4 Penny Stocks To Buy On Robinhood For Under $4 Right Now

Are These On Your List of Robinhood Penny Stocks In July?

Are you making a list of penny stocks to buy right now? I’m sure you’re not alone if you said yes. These cheap stocks are some of the most popular right now, especially among younger traders. Some of the sentiment has risen from new “gurus” on the web going against traditionalism and focusing on what matters the most; money. When it comes to making money with penny stocks, sure, you can buy and you can sell. But when you talk about trading, for instance, there’s a whole different strategy in place.

Traditionally, traders would look at certain fundamentals before buying shares. “No moderately professional day trader would buy a bankrupt company’s stock.” But then you have this year, 2020 when we saw countless “leaders of industry” plummeting in the stock market.

Read More

- Esports Penny Stocks Show Immunity To Coronavirus

- Coronavirus Penny Stocks Get A Booster Shot In July 2020

Names like Hertz, GNC, J.C. Penney and others fell victim to the coronavirus stranglehold on the economy. Brick and mortar, travel, many more; these sectors have gottten hit hard with the global landscape dramatically changing. Where you might call them “normal” traders wouldn’t touch companies like these after declaring bankruptcy, a new type of trader has emerged.

Robinhood, Penny Stocks & A New Generation Of Traders

Many in the media are calling them Robinhood traders. Initially popularized by purchasing penny stocks on Robinhood, these traders are throwing caution to the wind and following another type of strategy. It’s called follow the momentum. It doesn’t seem to matter how abysmal the business outlook is as long as there is hype and momentum behind a grouping of letters.

One of the voices of Robinhood penny stocks traders, Dave Portnoy has even gone so far as to buy stocks based on Scrabble letters pulled from a bag. Now, is this a strategy that makes sense, long-term? Most fundamental traders would say no but understand that there’s a whole new market out there.

Many of these “traders” are very wet behind the ears and there are a lot more of them than ever before. Blame it on the pandemic or simply on the stay at home orders, people are bored and learning a new skill called day trading. The unfortunate part is that I’ve seen many of these “noobs” get their accounts blown up by simply following hype.

So my best suggestion if you’re new to trading penny stocks on Robinhood, WeBull, or any other app, do a little bit of research at the very least. Understand why a stock is moving, not just the fact that…a stock is moving. With this in mind, let’s take a look at a few that can be bought for under $4 right now. Just because they’re cheap, does that mean they’re the best penny stocks to buy right now?

Robinhood Penny Stocks #1: Eros International

Eros International (EROS Stock Report) has been off and on our list of penny stocks for months now. After rallying to highs of $4.91 back in January, the entertainment penny stock dipped to lows of $1.10 in march. As with most stocks, EROS mounted a bit of a recovery since then. To date, EROS stock has climbed back by over 240% so far. Will that continue? Well, let’s look to see what (if anything) has helped drive positive momentum.

While there hasn’t been much news in July, we can see Eros made a bigger update at the end of June. The company announced its partnership with Dish TV. As part of the association, Dish TV & D2H users can access Eros Now’s massive content library including 12,000 plus movie titles, original shows, short-format content Quickie, music through their android set-top boxes – Dish SMRT Hub & D2H Stream, respectively. That’s according to Eros International.

[Read More] Best Penny Stocks To Watch Before Friday? 1 Up 125% This Week

Keep in mind that earlier this year, Eros and STX Filmworks announced they had entered into a definitive stock-for-stock merger. According to SXT, to date, the company has released 34 films grossing over $1.5 B in global box office receipts. This includes titles like Hustlers, Bad Moms and The Upside. STX Entertainment has a global distribution network spanning 150+ countries with its partners. At the end of June Eros passed resolutions tied to STX merger so this may be something to keep in mind as well.

Robinhood Penny Stocks #2: Enzo Biochem Inc.

Enzo Biochem Inc. (ENZ Stock Report) was another one of the trending penny stocks on Robinhood this week. The biggest part of its move came during the afternoon on July 8. ENZ stock traded higher after a new development posted on the FDA’s website.

It showed that Enzo Life Sciences received FDA Emergency Use Authorization for its AMPIPROBE coronavirus test system. Other than that, the company has not made a formal statement related to this. Enzo’s high-throughput kit for IgG antibody utilizes a routine blood collection at a lab’s patient service center, a doctor’s office, or a hospital. The sample is then sent to the clinical laboratory for processing and analysis.

