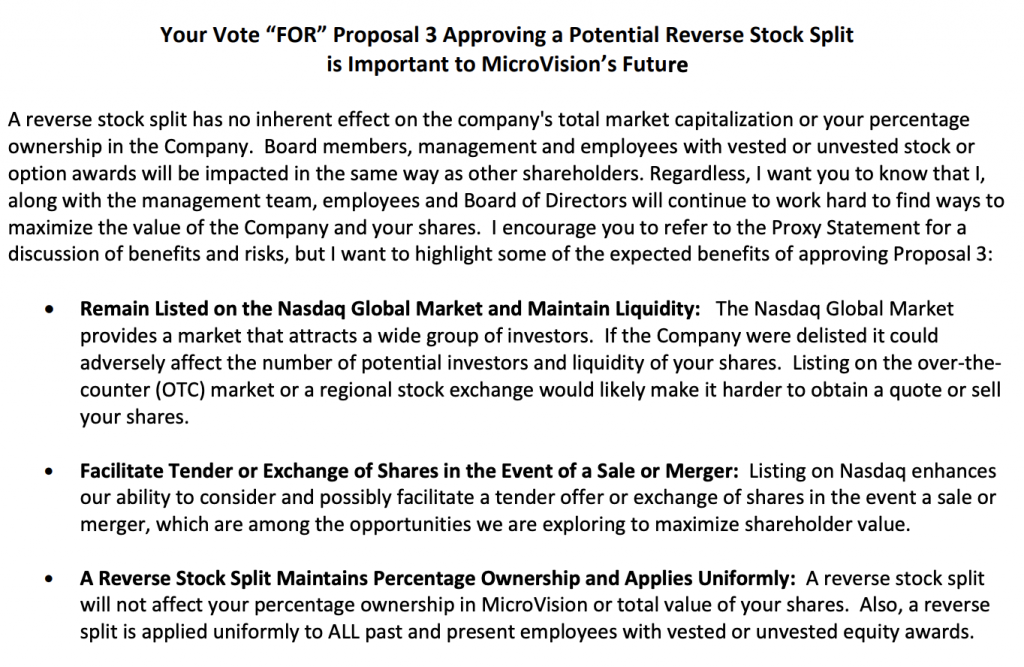

Over the last few days, it would seem MVIS stock has managed to find some footing as it hasn’t dipped below $0.70 in over a week. On Tuesday, the penny stock has started to rally again. While there was no news, a look back at some calendar dates shows today is the date of its shareholder meeting. In the meeting, there are a few things being voted on currently.

These include, among other things, approving a potential reverse split. The company states that one of the “expected benefits” of doing so would enhance its ability to “consider and possibly facilitate a tender offer or exchange of shares in the event a sale or merger, which are among the opportunities we are exploring to maximize shareholder value.” So, it might be something to be aware of if it’s on a watch list. Will it receive approval? if so, what would that mean for MicroVision? Let us know your thoughts if MVIS is on your list of penny stocks right now.

Penny Stocks To Buy [or sell]: Heat Biologics

Heat Biologics (HTBX Stock Report) has been in a steady uptrend since the middle of April. But recently HTBX stock has managed to push to its highest levels since mid-March. This time, so far it managed to hold those gains. Over the last week or so, Heat Biologics gained steam following a tweet about its platform and relationship to COVID-19:

The company also released a business update and first quarter results. Jeff Wolf, Chief Executive Officer of Heat Biologics , commented, “We continue to make progress advancing our unique COVID-19 vaccine utilizing our robust gp-96 vaccine platform in collaboration with researchers at University of Miami . We plan to commence preclinical testing for the COVID-19 vaccine this quarter and are finalizing our manufacturing plans, which we believe will help shorten the clinical timeline. Additionally, we are applying for grants to support clinical development of this program and are advancing collaboration discussions.”

[Read More] Defining The Next Generation Of Coronavirus Stocks: This Company Comes into Focus

With the company’s upcoming presentation at the ASCO Conference on May 29, could the recent surge have resulted from the anticipation of this event? In addition, the company has previously said it plans to begin an “end of Phase 2 Type B meeting with the FDA to discuss registrational strategy” for its HS-110.