3 Penny Stocks To Buy & 1 To Hold According To These Analysts

Are Analysts Correct About These Penny Stocks To Buy Right Now?

Penny stocks are some of the most interesting types of stocks to watch. This is the case for several reasons. For one, these stocks are known to be quite volatile. For those who use day or swing trading, volatility is paramount to success. With rampant price swings, traders have the potential to see large gains in short periods of time. On the other hand, investors should note that there is also the potential for big losses.

Second, because penny stocks are often small companies, the potential for long term gains are abound. These companies are often on the cusp of new business innovations and novel ways to produce returns for their investors. While this is not the case for all penny stocks, the potential is definitely palpable with some penny stocks to watch.

Although not all penny stocks are built for trend continuations, investors can use research to find the ones that are. This means finding penny stocks that have enough volume, the right financials, and a solid plan for the future. You could also look at other things like analyst reports to gain more insight.

Read More

- Looking For The Top Penny Stocks Today? 3 High Volume Names To Know

- 5 Top Penny Stocks On Robinhood To Watch As Markets Sell-Off

It’s important to note that analyst ratings aren’t the end-all, be-all. However, the information that is compiled in the reports includes a bit more information than just a simple rundown of corporate updates. With all of these factors in mind, finding the right penny stock to buy can be easier than previously imagined. In light of this, do you agree with what analysts have to say about these companies?

Penny Stocks to Buy [according to analysts]: Rockwell Medical Inc.

Rockwell Medical Inc. (RMTI Stock Report) is a U.S. based biopharmaceutical company. Rockwell has worked to create several products and treatments for different types of ailments. This includes the treatment of chronic kidney disease, iron deficiency, and other diseases.

The two main pharmaceuticals that the company produces are known as Calcitrol and Triferic. Triferic is a drug that is used to add iron to the body when patients have a deficiency. Calcitrol on the other hand is utilized to treat thyroid illnesses in adults. While this area of the pharmaceutical industry may be a niche one, there is definitely a great deal of value within it.

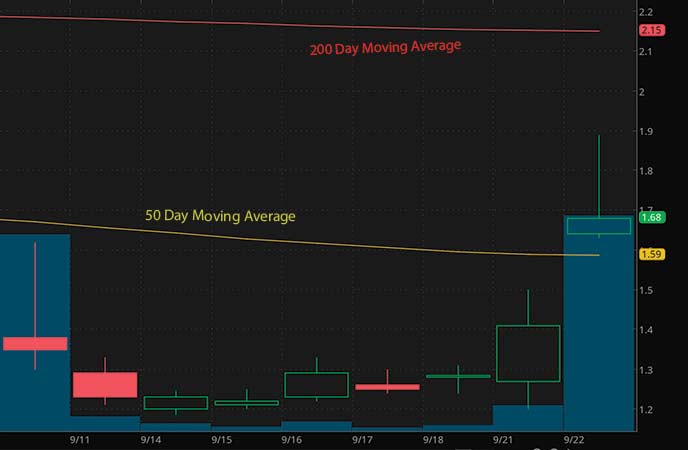

On September 21st, Rockwell Medical stock shot up by as much as 15% during the trading day. It also climbed by more than 30% from its Monday closing price. In addition, the stock was traded in much higher volume than in most other trading sessions. The majority of this is due to investor interest in pharmaceutical penny stocks as COVID has continued to hit world markets. While this gain is impressive, investors should definitely take note of the parabolic move from today. RMTI stock is within striking range of its 50 Day Moving Average. So this level will be important to see if it can hold as a new support or if RMTI is set to break back down.

RMTI Stock Forecast

What do analysts have to say about RMTI? The most recent rating comes from H.C. Wainwright. The firm recently reiterated its Buy rating this summer. It also gave the stock a $9 price target.

Penny Stocks to Hold [according to analysts]: Hermitage Offshore Services Ltd.

Hermitage Offshore Services Ltd. (PSV Stock Report) operates with its subsidiaries on offshore vessel support services. Its business is primarily centered in the North Sea as well as off the coast of Western Africa. As of mid-September, Hermitage owns as many as 23 vessels.