Late last month, Enzo announced that it partnered with Farmingdale State College to provide molecular and antibody testing for COVID-19 to the Farmingdale campus. This was entered into ahead of the college’s plan to reopen this summer. “This program fits perfectly into this fall’s campus plans designed by our COVID-19 Task Force, and testing our students with no required financial outlay is important,” said Farmingdale State College President John S. Nader. “Nothing is more critical than ensuring the safety and welfare of our campus community.”

However, given the fact that the FDA Authorization just recently came to light, will that continue boosting sentiment?

Robinhood Penny Stocks #3: Qudian Inc.

Qudian Inc. (QD Stock Report) has been trending much higher this month. At the start of July, QD stock traded around $1.70. Since then the penny stock has climbed to highs of nearly $3. This move hasn’t come on the back of much news from the company. However, the financial services sector and technology spaces have been red hot lately. Qudian is a technology platform focused on empowering the enhancement of online consumer finance experience in China.

Last month, Secoo Holding Limited (SECO Stock Report) and Qudian entered into a deal that made some waves. Secoo is Asia’s largest online integrated upscale products and services platform. Through the deal, Qudian and Secoo announced that the two entered into a definitive agreement. pursuant to which Qudian has agreed to purchase a total of up to 10,204,082 newly issued Class A ordinary shares of Secoo for an aggregate purchase price of up to US$100,000,003.60. This would give Quidian a 28.9% stake in Secoo.

“This strategic partnership leverages both companies’ resources, capabilities, industry expertise and market presence, while fostering collaboration in supply chain management, user acquisition and retention, quality appraisals, post-sales services, and financing solutions,” said Mr. Min Luo, Founder, Chairman and Chief Executive Officer of Qudian. As of June 11, Quidian reported a 21.57% stake in Secoo so far. With online retail surging, will a new round of shutdowns help boost momentum for companies like Quidian and Secoo this month?

Robinhood Penny Stocks #4: XpresSpa Group Inc.

Another one of the penny stocks with a love/hate relationship with traders has been XpresSpa Group Inc. (XSPA Stock Report). We were actually reporting on this company when rumors first started circulating about covid testing and XSPA. Initially, the company was only having ‘high level talks,’ which in my opinion doesn’t mean much.

[Read More] A Blooming Opportunity For Investors To Cash In On Mushroom Stocks

But as things got more serious, the market eventually starting paying more attention. The company is most popular for offering quick spa treatments like massages and pedicures in airport terminals. But with flight travel limited, they decided to utilize its footprint to offering a different service. That being coronavirus testing.

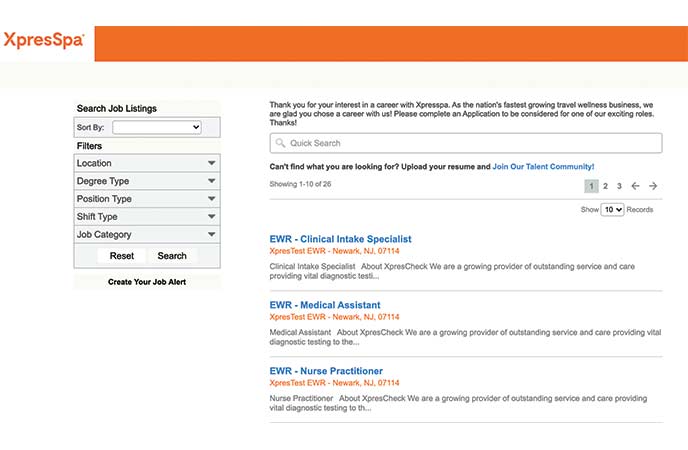

Fast-forward a few months and XSPA stock rallied to highs of $8.82 (from March 25th levels of $1.20) and the company gained a presence in one of the most active terminals in New York. Its XpresCheck has begun a pilot program at New York’s John F. Kennedy International Airport Terminal 4. Despite lack-luster earnings, XSPA stock continues to hold its support levels above $3.50 in July. Furthermore, shares began spiking after a job posting on PayComOnline showed XpresTest was looking to hire specialists at Newark Airport.

Keep in mind that nothing related to this was formally put out. However, in its July 6th business update the company alluded to new opportunities. “The Company is in active discussions with multiple U.S. airports to open new testing centers or convert existing spas, to XpresCheck facilities.”