3 Penny Stocks To Buy Right Now According To Analysts

These 3 Penny Stocks Have Analysts Rating Them a “Buy” But What Do You Think?

Penny stocks are somewhat of a skeptical equity class. Many of the companies have created this historic sense of intrigue among investors. As start-up stage companies, for the most part, small-cap companies attract investors looking to be part of the “cutting edge”.

On the other side of the coin, some who are investing in penny stocks may think it’s a way to take advantage of a “discount” in the market in some cases. This year, that ideology seems to be evident and not uncalled for either. We’ve seen countless companies fall victim to the coronavirus pandemic with their stock prices following closely behind. We’ve even seen some of the most well-known companies – mainly in retail and travel – either declare bankruptcy or go out of business entirely.

Read More

- Learn 5 Key Lessons Guaranteed to Make You a More Profitable Trader

- Penny Stocks To Watch In June 2020; 1 Up Over 120%

Wherever you stand on the subject, it’s important to note that penny stocks aren’t just a gamble. Many attract real coverage from some of Wall Street’s top analyst firms. But are analysts always right?

Are Analysts Always Right About Penny Stocks To Buy?

The short answer, in my opinion, is no. While many would like to take these ratings as “the gospel,” it’s important to note the timing of when the ratings were issued and what was going on with the company. Let me give an example. Let’s take marijuana penny stocks for instance. Had you looked at analyst ratings, you might see a vast majority rating hold or sell.

But look at the stock market today and you’ll see if you “held” or “sold” back when those ratings were issued, you would have missed out on a big rally in the sector recently. Will that remain the case for the rest of June? It’s hard to say based on the over all volatility of marijuana stocks.

My point is, depending on your strategy: day trading, swing trading, or investing in penny stocks, analyst recommendations may or may not hold substantial weight in your overall strategy. So let’s dive into a few names and you can decide for yourself if they’re penny stocks to buy or maybe wait on for now.

Penny Stocks To Buy [According To Analysts]: Vislink Technologies Inc.

Vislink Technologies Inc. (Analyst Rating For VISL Stock) has been one of the top penny stocks to watch for a few weeks now, if not months. If you’ve been a frequent reader of the site, you’re likely familiar with this company. If you’re not, here’s a brief overview: the company provides wireless video solutions to broadcast, law enforcement and defense markets and private mobile broadband networks. We started covering this company when it hit its first 52-week low. I say this because despite holding support for weeks after, VISL stock ended up dropping to another 52-week low of $0.11 in March as the entire market pulled back. However, what’s happened since then has been notable to watch.

Recently, the company caught some attention from the social media community following the SpaceX launch. An apparent Vislink satellite was in the camera shot on C-Span’s coverage of the SpaceX launch. But it doesn’t appear to have much to actually do with SpaceX itself. To us, it looks more like a simple broadcast satellite. View this video here and go to the period between 1:00:40 and 1:01:00 to see for yourself. But last week a tweet from Vislink ended up boosting sentiment in the market further.

What Do Analysts Think About VISL Stock?

If one thing’s certain, video companies are benefiting from the increase police response right now. Suffice to say the riots have been a cause for both hope and concern, it has seen cities adjusting how they handle rules of engagement with citizens. The Tweet in question was from June 5.

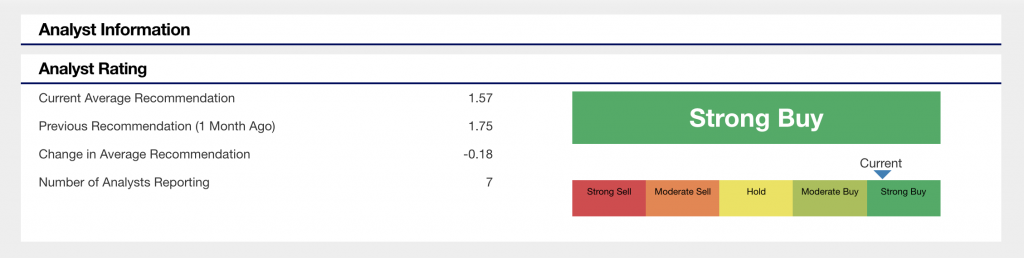

The company focused on utilizing its tech to aid law enforcement and emergency personnel via Vislink’s “Airborn Video Downlink System”. Considering riots are continuing and demonstrations are as well, VISL stock could remain one to watch in June. While there haven’t been any new analyst ratings on the penny stock, the most recent shows a “Strong Buy” rating. Do you agree or disagree? Leave a comment below.

