4 Penny Stocks To Buy In January According To Insiders

Stock Market Down? Insiders Are Buying Penny Stocks

We’ve talked about how penny stocks tend to move independently of the broader markets. But there has been particular attention placed on specific stocks that insiders seem to like. There’s no guarantee that buying from corporate leadership means prices will rise, or selling equates to falling prices in the future. However, it doesn’t stop the fact that investors may use such activities to gauge sentiment.

When was the last time you held company shares and saw the CEO buying? Did that make you feel a sense of certainty in your investment? What about seeing insider selling? Does that make you stray away from specific stocks? Market psychology plays a part for 99.9% of traders who aren’t complete robots, and insider activity can be a contributing factor.

This article looks at a handful of penny stocks that insiders are buying. We dive into the details of the purchases and any recent milestones to take into account. Then you can decide if they deserve a place on your list of penny stocks to watch or not.

Penny Stocks To Buy [according to insiders]

Myomo Inc. (MYO)

Shares of MYO stock have steadied over the last week. Since hitting lows of $0.37 on the 12th, the medical robotics company’s stock price rose back above $0.50 on Friday. Like most companies, Myomo recently announced plans to reduce its workforce, which could save as much as $2 million annually.

“While unfortunate, this action was necessary in improve operating leverage and extend our cash runway as we continue to work on obtaining coverage and reimbursement for the MyoPro for Medicare Part B patients,” said Paul Gudonis, Myomo’s Chairman and Chief Executive Officer in a January update.

If you’ve followed the company over the last few months, MyoPro has been in the spotlight. It’s Myomo’s upper limb device designed to support the arm and help restore function to weakened or even paralyzed arms. It’s used by patients who’ve suffered a stroke, brain trauma, spinal cord injustices, ALS, and numerous other neuromuscular diseases.

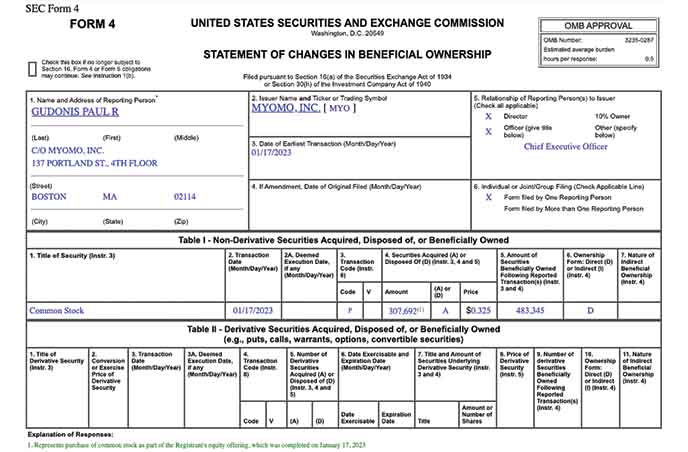

Shortly after the news, Myomo announced it would raise over $6 million at an average price of $0.325 per share. Participating in the offering were members of management. Company CFO, CCO, and CEO purchased shares of MYO stock in the multi-million dollar offering.CEO Gudonis made the largest purchase at $100,000 worth of stock.

Clear Channel Outdoor Holdings (CCO)

Outdoor marketing and media company Clear Channel has enjoyed a solid start to the New Year. CCO stock has climbed from $1 on January 3rd to highs this week of over $1.45. Earnings speculation and recently announced corporate milestones have helped boost sentiment in the stock market. Today CCO stock headed higher just days after reporting the activation of another digital media program at the grand opening of the Newark Liberty International Airport Termina A.

– 4 Cheap Robinhood Stocks Under $1 To Watch With High Short Interest

Clear Channel and the Port Authority of New York and New Jersey are working together on the project that features roughly 6,000 square feet of advertising media. Morten Gotterup, CCO Airports president, explained, “Our media network brings to life the transformation we have envisioned with our partners over the last two years, and as a result, we created a unique, immersive, and opulent program that will engage and inspire millions of people passing through the new magnificent terminal.”

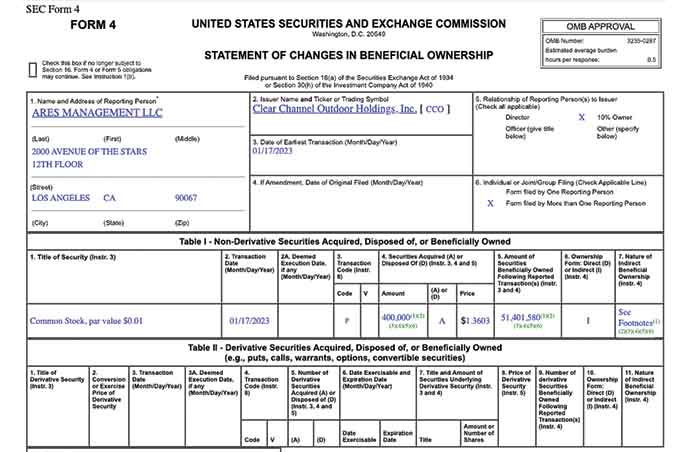

One of Clear Channel’s 10% owners, Ares Management and its affiliates, are the insiders in question this month. The firm reported purchasing over 700,000 shares of CCO stock between the 13th and 17th at average prices between $1.3603 and $1.3937. The largest purchase was the most recent for 400,000 shares at $1.3603

