CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Originally Posted: 11/10/2022 8:30 AM ET

Updated: 11/10/2022 8:48 AM ET

What’s happening in the stock market today has dramatically affected the inflation outlook. It doesn’t matter if you’re trading penny stocks or stocks over $5 to feel the impact. While we mainly cover trending topics on cheap stocks to buy, 2022 has made sure to put a significant focus on economic data. It has been one of the main contributors to producing so many “new” penny stocks this year. It has also led to a quick reevaluation of all asset classes. That includes Bitcoin and cryptocurrencies, as seen in the last 24 hours from the FTX saga.

The November Fed meeting brought plenty of uncertainty, mainly resulting from Jerome Powell’s press conference. His words contradicted what was published in the November FOMC statement. It read slightly dovish. Meanwhile, Jerome “The Hawk” Powell made sure to quell much of the bullish exuberance from early in the session.

Now that the stock market looks ahead at today’s Consumer Price Index figures. CPI inflation data from October will either confirm Powell’s cautious outlook on policy or lay the groundwork for a potential pivot. September CPI inflation data came in at 8.2% compared to expectations of 8.1%. Increases in the shelter, food, and medical care indexes were the most significant contributors to the monthly seasonally adjusted all items increase.

Let’s go over some of the basics for those who may not be familiar with and are asking questions like:

What is CPI data??

CPI Inflation Data vs. PPI Inflation Data & Why CPI is data critical to the stock market today

How can CPI inflation data be used in your investing and trading strategy?; and lastly

What are the results of the September CPI inflation report?

What Is CPI Inflation Data & The CPI Report?

While the market jostles with concerns over cryptocurrency leverage and the FTX blowback, October CPI inflation data could be the final piece that either sparks bullish optimism or bearish pessimism heading into the end of the year. If you’re new to economics, however, you might not understand what CPI inflation data is or what to look for in October’s CPI report.

What Is CPI Inflation Data? CPI stands for “Consumer Price Index.”

The U.S. Bureau of Labor Statistics explains it as“The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).”

– 7 Hot Penny Stocks With Unusual Options Activity, Time To Buy?

CPI data measures “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.”

September CPI Inflation Data

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in September on a seasonally adjusted basis after rising 0.1% in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 8.2% before seasonal adjustment.

The all-items index increased 8.2% for the 12 months ending September, a slightly smaller figure than the 8.3%increase for August. The all items less food and energy index rose 6.6% over the last 12 months. The energy index increased 19.8% for the 12 months ending September, a smaller increase than the 23.8%increase for the period ending August. The food index rose 11.2% over the last year.

Core CPI rose 6.6% over the 12 months ending in September. The energy index fell 2.1% over the month as the gasoline index declined, but the natural gas and electricity indexes increased. Meanwhile, the index for electricity rose 15.5% over the last 12 months, and the index for natural gas increased 33.1% over the same period. In addition, the food index increased 0.8% over the month as the food at home index rose 0.7%

October CPI Inflation Data Release Expectations

Let’s look at CPI and Core CPI expectations for October. The year-over-year CPI expectations for October are set at 8.0%. This would be lower than September’s 8.2% CPI readout. Core CPI is expected to come in at 6.5% for October and slightly lower than September’s 6.6%.

Consumer Price Index Report For October 2022 & CPI Numbers

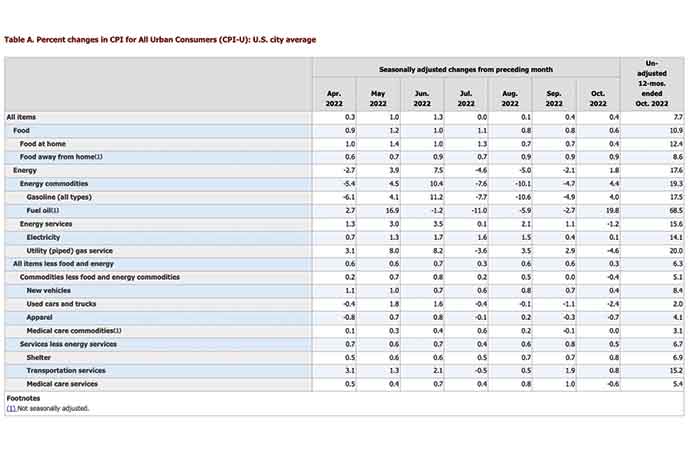

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in October on a seasonally adjusted basis, the same increase as in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 7.7% before seasonal adjustment.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. The energy index increased 1.8% over the month as the gasoline index and the electricity index rose, but the natural gas index decreased. The food index increased 0.6% over the month with the food at home index rising 0.4%.

