CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Originally Posted: 10/13/2022 8:30 AM ET

Updated: 10/13/2022 9:04 AM ET

It doesn’t seem to matter if you’re trading penny stocks or stocks over $5; what’s happening in the stock market this week has greatly impacted sentiment on the inflation outlook. Yesterday’s Producer Price Index showed a surprise jump in inflation. September PPI inflation data came in at 8.5% compared to expectations of 8.4%. The fine details also showed multiple instances of rising prices, especially for food and energy.

While yesterday it was about the cost to produce goods, the consumer cost is what everyone is paying attention to in the stock market today. This article breaks down the September CPI Report live and discusses key takeaways for you to digest and game plan around before making your next investment. But first, let’s cover some basics for those who may be new to the stock market or economic data in general.

First, let’s go over some of the basics for those who may not be familiar with and are asking questions like:

What is CPI data??

CPI Inflation Data vs. PPI Inflation Data & Why CPI is data important to the stock market today

How can CPI inflation data be used in your investing and trading strategy?; and lastly

What are the results of the September CPI inflation report?

What Is CPI Inflation Data & The CPI Report?

CPI stands for “Consumer Price Index.”

According to the U.S. Bureau of Labor Statistics, “The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).”

Consumer Price Index data measures “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.

– Penny Stocks to Buy Right Now? 3 to Watch in Mid-October 2022

CPI vs. PPI: Why Is PPI Important?

The Consumer Price Index inflation data is important because it acts as another data point for investors to understand current inflationary tendencies. It can also be used as potential reasoning for policymakers to continue or adjust the current monetary policy strategy. On the other hand, compared to PPI data, Consumer Prices show a picture from the lens of consumers purchasing final products, what their costs are, and give a glimpse into whether or not prices could trigger a jump or drop in inflation.

August CPI Inflation Data

In August, the Consumer Price Index for All Urban Consumers rose 0.1% in August on a seasonally adjusted basis after being unchanged in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 8.3% before seasonal adjustment.

The index for all items less food and energy rose 0.6% in August, a larger increase than in July. The indexes for shelter, medical care, household furnishings and operations, new vehicles, motor vehicle insurance, and education were among those that increased over the month. Some indexes declined in August, like airline fares, communication, and used cars and trucks.

– Best Penny Stocks To Buy? 3 To Watch During The Stock Market Crash

Core CPI rose 6.3% over the 12 months ending in August. The energy index increased 23.8% for the 12 months ending August, a smaller increase than the 32.9% increase for the period ending July. The food index jumped 11.4%, which was the largest 12-month increase since the period ending May 1979.

September CPI Data Release Expectations

Let’s look at CPI and Core CPI expectations for September. The year-over-year CPI expectations for September are set at 8.1%. This would be lower than August’s 8.3% CPI readout. Core CPI is expected to come in at 6.5% for September and would be higher than August’s 6.3%.

Consumer Price Index Report For September 2022 & CPI Numbers

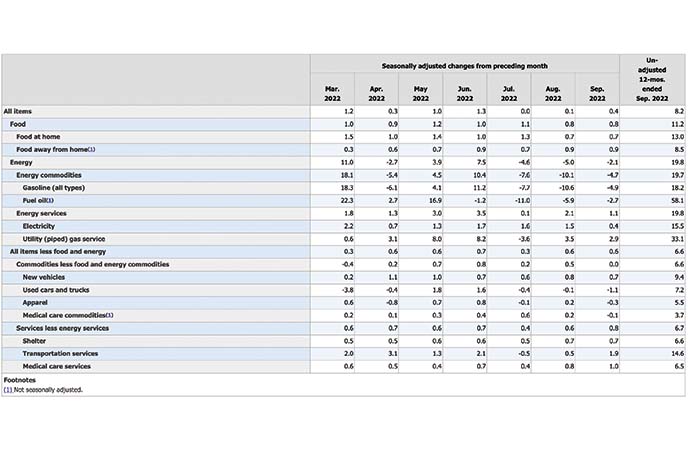

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4% in September on a seasonally adjusted basis after rising 0.1% in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 8.2% before seasonal adjustment.

The all-items index increased 8.2% for the 12 months ending September, a slightly smaller figure than the 8.3%increase for August. The all items less food and energy index rose 6.6% over the last 12 months. The energy index increased 19.8% for the 12 months ending September, a smaller increase than the 23.8%increase for the period ending August. The food index increased 11.2% over the last year.

Breaking Down The CPI Data: Key Takeaways

- CPI over the last 12 months, the all items index increased 8.2% before seasonal adjustment. – ABOVE ESTIMATES

- Core CPI came in at 6.6% for September – ABOVE ESTIMATES

- Increases in the shelter, food, and medical care indexes were the largest of many contributors to the monthly seasonally adjusted all items increase

- The food index continued to rise, increasing 0.8% over the month as the food at home index rose 0.7%

- The energy index fell 2.1% over the month as the gasoline index declined, but the natural gas and electricity indexes increased

- The index for all items less food and energy rose 0.6% in September

- The food at employee sites and schools index rose 44.9% in September, reflecting the expiration of some free school lunch programs

- The food-at-home index rose 13% over the last 12 months

- The energy index declined 2.1% in September after falling 5% in August.

- The energy index rose 19.8 percent over the past 12 months. The gasoline index increased 18.2% over the span, and the fuel oil index rose 58.1%

- The index for electricity rose 15.5% over the last 12 months, and the index for natural gas increased 33.1% over the same period

- The index for all items less food and energy rose 0.6% in September, the same as in August

- The rent index rose 0.8% in September

- The owners’ equivalent rent index also increased 0.8% over the month and was the most significant monthly increase in that index since June 1990

The Stock Market Today

Following the latest CPI inflation data report, markets fell, with major indexes slumping to new lows. The S&P 500 SPDR ETF (NYSEARCA: SPY) dipped below $350 to lows of $348.53, and the Invesco Nasdaq ETF (NASDAQ: QQQ) dropped to lows of $254.63. Meanwhile, consumer stocks including Domino’s Pizza (NYSE: DPZ), which had been climbing after posting the latest earnings report, fell from premarket highs of $334 to below $325. Bank stocks also dropped to new lows including Bank Of America (NYSE: BAC), which reached $29.06 and KeyBank (NYSE: KEY), dropping to lows of $15.32.

Adding to the data were Jobless claims. Initial claims came in at 228,000 compared to the 225,000 expected. Continuing jobless claims reached 1.368 million compared to the 1.365 million anticipated.

September’s red-hot inflation results sent stocks tumbling in the stock market today. While this was lower than August, it was above the analyst consensus of 8.1%, showing that the market isn’t quite in line with the economy’s pace of lower inflation. Now the speculation begins as to what the next move for the Federal Reserve will be. Chances of a 75 bps rate hike were already high, and now the thought of a full 1% increase is beginning to get thrown into the conversation.