Tenaya Therapeutics Inc. (TNYA)

Tenaya was on our list of penny stocks to watch at the end of 2022 after insiders purchased shares. The purchases came from Eli Casdin via his Casdin Capital, LLC. The firm paid $2.60 per share for nearly 2.5 million shares of TNYA stock. Much of the speculation was surrounding regulatory submissions that are anticipated for this year. It also came after Tenaya’s latest Orphan Drug news.

It received Orphan Drug Designation for its TN-401 in treating cardiomyopathy. Tenaya expects to submit the TN-401 Investigational New Drug (IND) application to the FDA in 2023. Preclinical data was presented at industry meetings supporting the treatment’s potential. This month another pipeline treatment is getting attention. The FDA provided clearance for its IND application to initiate clinical testing of TN-201.

TN-201 is Tenaya’s investigational gene therapy candidate for treating hypertrophic cardiomyopathy (HCM). Whit Tingley, M.D., Ph.D., Tenaya’s Chief Medical Officer also mentioned in a January update, “TN-201 is being developed by Tenaya to correct the underlying genetic cause of HCM after a single dose, offering the hope of restoring normal contractility and preventing the serious complications associated with this disease.”

Director and 10% owner David Goeddel is the insider buying up TNYA stock this month. The average price of the purchases was between $2.4947 and $2.5163. They were done through an associated fund, Column Group III Gp, LP.

Werewolf Therapeutics Inc. (HOWL)

Werewolf stock has been flying high this month, and a mix of recent catalysts, including insider activity, have contributed to the move. Werewolf develops therapeutics to stimulate immune function and treat cancer. Its pipeline hosts multiple candidates for treating solid tumors, including WTX-124 and WTX-330.

Last quarter, management outlined milestones and plans for clinical trials heading into the new year. “Werewolf continues to deliver against key corporate objectives with notable pipeline progress highlighted by our transition into a clinical-stage company,” said Daniel J. Hicklin, Ph.D., President and Chief Executive Officer of Werewolf. “During the third quarter, we initiated the first-in-human clinical trial of our lead program, WTX-124, for treatment of advanced solid tumors. In addition, we have received IND clearance from the FDA for WTX-330, our IL-12 program, which puts us on track to have two actively enrolling clinical trials in 2023. Finally, Werewolf remains well-capitalized with runway that we project will carry us through at least the second quarter of 2024, which supports the development plans for both clinical programs and continued value creation for our early-stage pipeline assets.”

– 4 Penny Stocks To Buy According To Analysts & Targets Up To 347%

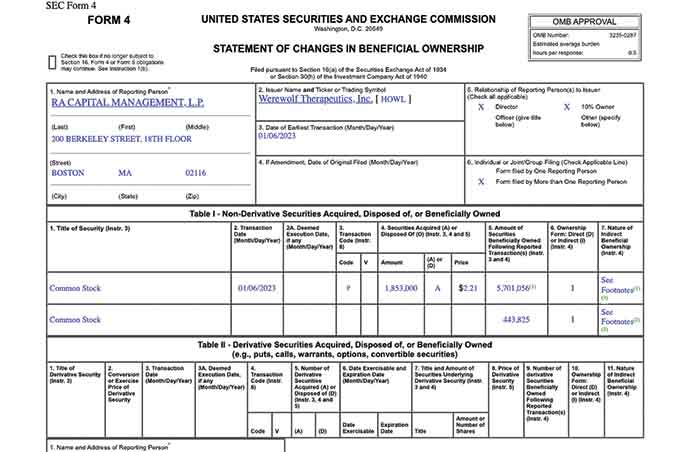

Following a series of preclinical data presentations through the end of 2022, insiders appear to have noticed. Most recently, RA Capital Management boosted its position by purchasing over 1.85 million shares of HOWL stock. The buying round brought the firm’s holdings above 6.1 million shares, total.

List Of Penny Stocks To Watch

- Myomo Inc. (NYSEAMERICAN:MYO)

- Clear Channel Outdoor Holdings (NYSE:CCO)

- Tenaya Therapeutics Inc. (NASDAQ:TNYA)

- Werewolf Therapeutics Inc. (NASDAQ:HOWL)