Originally Posted: 10/12/2022 8:30 AM ET

Updated: 10/12/2022 9:01 AM ET

This week’s September PPI (Producer Price Index) inflation data is hoped to show some slowdown in price inflation. Whether you are looking for top penny stocks today or the newest company to IPO, red hot inflation has been a driving force for stock market trends this year.

Since last month’s CPI (Consumer Price Index) data came out and showed details that were above expectations, fears were that the Federal Reserve might need to strengthen the chokehold on the economy more.

This month, PPI data comes out before CPI data, so the overreaching consensus may not be reached until Thursday’s report. Nevertheless, this article breaks down the latest PPI inflation report live and highlights some important details for you to consider. First, let’s go over some of the basics for those who may not be familiar with and are asking questions like:

What is PPI data??

PPI Inflation Data vs. CPI Inflation Data & Why PPI is data important to the stock market today

How can PPI inflation data be used in your investing and trading strategy?; and lastly

What are the results of the September PPI inflation report?

What Is PPI Inflation Data & The PPI Report?

A measure of the average change over time in the selling prices received by domestic producers for their output is what has defined the producer pricing index according to the U.S. Bureau of Labor Statistics. The prices included in the PPI are from the first commercial transaction for many products and some services.”

[Read More] Are Penny Stocks Worth Buying Today? 3 To Watch Right NowPPI vs. CPI: Why Is PPI Important?

The Produce Price Index inflation data is vital because it acts as a data point for investors to understand future inflationary tendencies. It can also be used as potential reasoning for enacting monetary policy. On the other hand, compared to CPI data, Producer Prices show a picture from the lens of companies producing final products, what their input costs are, and give a glimpse into whether or not prices could trigger a jump or drop in retail costs that consumers incur.

August PPI Inflation Report

What happened in the August PPI inflation report? The Producer Price Index for final demand fell 0.1% in August. Prices for final demand goods dropped 1.2%, and the index for final demand services advanced 0.4%. Final demand prices climbed 8.7% for the 12 months ended in August. Considering that the August PPI report data came in lighter than expected, some hope that it was a sign of what’s to come for hopeful progress in September. For the full August PPI inflation report, click here.

September PPI Data Release Expectations

Let’s look at PPI and Core PPI expectations for September. The year-over-year PPI expectations for September are set at 8.4%. This would be lower than July’s 9.8% PPI readout and show continued progress from August’s 8.7%. Core PPI is expected to come in at 7.3% for September and would be in line with August’s 7.3%.

[Read More] Penny Stocks to Buy Right Now? 3 to Watch in Mid-October 2022Producer Price Index Report For September 2022 & PPI Numbers

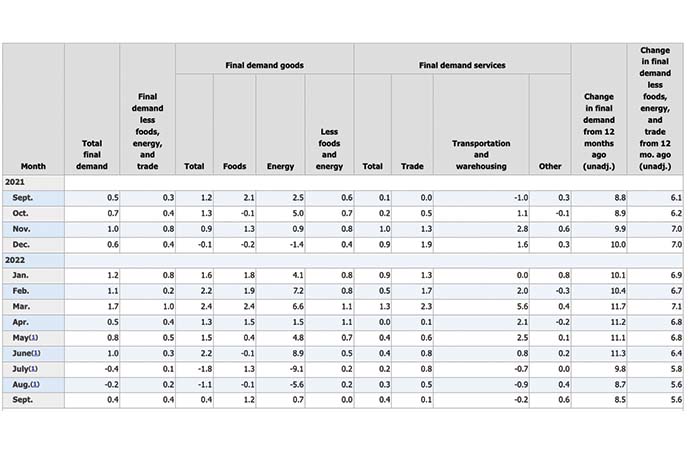

The Producer Price Index for final demand increased 0.4 percent in September, seasonally

adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices declined 0.2% in August and 0.4 percent in July. On an unadjusted basis, the index for

final demand advanced 8.5% for the 12 months ended in September.

In September, two-thirds of the increase in the index for final demand can be traced to a 0.4% rise in prices for final demand services. The index for final demand goods also advanced

0.4%.

Prices for final demand less foods, energy, and trade services advanced 0.4 percent in September,

the largest rise since increasing 0.5% in May. For the 12 months ended in September, the

index for final demand less foods, energy, and trade services moved up 5.6%.

One thing that the Bureau pointed out was that “A major factor in the September increase in prices for final demand goods was a 15.7% advance in the index for fresh and dry vegetables. Prices for diesel fuel, residential natural gas, chicken eggs, home heating oil, and pork also moved higher. Conversely, the index for gasoline fell 2.0%. Prices for prepared poultry and for steel mill products also declined.”

Breaking Down The PPI Data: Key Takeaways

- September PPI inflation data came in at 8.5%

- The index for final demand less foods, energy, and trade services moved up 5.6%.

- Prices for final demand less foods, energy, and trade services advanced 0.4% in September, which is the largest rise since increasing 0.5% in May.

- Prices for processed goods increased 0.1%

- The index for unprocessed goods rose 0.3%

- Prices for services advanced 0.3%

- The index for processed goods for intermediate demand rose 0.1% in September after decreasing 1.5% in August

- For the 12 months ended in September, prices for processed goods for intermediate demand increased 13.1%

- Prices for diesel fuel advanced 9.1%

- Prices for steel mill products fell 6.7%

- The indexes for primary basic organic chemicals, liquefied petroleum gas, and prepared poultry also declined

- For the 12 months ended in September prices for unprocessed goods for intermediate demand advanced 34.2%

- Index for natural gas increased 3.1%

- The crude petroleum index fell 3.4%

- In September, a 5.6% rise in the index for investment banking was a “major factor” in the advance in prices for services for intermediate demand

- Prices for arrangement of freight and cargo transportation fell 12.7%

The Stock Market Today

Immediately following release of the PPI inflation report for September, markets slid. The S&P 500 ETF (NYSEARCA:SPY) dropped to $357.74 and the Invesco Nasdaq ETF (NASDAQ: QQQ) dipped to the $263 area. While these were noticeable retreats from premarket highs, they weren’t nearly as low as where the ETF’s finished out on Tuesday, October 11th. Considering that PPI inflation data for September came in slightly higher than expected but lower than the prior month may have played a role in this lighter selling on Wednesday.

In addition, the September PPI data showed a continued decline in pricing for a 4th consecutive month. Ever since June’s surprise 11.3%, PPI data has been dropping. What’s also interesting to note is that the data less foods, energy, and trade remained at 5.6%, which is where the figure sat in August. However, a sticky point could be on the month-over-month figure which showed producer prices increased from August’s 0.3% to September’s 0.4%

Other popular stocks today including Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) following the overall market trend and traded lower. Meanwhile, there were a handful of penny stocks making moves higher. These included Pineapple Energy Inc. (NASDAQ: PEGY), Hempacco Co Inc. (NASDAQ: HPCO), and Cango Inc. (NYSE: CANG).

Now that September PPI inflation data is out and came slightlight higher than expected, the stock market looks to FOMC minutes and Thursday’s September CPI inflation report for more clues.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!