Cheap Penny Stocks On Robinhood To Buy Under $1, Are They Worth It?

Are These Penny Stocks On Your Buy Or Sell List?

As we head toward the end of January, many penny stocks are presenting investors with opportunity. With Joe Biden now the president of the U.S., investors are working out longer-term strategies for their holdings. With any large event or change in political power, traders can look out for plenty of investment opportunities.

As we’ve stated many times before, Joe Biden could affect a few select industries. As they relate to penny stocks, this could be EV, renewables, tech, cannabis, or even biotech. Obviously, this list is quite broad, but there are ways to narrow down one’s options.

Making A List Of Penny Stocks

The best way to do this is by starting with a long list of penny stocks to watch. From here, investors can pour through balance sheets and press releases to get an idea of what a company looks like. After this step is completed, investors should decide on an exit strategy for each specific penny stock.

[Read More] 3 Green Energy Penny Stocks To Buy On Under $4 In January 2021

While some stocks may show gains in the short term, others could be poised for long term gains. However, as we’ll discuss in this article, certain groups of traders, in this case, Robinhood traders, flock to volatility. This unique group of traders also focuses on Nasdaq and NYSE-listed companies. The only reason for that is Robinhood and Webull, for that matter, only allow access to stocks on those exchanges.

At the end of the day, it simply comes down to researching and analyzing the industry overall. I know if you’re used to high-volatility trading, research is the last thing on your mind. But it helps when it comes to finding penny stocks to buy that you plan to stay in longer than a few minutes. So, as we head deeper into 2021, plenty of cheap stocks are coming into focus. Here are four that are trading under $1 right now. Are they top penny stocks to buy now or avoid?

Robinhood Penny Stocks To Buy Under $1

- Color Star Technology Co Ltd. (NASDAQ: CSCW)

- Sonim Technologies Inc. (NASDAQ: SONM)

- Synthetic Biologics Inc. (NYSE: SYN)

Color Star Technology Co Ltd.

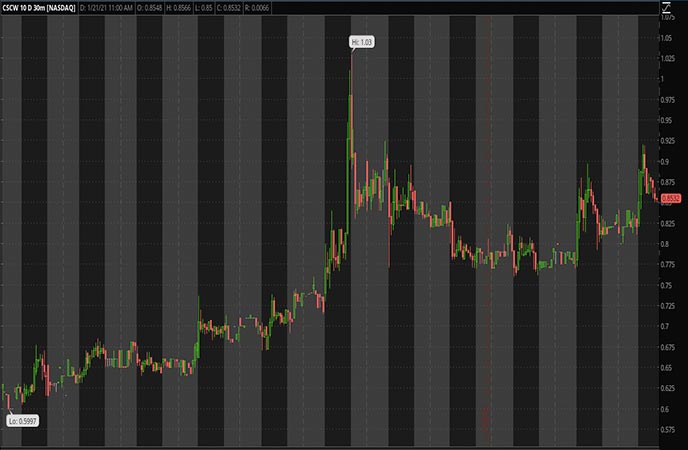

A decent gainer of the day on January 21st is Color Star Technology Co. During trading, shares of CSCW stock are up by around 5% to $0.86 per share. In the past month, shares are up by almost 70%, which is quite substantial. Color Star works as an entertainment company specializing in online performances and music education. The company has several subsidiaries that it operates through around the world as well.

This includes both Color China Entertainment Ltd. and CACM Group Inc. During the pandemic, online entertainment has become paramount, with more people at home than ever before. We even saw a big jump in stocks like Vinco Ventures (NASDAQ: BBIG) today simply after announcing it merged with a media company. Because of this, companies like Color Star have seen heightened popularity in the past few months.

Of course, it does have quite a few big-name competitors that investors should consider. But, it also appears as though Color Star has its own unique entertainment market. A few weeks ago, the company announced that it had formed a strategic partnership with two UAE based companies. This deal is structured so that Multiple Events UAE and Hunter International Travel & Tourism will form a partnership with Color China Entertainment. Biao Lu, CEO of Color Star, states that “Color Star strives to become a top global entertainment company. We have built strategic partnerships in Southeast Asia, Europe, and America, and now in the Middle East.”

With all of this in mind, will CSCW be on your list of cheap stocks to watch?

Sonim Technologies Inc.

Sonim Technologies works as a provider of rugged mobile phones and accessories for use in the field. These devices are in demand for construction, transportation, utility, management, and more. In addition to offering network services and mobile devices, Sonim Technologies also works in the cloud software industry. As you can see, its market is quite broad in both its hardware and software products. Although construction and transport were slowed at the beginning of 2020, these operations have started to resume slowly. This means the Sonim has not seen revenue decrease as much as other, more affected industries.

Read More

- 5 Top Penny Stocks To Watch During January’s Biotech Boom

- Penny Stocks Are Red Hot But Is Now The Right Time To Buy?

With a 15% after-hours gain yesterday, SONM stock made some solid headway on Wednesday, January 20th. This large share price gain was due to news announced at around 1:15 PM PST. The company stated that it had received an extension of 180 days to regain NASDAQ compliance. CEO of Sonim, Tom Wilkinson, states that “we remain confident in our turnaround plans at Sonim, including the significant restructuring we have previously undertaken to lower our operating expenses and improve margins long term, the benefits of which are already starting to be seen in our reported results.”

Investors should keep an eye on what occurs next with this news. But, as it works to restructure its business, SONM could be a penny stock to watch.

Synthetic Biologics Inc.

One of the more interesting biotech penny stocks that we’ve been discussing is Synthetic Biologics Inc. We’ve covered SYN stock in the past few weeks due to its large pipeline of compounds and increased momentum. The company is currently working on therapeutics that specifically target the gastrointestinal system and treat systemic diseases. It has several lead product candidates, including SYN-004 (ribaxamase) and SYN-20, and more.

These treatments are used to combat otherwise unmet needs of the medical industry. In an exciting announcement made a few weeks ago, the company stated that its drug SYN-004 received approval from the Institutional Review Board at the Washington University School of Medicine in St. Louis.

It can now move on to the Phase 1B/2A trials of SYN-004 as soon as the first quarter of this year. Steven Shallcross, CEO of Synthetic Biologics, stated that “approval of the Phase 1B/2A clinical protocol by Washington University’s IRB is an important step in pursuing a potentially more cost-effective development strategy for SYN-004, targeting a highly specialized patient population.”

Obviously, it will take some time before the company can move on to these trials’ latter stages. But in the meantime, this is definitely news to consider.

Are Penny Stocks Under $1 Worth The Risk?

Just a few closing comments to keep in mind. No matter the price of the penny stock you’re looking to buy, make sure you have a plan in place. Understand your entry and exit points. Furthermore, it’s important to keep volatility in mind. Cheaper stocks don’t need much in terms of price movement to experience significant percentage changes. In the past, with some of these stocks, even a move of 20 cents equated to significant pops and drops. So make sure to understand the risk/reward of cheap stocks.