Penny Stocks To Buy [According To Analysts]: Electrameccanica Vehicles Corp. Ltd.

Electra Meccanica Vehicles Corp. Ltd. (Analyst Rating For SOLO Stock) is new to the list of penny stocks to watch. But SOLO stock has been gaining some traction in the stock market recently. Trading volume has been picking up since late May and SOLO stock price has upheld an overall bullish trend albeit a very volatile one all the same.

However, it might find itself benefiting from the likes of Tesla (TSLA Stock Report), Nio Inc. (NIO Stock Report) and the recent IPO of Nikola Corporation (NKLA Stock Report). The Company builds the all-electric SOLO, a single passenger vehicle.

If you’re just starting to follow this company and look up its product, it’s an odd-looking car. But as a fan of Amazon’s “Upload,” I also found it interesting to see the car on the show. Electrameccanica also acknowledged this in a Tweet.

Regardless of the “fanfair” from an Amazon original, SOLO stock seems to be rallying on a bit of buzz. This buzz has even gone as far as identifying some potentially risky “misinformation” being spread by a few groups on social media.

What Do Analysts Think About SOLO Stock?

The company had to actually put out a statement simply saying that they weren’t going to announce anything on June 5th. This may seem confusing but the narrative at the time on social media was that apparently “news was expected”. In the statement, the company said that “misinformation was spread across social media platforms…indicating a press release planned for June 5th…Any news on topics related to company activities will be distributed at the appropriate time.”

[Read More] Top Penny Stocks On Robinhood & WeBull To Watch Right Now

However, the recent excitement surrounding a potential EV boom seems to have been enough to build momentum not only for SOLO but for other electric vehicle companies as well. Can that continue into June? Time will tell and according to analysts, the current rating on SOLO stock shows a “Moderate Buy.”

Penny Stocks To Buy [According To Analysts]: Nokia Corp.

If there’s one company that has held a spot on a list of penny stocks to watch this year, Nokia Corp. (Analyst Rating For NOK Stock) has fought for a spot. Late last year, 5g stocks to invest in were red hot. NOK stock saw a surge to highs of $4.53 before following the rest of the market in the March sell-off.

However, since then, it has been one of the 5g penny stocks to watch and hasn’t come with dramatic fanfare that major of the new “cult penny stocks” have had. Since its March low of $2.34, NOK stock has recovered by as much as 92% as searches for the “best 5g penny stocks” have continue to increase.

One of the biggest topics has been Huawei, which has seen countries open up more competitive landscapes against the Chinese juggernaut. Over the weekend reports cycled through with regard to recent events in Europe. Huawei pushing back to try and preserve its role in Britain’s 5G networks.

What Do Analysts Think About NOK Stock?

The company was urging Boris Johnson not to “overestimate the risk of security and forget the economic impact” of delaying the rollout of full-fiber broadband. This has seen investors looking for more opportunities with other 5g stocks.

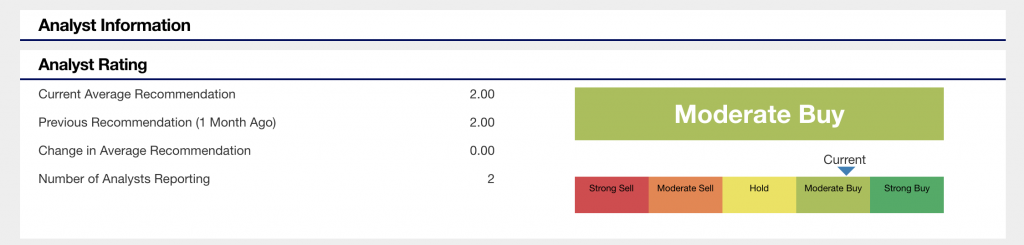

The most recent round of analyst activity has come from JP Morgan (JPM Stock Report) who now sees $5.50 as the target. It also holds an “Overweight” rating on NOK stock. Analyst Sandeep Deshpande wrote, “With – EUR6 million [free cash flow in the first quarter,] Nokia is in a very good place to report a positive [free cash flow] for the year, which is an essential element of the company’s turnaround.”