Are Penny Stocks Worth It? 5 To Know Now

5 Penny Stocks To Watch This Week

When it comes to penny stocks, the right mix of risk and reward needs to be taken into consideration. All too often, novice traders and investors treat these cheap stocks like lottery tickets. In actuality, they are investments like any other. One of the big differences is that these investments can produce gains rather quickly.

As we saw last week, marijuana penny stocks sparked a big rally. Some of them even jumped over 50% within the matter of a single trading day. However, just as quickly as penny stocks can move up, they can also topple over. In the article, “These Penny Stocks Just Hit New Lows; Now What?” we discussed companies that had gotten crushed by selling pressure.

Keep in mind that it’s always great to point out the big wins from low-priced stocks but you can’t ignore the big losses either. At the end of the day, it’s up to you as the investor to decide whether or not a company is one of the best penny stocks to buy or not. Search out different industries, look at trending stock charts, follow along with the current news feed, etc.

These are all things that can help you sift through the thousands of names and fine the companies to add to your list of penny stocks. With this in mind, here are 5 companies that have seen bigger action in the market recently and may be on a few penny stocks watch lists this week.

Penny Stocks To Watch #1: International Land Alliance, Inc.

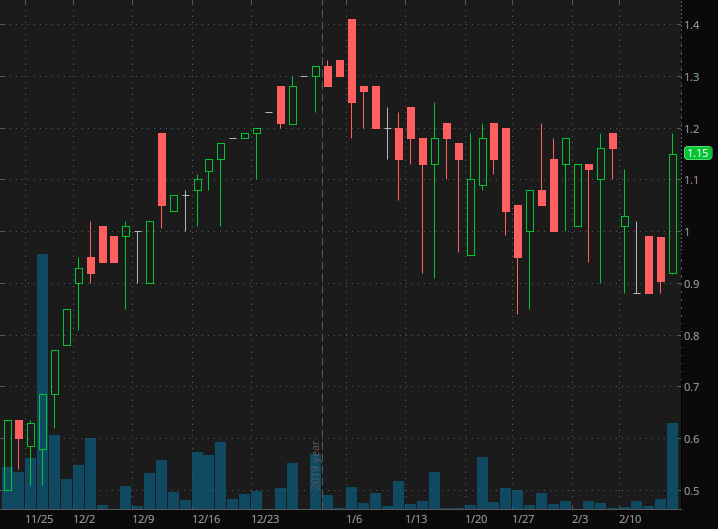

First, on this list of penny stocks, International Land Alliance, Inc. (OTC: ILAL) saw its first day of irregular trading volume on Friday. The real-estate development company has taken up a model that some of the top-tier global developers are currently focusing on. With the baby-boomer population growing at break-neck speed, the push for luxury living on sandy beaches has hit a chord with an entire generation.

What may have also sparked attention is the companies balance sheet compared to its market value. International Land Alliance’s (ILAL – Free Report) projects have a total appraised value of over $27,000,000. Considering the market cap is under $25 million, this fact alone should have raised some eyebrows. Currently, International Land Alliance owns a total of five different real estate development properties consisting of over 600 acres of land.

Its main target areas are in an untapped area of development in Baja California, Mexico. The country is the world’s 15th largest economy with the potential to become 5th by 2050. In addition to this, the revenue potential of its current portfolio could be north of $60 million including several near-term prospects. Shares closed at $1.15, up around 15% for the week.

Penny Stocks To Watch #2: Senmiao Technology Limited

Next, Senmiao Technology Limited (NASDAQ: AIHS)has taken off this week. After closing last week at $0.5849, shares have reached highs of $1.19 on Tuesday morning. After the market closed on February 14, Senmiao reported its financial results for the 3rd fiscal quarter ended December 31, 2019. The China-based auto finance company saw a 2,212% increase, year-over-year in revenues.

This was a jump from under $120,000 in its prior-year period to over $2.74 million during this current period. It also saw revenues expand from its automobile transaction business during the first 9 months of its fiscal 2020 period. Something to keep in mind, however, is that management does expect to see some turbulence. This is likely from the blowback of the coronavirus. Needless to say, they are optimistic about the longer-term prospects of the company.

Xi Wen, Chairman, Chief Executive Officer and President of Senmiao (AIHS – Free Report) said, “Looking ahead, in light of the Chinese New Year holidays and the current coronavirus outbreak in China, we anticipate that the fourth fiscal quarter will be a challenging one. However, despite extensive restrictions being put in place to combat the nationwide coronavirus outbreak, we believe that the long-term market opportunity for ride-hailing services in China remains compelling.”

Penny Stocks To Watch #3: Lilis Energy, Inc.

Another one of the penny stocks taking off this week is Lilis Energy, Inc. (NYSE American: LLEX). After seeing a big day of momentum on February 14, the trend continued on the 18th. Initially, the company reported that its bank lending group extended its due date for installment payments. Lilis (LLEX – Free Report) also executed a purchase and sale agreement for the sale of roughly 1,185 undeveloped acres in New Mexico. This was done at a price of $24.9 million.

On top of that, despite the market closure in the U.S. on the 17th, Lilis announced that it extended the expiration of a take-private offer from a major shareholder, Varde Partners. The new expiration date will now be on February 27th. The deal would see Varde acquire Lilis for $0.25 per share.