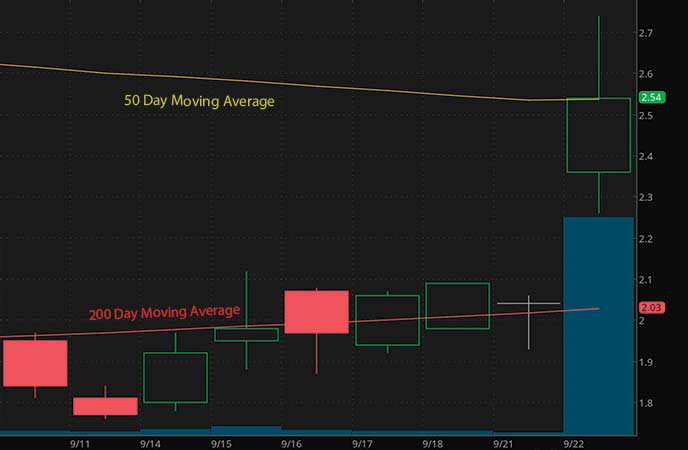

Within these 23 vessels are 11 boats for crew, 2 anchor vessels and 10 platform supply ships. On Tuesday, September 22nd, shares of PSV stock shot up by as much as 62% during Tuesday’s session. Recently, Hermitage announced that it had filed a voluntary reorganization under the Chapter 11 Code in New York.

While this may seem like a negative, a lot of businesses utilize this resource to reorganize their financial standing. The company faced a great deal of pressure as COVID drew oil prices down. When companies file for bankruptcy, oftentimes they jeopardize their listing on large exchanges.

[Read More] Are These Penny Stocks To Buy Right Now Or Should You Wait?

But, the company filed for a review of its status on the NYSE. The result of this should come out within the next few months. Its vessels are all focused on, and used primarily in, the oil and gas business, including in the installation, maintenance, and movement of oil and gas platforms. Demand for its services depends on activity in offshore oil and natural gas exploration. Will the oil and gas industry may play a larger role in the near term?

PSV Stock Forecast

What do analysts have to say about PSV? The most recent rating comes from BTIG Research. The firm actually downgraded its Buy rating and issued a Hold this summer. In light of the recent volatility in oil and gas plus a Chapter 11 that has followed, is this the right rating for PSV stock?

Penny Stocks to Buy [according to analysts]: AIM ImmunoTech Inc.

AIM ImmunoTech Inc. (AIM Stock Report) is another pharmaceutical penny stock working on the R&D of several new therapeutic drugs. The company develops pharmaceuticals specifically for the treatment of immune disorders, viral diseases and certain types of cancers.

Its main pharmaceutical known as Ampligen works by targeting RNA molecules to help treat certain types of cancer and other illnesses. In clinical trials, the drug has shown itself to be a viable treatment for specific types of cancer including breast cancer, ovarian cancer, melanoma, and more. In addition, the company has been working on using Ampligen to treat COVID-19.

This has helped to bring in a lot of notoriety to the company in the past few months. The company recently received authorization to start its first human trial to help assess the safety of Ampligen on COVID-19 patients. But Ampligen isn’t only being tested for COVID. The attention today comes from something a bit different.

AIM announced receipt of positive pancreatic cancer survival results from a multi-year Early Access Program. This was conducted by Erasmus University Medical Center. Ampligen was used in patients with pancreatic cancer. AIM CEO Thomas K. Equels stated: “We started this program in January 2017. These exceptional results from Erasmus exceed even our most optimistic expectations.

AIM Stock Forecast

What do analysts have to say about AIM? The most recent rating comes from TD Securities this month. The firm actually has a Buy rating on the stock and actually increased its price target. Previously, TD had its target set at $4.25 but has since boosted it to $5.50.

Penny Stocks to Buy [according to analysts]: Auto Web Inc.

AutoWeb Inc. (AUTO Stock Report) is a digital marketing company that works in the automotive industry in America. Specifically, AutoWeb works by offering manufacturers services to help market and sell vehicles direct to consumers. Auto Web has several products in its pipeline that include vehicle lead programs for both new and used cars, as well as WebLeads+ which offers customers coupons for purchasing vehicles.

[Read More] Will Aurora Cannabis Become A Penny Stock In September 2020?

In addition, the company offers various online tools to help dealers run their businesses more effectively. This includes digital platforms that help dealers market their dealerships, track online traffic, and services that offer directly to consumer marketing strategies.

Because of its unique business model, Auto Web is considered to be a more niche penny stock to watch. But, with so many auto dealerships in the U.S., it seems as though AutoWeb’s market is almost unlimited.

On Tuesday, September 22nd, shares of AUTO stock shot up to highs of $3.53 ending a 2-day downturn in the stock. It seems as though AUTO stock has a correlation with the auto industry as a whole. This includes a correlation with some major car outlets like Carvana (CVNA Stock Report). Today, Carvana may have played a partial “sympathy” role in momentum for certain companies like AutoWeb. The company announced that it’s expecting record Q3 performance, on Tuesday.

AUTO Stock Forecast

What do analysts have to say about AUTO? The most recent rating comes from Barrington Research. The firm actually boosted its rating from Market Perform to Outperform last month. Barrington also has a $10 price target on AUTO stock right now.