The index for all items less food and energy rose 0.3% in October, after rising 0.6% in September. The indexes for shelter, motor vehicle insurance, recreation, new vehicles, and personal care were among those that increased over the month. Indexes which declined in October included the used cars and trucks, medical care, apparel, and airline fares indexes.

The all items index increased 7.7% for the 12 months ending October, this was the smallest 12 month increase since the period ending January 2022. The all items less food and energy index rose 6.3% over the last 12 months. The energy index increased 17.6% for the 12 months ending October, and the food index increased 10.9% over the last year; all of these increases were smaller than for the period ending September.

Breaking Down The CPI Data: Key Takeaways

- October CPI index increased 7.7% before seasonal adjustment – BELOW ESTIMATES

- October Core CPI rose 6.3% over the last 12 months – BELOW ESTIMATES

- The food index increased 0.6% in October following a 0.8% increase in September. The food at home index rose 0.4% in October, the smallest monthly increase in this index since December 2021.

- The energy index increased 1.8% in October after falling in the preceding three months. The gasoline index rose 4.0% over the month, also following three consecutive declines. (Before seasonal adjustment, gasoline prices rose 3.1% in October.

- The energy index rose 17.6% over the past 12 months. The gasoline index increased 17.5% over the span and the fuel oil index rose 68.5%. The index for electricity rose 14.1% over the last 12 months, and the index for natural gas increased 20.0% over the same period.

- The index for all items less food and energy rose 0.3% in October, following a 0.6% increase in September. The shelter index continued to increase, rising 0.8% in October, the largest monthly increase in that index since August 1990.

- The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy; other components were a mix of increases and declines. Among the indexes that rose in October was the index for motor vehicle insurance which rose 1.7% in October after rising 1.6% in September.

- The index for recreation rose 0.7% over the month, following a smaller 0.1-% increase in the previous month. The new vehicles index increased 0.4% in October, and the personal care index rose 0.5%.

- Other indexes which declined over the month include the index for used cars and trucks, which fell 2.4% in October after decreasing 1.1% in September.

- The apparel index fell 0.7% over the month, after declining 0.3% the previous month.

- The index for airline fares fell 1.1% in October, following a 0.8% increase in September.

- The index for household furnishings and operations was unchanged over the month.

The Stock Market Today

Immediately following the October CPI inflation data report, broader markets exploded to the upside, with major indexes ripping higher. The S&P 500 ETF (NYSE: SPY) jumped back above $385, The Nasdaq (NASDAQ: QQQ) jumped above $273, while the Dow’s (NYSE: DIA) climbed have $334 for the first time since August. Companies reporting earnings, including Rivian (NASDAQ: RIVN) and retailers like Dillard’s (NYSE: DDS), were already trading higher, with CPI helping give another boost during premarket trading on Thursday.

Accompanying the data were Jobless claims. Initial claims came in at 225,000 compared to the 220,000 expected. Continuing jobless claims reached 1.493 million compared to the 1.475 million anticipated.

This latest round of CPI data comes on a day full of additional central banker speaking engagements. If you read our article Penny Stocks & What To Watch In The Stock Market This Week Nov 7-Nov 11, you know what’s coming today. FOMC Waller, George, Williams, Mester, and Fed Presidents Harker and Logan speak. There will also be commentary from the ECB’s Enria and BOE MPC members Ramsden & Tenreyro. The Baker Hughes rig count comes out during the early afternoon session, which could also play its part in directional momentum for oil & gas stocks on Thursday.

There’s plenty of optimism thanks to October’s CPI inflation report but we may not be out of the woods yet. There is still one final CPI readout and rate hike planned before the end of the year. The Consumer Price Index for November 2022 is scheduled to be released on Tuesday, December 13, 2022, at 8:30 a.m. (ET). The Fed’s last hike will also be in December.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!