Originally Posted: 9/14/2022 8:30 AM ET

Updated: 9/14/2022 8:49 AM ET

This week’s August CPI (Consumer Price Index) data release shocked the stock market. Whether you were trading, penny stocks are not, the impact was felt across almost every sector. Red hot inflation was the topic of discussion and what the Federal Reserve might do at its upcoming September meeting next week.

Since CPI came in above expectations, the next round of Producer Price Index data doesn’t have high hopes from traders in the stock market today. Nevertheless, this article breaks down the latest PPI report live and highlights some important details for you to consider. First, let’s go over some of the basics for those who may not be familiar and are asking questions like:

- What is PPI data??

- Why is PPI data important to the stock market today?

- How can PPI data be used in your investing and trading strategy?; and lastly

- What are the results of the August PPI report?

What Is PPI & The PPI Report?

According to the U.S. Bureau of Labor Statistics, the Producer Price Index or PPI measures “the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.”

[Read More] Top Penny Stocks to Watch After the Market CrashPPI vs CPI: Why Is PPI Important?

PPI is important because it can serve as another data point for investors to understand future inflation and potential reasoning for enacting monetary policy. In contrast to CPI data, Producer Prices show a picture from the lens of companies producing final products, their input costs, and if prices might trigger an increase or decline in overall retail costs to consumers.

July PPI Report

Before the August PPI data comes out, it’s important to note what happened in July’s PPI report to understand where we were and where we’re heading. The Producer Price Index for final demand fell 0.5% in July. Prices for final demand goods dropped 1.8%, and the index for final demand services advanced 0.1%. Final demand prices climbed 9.8% for the 12 months ended in July.

[Read More] Penny Stocks To Buy: 3 Short Squeeze Stocks To Watch Right NowIn particular, energy was an essential factor in July. According to the Bureau’s report, “Over half of the July decrease in prices for unprocessed goods for intermediate demand can be traced to a 27.6% decline in the index for natural gas. Prices for crude petroleum, grains, iron and steel scrap, oilseeds, and nonferrous metal ores also fell.”

August PPI Release Expectations

Let’s look at PPI and Core PPI expectations for August. The year-over-year PPI expectations for August are set at 8.8%. This would be lower than July’s 9.8% PPI read out. Core PPI is expected to come in at 7.1% for August and would be slightly lower than July’s 7.6%.

Producer Price Index Report For August 2022 & PPI Numbers

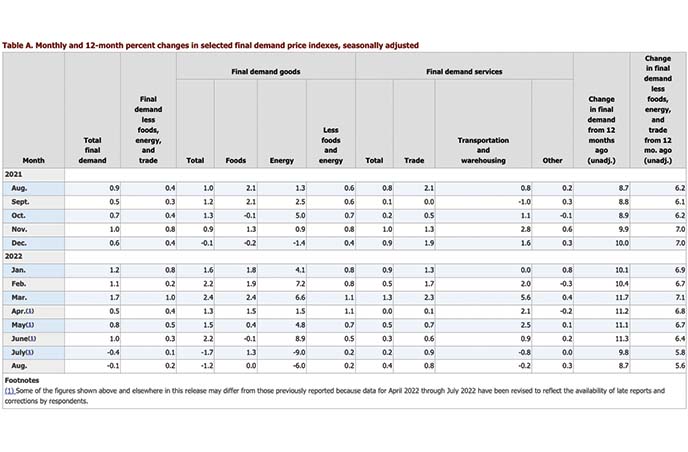

The Producer Price Index for final demand fell 0.1% in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.4 percent in July and advanced 1.0% in June. On an unadjusted basis, the index for final demand moved up 8.7% for the 12 months ended in August.

Prices for final demand less foods, energy, and trade services moved up 0.2% in August following a 0.1% rise in July. For the 12 months ended in August, the index for final demand less foods, energy, and trade services increased 5.6%.

PPI Data Key Take Aways

- PPI, on an unadjusted basis, the index for final demand moved up 8.7% for the 12 months ended in August.Within intermediate demand in August, prices for processed goods decreased 1.7%.

- The index for unprocessed goods rose 5.7%

- Prices for services advanced 1.0 %.

- The index for unprocessed goods for intermediate demand moved up 5.7% in August & was the largest advance since increasing 9.8% in February.

- Leading the August increase in prices for unprocessed goods for intermediate demand, the natural gas index surged 35.3%.

- A large portion of the August decline is attributable to a 5.2% drop in prices for processed energy goods.

- The index for processed materials less foods and energy moved down 0.8%.

- Prices for processed foods and feeds inched up 0.1%.

- Leading the August rise, prices for unprocessed energy materials climbed 13.5%.

- The index for unprocessed nonfood materials less energy advanced 1.0%.

- Thirty percent of the August increase in the index for services for intermediate demand is attributable to a 5.5% rise in prices for nonresidential real estate rents.

- Prices for warehousing, storage, and related services fell 5.3%.

The Stock Market Today

Thanks to the latest round of PPI data released for August, indexes popped in the stock market today. Major ETFs including the S&P 500 (NYSEARCA:SPY), Nasdaq (NASDAQ:QQQ), and Dow (NYSEARCA:DIA) all jumped higher following the Producer Price Index report. While this wasn’t nearly as high as where they fell from on Tuesday, the more bullish sentiment based on PPI data was felt during premarket hours. Even the Russell 2000 ETF (NYSEARCA:IWM) crept higher and back above the $182 mark.

Also in focus was natural gas. The ProShares Ultra Nat Gas ETF (NYSE:BOIL) climbed to highs of nearly $90 during Wednesday’s premarket session.

August PPI Takeaways & Where To Focus Next

With PPI data coming in lighter than expected, some are hoping that this will be the leading indicator for September’s CPI as producer prices appear to have lessened. For that, you’ll have to wait until the next CPI report which comes out October 13, 2022 at 8:30 AM ET.

Where should investors focus next? There are still several economic events in the stock market this week, including tomorrow’s jobs data and retail sales. Expectations for continuing jobless claims are set at 1.475 million, while jobless claims are set at 226,000. Both expectations are higher than the previous reads for both figures. Meanwhile, Core Retail Sales for August are expected to show a 0.1% increase. That’s much lighter than the previous read out of 0.4%.

Now that PPI and CPI data are out, investors continue to look to next week. September 20-21 is when the next FOMC meeting takes place and where new policy updates will be given. The market is pricing in at least a 75 bps rise in rates but some are throwing around the 100 bps figure after the latest round of CPI data.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!