Will fuboTV Inc. (FUBO) Be On Your List Of Penny Stocks In 2022?

What is the definition of a penny stock? According to the Securities & Exchange Commission, penny stocks are shares of companies that trade for $5 or less per share. In general, these cheap stocks are connected to companies that are either start-ups or that have fallen on hard times. Interestingly, of the traders we asked, few had thought that higher-profile companies could ever fall into this category.

Believe it or not, there are plenty of household names that trade as penny stocks. Companies including Party City (NYSE: PRTY), 23andMe (NASDAQ: ME), Express Inc. (NYSE: EXPR), and even popular gift company, Wish (NASDAQ: WISH) trade publicly below the $5 threshold. Are these “household name stocks” doomed? A lot depends on the market and the companies’ abilities to turn things around.

A few years ago, we wrote about a popular EV penny stock, Nio Inc. (NYSE: NIO). It was a beaten-down name that fell from over $10 to as low as $1.19 in 2019. But as you’ll see, NIO stock is far from that $5 threshold as of today. While penny stocks may coincide with companies falling on hard times, they also offer potential discounts to the market. In NIO’s case, that was a pretty big “discount” had you seen the stock in 2019 and early 2020.

Will FUBO Stock Join The List Of Penny Stocks?

In the event traders identify continued selling pressure, the question of “what’s next” comes into play. As discussed with NIO and earlier this week with SoFi Technologies (NASDAQ: SOFI), traders wonder: Will they become a penny stock? In the case of fuboTV (NASDAQ: FUBO), that question may have begun to come up.

One of the biggest reasons is that shares of the streaming media company reached fresh 52-week lows on April 7th. After dropping to $5.80, shares of FUBO stock sat $0.80 shy of the penny stock threshold before bouncing at the end of the day. But will it break below it?

Despite hitting record subscriber figures at the end of the year (1.13 million), fubo’s recent earnings results failed to impress investors. A mixed outlook contributed to downbeat sentiment in the stock market. The FUBO stock price has been unable to recover since.

FUBO Stock Forecast

We’ll discuss more specifics of those earnings results later on. For now, let’s understand what all of this could mean for FUBO stock and whether or not it will soon be on the list of penny stocks to watch. With shares down more than 60% year to date, there are likely some concerns buzzing with anyone who thought this was a long-term hold in January.

Recent analyst adjustments have come out over the past few months as well:

- JP Morgan FUBO Stock Forecast: Downgrade to Neutral, Price Target Cut to $12

- Wedbush FUBO Stock Forecast: Maintains Outperform, Price Target Cut to $15

- Berenberg Bank FUBO Stock Forecast: Maintains Buy, Price Target Cut to $20

- Wedbush FUBO Stock Forecast: Maintains Outperform, Price Target Cut to $19

- Oppenheimer FUBO Stock Forecast: Maintains Outperform, Price Target Cut to $16

Considering the current state of global economics, higher interest rates, and inflation, it will be interesting to see if consumer discretionary spending is directed toward streaming services. As you’ll see, however, fubo remains optimistic about 2022’s performance and could be worth noting.

“Our fourth quarter closes out an extraordinary year defined by delivering triple-digit year-over-year growth in total revenues, advertising revenues and subscriber growth all while continuing to expand adjusted contribution margin…Within the year, we achieved several important milestones, representing meaningful advancements towards our mission to build the world’s leading global live TV streaming platform with the greatest breadth of premium content, interactivity and integrated wagering.”

Edgar Bronfman Jr ., executive chairman, fuboTV

Should You Buy FUBO Stock?

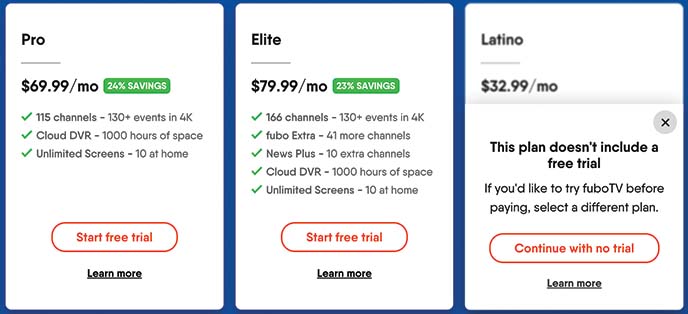

Is the risk worth the reward? Only you can decide this, but given the climate surrounding discretionary spending, inflation could play a role. Meanwhile, fuboTV is also raising subscription prices for all customers. The sports-centric streaming app now offers Pro & Elite packages ranging from $69.99 to $79.99. There’s also a Latino package offering 40 channels.

Meanwhile, there are several irons in the fire for fuboTV. Within North America, the company expects first-quarter revenue of $232 million-$237 million. fubo’s full-year revenue is anticipated to surpass the billion-dollar mark between $1.08 billion-$1.09 billion. This would be the first time in its history to report revenue with a “B” at the end.

You’ve also got to account for the company’s real=money wagering launch via Fubo Sportsbook in two states. Market access agreements for Fubo Sportsbook have already been signed in Mississippi, Louisiana, and Missouri through Caesars Entertainment (NASDAQ: CZR). The agreements brought its total to 10 states and allow for mobile access for sports betting. More market access deals include Arizona, Iowa, Ohio, Pennsylvania, and Texas, according to fubo.

While FUBO stock has stumbled in recent months, the company has continued progressing. Fubo Sportsbook’s proprietary feature, Watching Now, is a unique product. It leverages fuboTV’s first-party user data to engage participants by recommending relevant bets based on what they are streaming. fubo has also said that this is available even as they change the channel. If FUBO stock is on your watch list right now, leave a comment about your outlook for the company and whether or not you think new lows are in store.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!