Considering the fact that shares closed above this level on the 14th and currently trade nearly 2x that this week, it will be an interesting scenario to keep track of. The company stated that it doesn’t anticipate making further public statements about this matter. That is unless it determines to enter into a definitive agreement for a transaction or the board of directors determines that no such transaction will be effected. A buyout can be a great thing for a company. But the price of the buyout is important for current shareholders to monitor. In this case, a $0.25 price would be a big discount to the current retail market as of right now.

Penny Stocks To Watch #4: Viveve Medical, Inc.

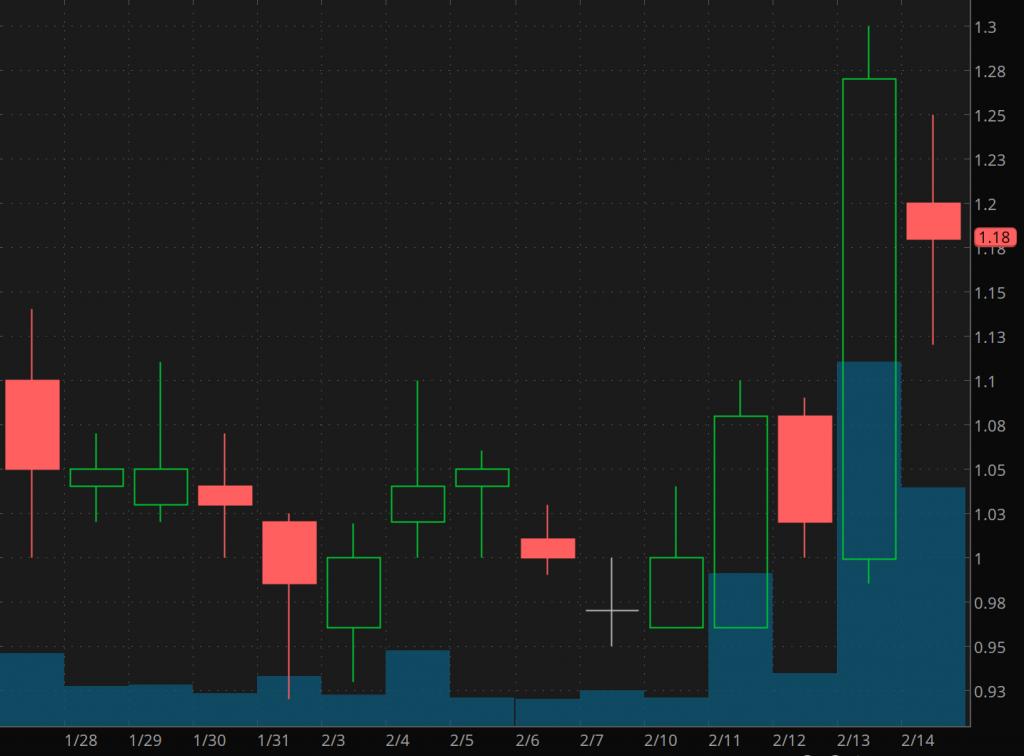

Viveve Medical, Inc. (VIVE) has seen its shares steadily climb this month. At the start of February, VIVE stock traded around $0.96. It has since climbed to highs of $1.45 during premarket trading on February 18.

There hasn’t been much news over the last few weeks. However, on the 13th and 14th there were several filings made that show larger interest from several institutional holders. You can view the latest filings on the Viveve stock profile page. Needless to say, it caused a bit of excitement over the weekend with several popular message board sites buzzing about.

At the end of January, the FDA’s website reported that Viveve received approval for its Viveve 2.0 system via FDA510(k). This came within a week after Viveve (VIVE – Free Report) announced the initiation of enrollment of its short-term feasibility study in stress urinary incontinence.

Penny Stocks To Watch #5: Stealth BioTherapeutics Corp

Finally, Stealth BioTherapeutics Corp (NASDAQ: MITO) came out trading strong at the start of the week. After hitting fresh 52-week lows on Friday, Stealth Bio (MITO – Free Report) jumped over 50% Tuesday morning. This came after the company announced some big news that sent shares to levels not seen since December.

The company announced positive results from its retrospective natural history study of SPIBA-001. This evaluated the efficacy of subcutaneous injections of “elamipretide relative to a natural history control.” The FDA has granted Fast Track and Orphan Drug designations for elamipretide for the treatment of Barth syndrome.

Reenie McCarthy, Chief Executive Officer of Stealth said, “Thanks to the foresight and commitment of our investigators at Johns Hopkins and the Barth Syndrome Foundation, we have been able to show that elamipretide’s effect on important functional parameters associated with Barth is not only striking but well-beyond what would be expected based on the natural course of disease progression.”

Disclaimer: PennyStocks.com is owned and operated by Midam Ventures, LLC. Pursuant to an agreement between Midam Ventures LLC and International Land Alliance (ILAL), Midam is being paid $225,000 for a period from January 31, 2020, to May 18, 2020. We may buy or sell additional shares of International Land Alliance (ILAL) in the open market at any time, including before, during or after the Website and Information, to provide public dissemination of favorable Information about International Land Alliance (ILAL). Read our full disclaimer here.