Stock Market & Inflation: A Look at the U.S. Producer Price Index for February 2023

Introduction

This week is a big week for inflation data in the U.S. Tuesday saw investors take account of Consumer Prices for February 2023 (summary breakdown here). Most of February’s CPI inflation report showed data was in line with analyst expectations. Some of the more notable factors included the index for food and shelter.

Surprisingly, the index for energy declined in February. With CPI data in the rearview, investors are looking at the latest PPI inflation data to hit the tape. Whether you’re looking for penny stocks to buy or trying to find undervalued mega-cap stocks to invest in, this week’s reports are being weighed heavily ahead of the Federal Reserve’s next rate hike decision.

The U.S. Bureau of Labor Statistics (BLS) reported that the Producer Price Index (PPI) for Final Demand fell 0.1% in February 2023. This decrease followed a 0.3% increase in January and a 0.2% decline in December 2022. This article will explore the factors that contributed to this decline and its implications for the stock market, inflation, and penny stocks. At the end, we’ll summarize the 15 most important points.

PPI Decline in February

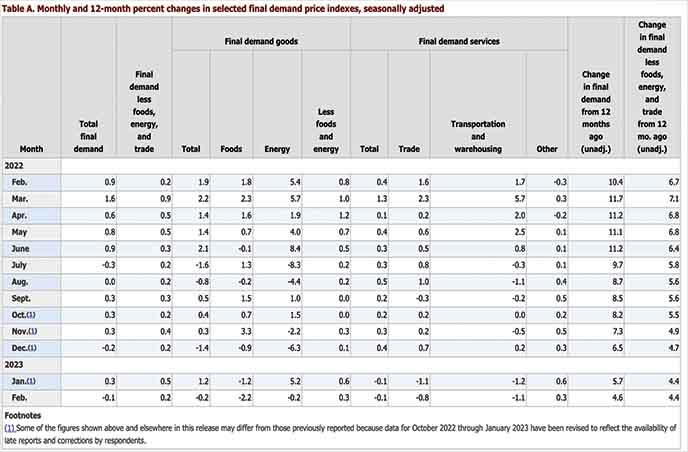

The decrease in the PPI for Final Demand was driven by a drop in prices for final demand goods (down 0.2%) and final demand services (down 0.1%). The index for final demand less foods, energy, and trade services increased 0.2% in February after rising 0.5% in January. For the 12 months ended in February, prices for final demand less foods, energy, and trade services advanced 4.4%.

Final Demand Goods and Services

The decline in the index for final-demand goods was primarily due to a 2.2% decrease in prices for final-demand foods. The index for final demand energy fell 0.2%, while prices for final demand goods less foods and energy rose 0.3%. Over 80% of the February decline in the index for final demand goods was attributed to a 36.1% drop in prices for chicken eggs.

– 7 Penny Stocks To Watch Under $5 With Unusual Options Action

The index for final demand services edged down 0.1% in February, led by a 0.8% decline in margins for final demand trade services. Prices for final demand transportation and warehousing services fell 1.1%. However, the index for final demand services less trade, transportation, and warehousing advanced 0.3%.

Intermediate Demand by Commodity Type

In February, prices for processed goods fell 0.4%, unprocessed goods declined 3.8%, and prices for services increased 0.3%. The index for processed goods for intermediate demand moved down 0.4% in February, following a 1.1% increase in January. Unprocessed goods for intermediate demand fell 3.8% in February, driven by a 9.1% decrease in prices for unprocessed energy materials and a 1.1% drop in the index for unprocessed foodstuffs and feedstuffs. The index for services for intermediate demand moved up 0.3% in February.

– CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Intermediate Demand by Production Flow

In February, the indexes for stage 4, stage 3, and stage 1 intermediate demand remained unchanged, decreased 0.2%, and decreased 0.4%, respectively. The index for stage 2 intermediate demand fell 1.0% in February.

Summary

Here are the 15 most important points from the information above:

- The PPI for Final Demand fell 0.1% in February 2023.

- The decrease was led by declines in final demand goods and services.

- Prices for final demand less foods, energy, and trade services increased 0.2%.

- The index for final demand goods fell 0.2% due to a 2.2% decrease in final demand food prices.

- The index for final demand energy fell 0.2%.

- Prices for final demand goods less foods and energy rose 0.3%.

- The index for final demand services edged down 0.1%.

- Prices for processed goods for intermediate demand fell 0.4% in February.

- The index for unprocessed goods for intermediate demand declined 3.8% in February.

- Prices for services for intermediate demand increased 0.3% in February.

- Stage 4 intermediate demand remained unchanged in February.

- Stage 3 intermediate demand decreased 0.2% in February.

- Stage 2 intermediate demand fell 1.0% in February.

- Stage 1 intermediate demand decreased 0.4% in February.

- The 12-month change in prices for final demand less foods, energy, and trade services was 4.4%.

February PPI Inflation Data Recap

The decline in the PPI for Final Demand in February 2023, driven by drops in prices for final demand goods and services, can potentially impact the stock market, inflation, and penny stocks. Investors should closely monitor these economic indicators to make informed investment decisions. The 15-point summary above highlights the most important aspects of the PPI report and can serve as a reference for understanding the current state of the U.S. economy.

Even with this surprise shift lower in producer prices, markets are selling off mid-week. Most of the concerns arise from other factors. The banks are putting pressure on the overall markets mainly due to recent headlines from Credit Suisse (NYSE: CS) and Wells Fargo (NYSE: WFC). Credit Suisse, in particular, continued deeper into the penny stock range and hit lows of $1.75 on Wednesday morning.

– Tips for Buying Penny Stocks During After Hours

This is being seen as a potential financial institution contagion stemming from last week’s Silicon Valley Bank debacle. Most major bank stocks, including JP Morgan (NYSE: JPM), Goldman Sachs (NYSE: GS), and others, slumped at the open. Meanwhile, digital asset stocks, including those with exposure to Bitcoin, traded higher. Digital brokerage company, Coinbase (NASDAQ: COIN) saw its stock climb more than 3.7% from Tuesday’s close as other cryptocurrency stocks followed suit.

Moody’s went further this week to give its outlook on the sector. “We expect pressures to persist and be exacerbated by ongoing monetary policy tightening, with interest rates likely to remain higher for longer until inflation returns to within the Fed’s target range. US banks also now are facing sharply rising deposit costs after years of low funding costs, which will reduce earnings at banks, particularly those with a greater proportion of fixed-rate assets,” Moody’s explained.

Moody’s also said that it’s expecting a U.S. recession later this year that could add more fuel to the fire in the banking industry.