Penny Stocks With Unusual Options Activity

When it comes to trading penny stocks, options usually don’t initially come to mind for new traders. Most new traders will choose to buy options because higher-priced stocks are too expensive. The options contracts are much cheaper.

However, unlike popular opinion, there are penny stocks with options, and options flow has become a favorite data point for some investors when it comes to identifying sentiment. This article looks at a few more companies that have experienced an uptick in options trading action. It continues our list of penny stocks from yesterday’s article 4 Hot Penny Stocks With Unusual Options Activity, Time To Buy?” and focuses on a few companies experiencing an uptick in trading volume in their options chains.

We’ll look deeper at what the data shows, where the strike prices are, and which expiration dates are in question, and then you can decide how to use that data to your advantage. We also look at any company catalysts that could be on the horizon or were recently announced that could impact the market.

Penny Stocks To Watch This Week

- Marinus Pharmaceuticals Inc. (NASDAQ: MRNS)

- Olaplex Holdings Inc. (NASDAQ: OLPX)

- Nu Holdings Ltd. (NYSE: NU)

Marinus Pharmaceuticals Inc. (NASDAQ: MRNS)

Shares of Marinus Pharmaceuticals caught a pop on Wednesday after plummeting on Tuesday thanks to the pricing of a public offering of $60 million at a discounted price. With that financing expected to close on November 10th, the market seems to have started to refocus on the company’s future.

The funds themselves are earmarked to fund the commercialization of its ZTALMY® (ganaxolone) oral suspension CV. It also plans on using the money to fund the development of its product candidates, R&D, clinical trial expenditures, and even acquisitions of new technologies.

In its most recent business update, Scott Braunstein, M.D., Chief Executive Officer of Marinus, explained, “The strong U.S. launch of ZTALMY coupled with two important recent transactions–the sale of the priority review voucher and the revenue interest financing–are projected to extend our cash runway into 2024 and allow us to continue to focus on executing beyond our two anticipated Phase 3 trial data readouts.”

Are traders making even bigger bets in the options market? Most of the unusual options action in MRNS stock today is in the December options chain. In particular, the December 16 $5 and $6 Calls have experienced an explosion in volume compared to open interest. The strike price with the highest is the $5 Call option, with more than 11,000 contracts traded.

[Read More] 3 Biotech Penny Stocks To Watch After MACK Stock Jumps 240%Olaplex Holdings Inc. (NASDAQ: OLPX)

Like Marinus, Olaplex has tried to bounce back from a significant sell-off. Last month the company revised its 2022 guidance attributed to a slowdown in sales momentum thanks to macroeconomic pressure. The company also set earnings expectations for the third quarter ahead of the formal earnings update this week.

The tech-based beauty company published its third quarter results showing over $176 million in sales, which beat estimates. It also recorded an EPS of eleven cents, exceeding the $0.10 expectations. These results prompted a more bullish tone in the stock market today.

JuE Wong, OLAPLEX’s President and Chief Executive Officer, commented: “Our third quarter performance was in line with the preliminary estimates provided in our business update in October 2022. In response to the moderating sales growth trends, we are taking actions that we believe will strengthen our forecasting capabilities and accelerate demand for Olaplex products. The successful execution of these initiatives is expected to drive new customer acquisition and maintain our strong customer retention rates.”

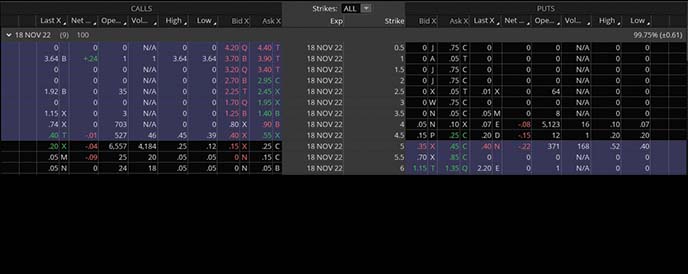

Where are options traders placing their bets on OLPX stock? The November 18th $5 strike Call options are gaining the most interest. Not only were there 6,557 contracts of Open Interest, but more than 4,100 were traded at the time of this article.

Nu Holdings Ltd. (NYSE: NU)

The so-called “Buffet penny stock,” Nu Holdings, has recently gained some momentum in the stock market. In fact, since hitting 52-week lows in May, shares of NU stock are up nearly 50%. The exposure the fintech name has to cryptocurrency is one of the reasons that shares took a tumble on Wednesday.

Nu is a digital bank in Brazil, and its most recent quarterly results showed it’s also realizing significant customer growth. CEO David Velez, who also founded the company, explained in an August business update, “Our largest operation – Brazil – is now profitable, having registered a net profit of US$ 13 million in the first half of 2022, driven by customer growth to 65 million and ability to offer and cross-sell new products.”

[Read More] 5 Penny Stocks To Buy According To Analysts, Targets Up To 995%With earnings season in full swing and bank stocks taking home small victories when they report, eyes are on Nu’s next update. Conveniently, that isn’t too far out into the future. Next week, the market will be focusing on Nu earnings that come out on November 14th after the closing bell.

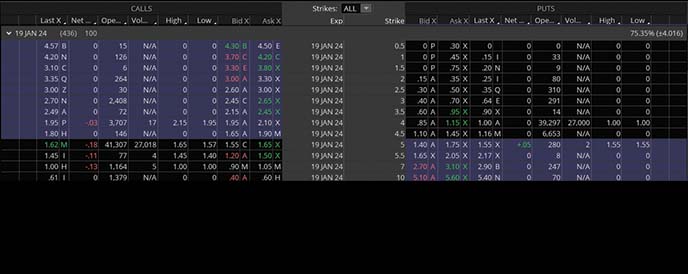

These earnings might be one of the reasons why such a unique options trade is placed today. If you look at the December 16, 2022, and January 19, 2024, options chains, you’ll see a high volume on both Calls and Puts. These are spread-style trades that attempt to take advantage of indecision in the market.

Considering the upcoming earnings, the current state of the stock market, and how volatile the global financial system has been, NU stock could be the focus of both bulls and bears. If this is on your list of penny stocks to watch in November, it may be something to keep in mind.

7 Penny Stocks To Watch

- Marinus Pharmaceuticals Inc. (NASDAQ: MRNS)

- Olaplex Holdings Inc. (NASDAQ: OLPX)

- Nu Holdings Ltd. (NYSE: NU)

- Bed Bath And Beyond (NASDAQ: BBBY)

- Kinross Gold Corp. (NYSE: KGC)

- Redfin Corporation (NASDAQ: RDFN)

- Growgeneration Corp. (NASDAQ: GRWG)

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!