Are These Penny Stocks To Buy Or Sell? Here’s What Analysts Say

3 Penny Stocks Turning Heads Right Now But Do Analysts Rate Them A “Buy” or “Sell?

You don’t normally think about penny stocks and analyst ratings all the time. But just like any other public company, early-stage, small- and micro-cap companies garner analyst attention. No matter the business or history, penny stocks are more than just equities; they’re businesses too.

Needless to say, some gasp at the idea that any “worthy analyst” would “waste time” covering such cheap stocks. But at the end of the day, the large institutions and retail investors looking to buy penny stocks likely get use out of analyst reports.

Given this, it’s also important to understand that just because analysts say one thing, it means that’s what a stock will do. Target prices are ideas, essentially based on the fundamentals of the company and comparable businesses.

Read More

- Psychedelic Penny Stocks To Watch Amid The Mushroom Boom

- 4 Penny Stocks On Robinhood & WeBull To Buy For Under $4

Keeping this in mind, many reports are written during certain time periods and may not be updated as often as they need to. Let’s look at an example. Shares of Aurora Cannabis (ACB Stock Report) were mostly rated at the equivalent of a “HOLD” and most of those ratings came a month ago or longer.

Are Analysts Always Right About Penny Stocks?

This didn’t take into account the reverse split nor the huge sell-off after the reverse split. What they also didn’t consider was the fact that Aurora would come out with better than expected earnings and a recent deal to buy U.S.-based CBD company Reliva, giving the struggling Canadian company a business foothold in America. Had you heeded the analysts and took a less bullish approach, you may have not even considered adding it to your marijuana stocks watch list.

But then again, you also would have missed out on a run of over 100% from its reverse price. The point is, analyst ratings don’t need to be the ultimate factor to decide whether or not certain companies are the best penny stocks to buy. Take them into account but also do more research on your own. No matter if you listen to analysts or do hours of additional research, at the end of the day, you’re the one responsible for pulling the trigger and deciding to buy penny stocks or not.

Penny Stocks To Buy [or sell]: Seelos Therapeutics

Shares of Seelos Therapeutics (SEEL Stock Report) started creeping up recently. The company was in the spotlight last Friday as you might recall. On May 15 SEEL stock broke out after the company’s new update. It came earlier in the day and again mid-morning. First, the company announced that it has been granted Rare Pediatric Disease Designation for SLS-005 in Sanfilippo syndrome from the U.S. FDA. Later in the session, Seelos announced the appointment of F. Hoffman-La Roche alum, Judith Dunn to its Board.

There could be both short and long-term potential catalysts to look for from the company. Earlier this week, Seelos announced that it will host a key opinion leader call to discuss the unmet medical needs in suicide and depression on Tuesday, May 26, 2020. Raj Mehra, Ph.D., Chairman and CEO of Seelos Therapeutics, Inc. , will discuss Seelos’ lead candidate, Intranasal Racemic Ketamine (SLS-002) for Acute Suicidal Ideation and Behavior in patients with Major Depressive Disorder. In June, the company will participate in the Benchmark Company Healthcare House Call Virtual Video 1×1 Investor Conference, June 15-16.

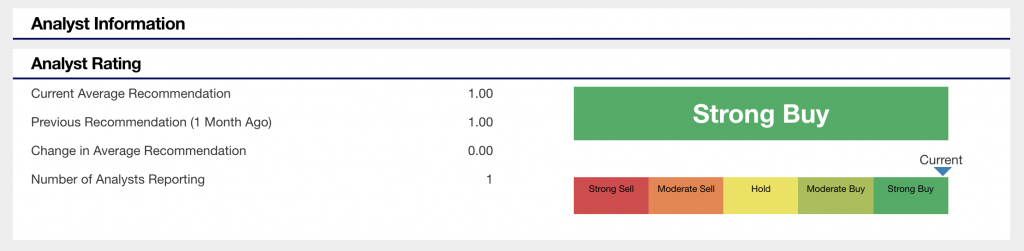

What do analysts think about SEEL stock? As far as the ratings are concerned, there weren’t many who are covering the company. However, among those following SEEL stock, they have a generally high expectation of Seelos. On average, analysts rate SEEL stock a “Strong Buy”. Will this factor into the next trend for the company or will investors take this with a grain of salt?

Penny Stocks To Buy [or sell]: Tetraphase Pharmaceuticals Inc.

Tetraphase Pharmaceuticals Inc. (TTPH Stock Report) is another one of the popular penny stocks to watch this year. If you remember when we picked up on some TTPH stock momentum in March, shares saw their first glimmer of bullish momentum. At the time the company had just announced a merger agreement with AcelRx (ACRX Stock Report). Through the deal, Tetraphase would be acquired. Furthermore, the two companies also entered into a co-promotion agreement to market and promote XERRAVA. But time passed and something happened. That “something” was more akin to someone’s date ditching them at the high school dance for another dance partner.

As discussed earlier this month, a Form 8K filing revealed some potentially big events for Tetraphase. On May 6, 2020, Tetraphase Pharmaceuticals received an unsolicited proposal from La Jolla Pharmaceutical Company to acquire Tetraphase for $22 million in cash, plus an additional $12.5 million in cash potentially payable under contingent value rights to be issued in the transaction.

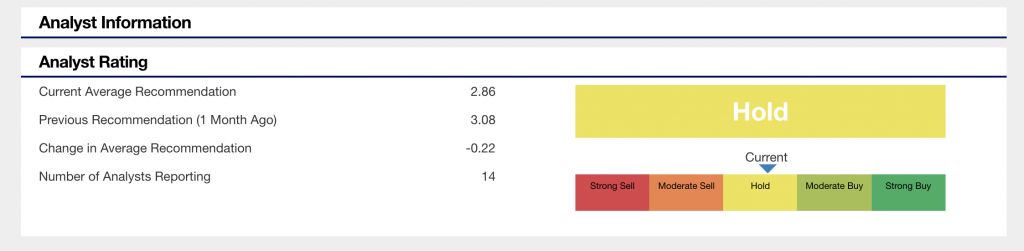

But that wasn’t all, Tetraphase released another 8K revealing a $27 million offer from Melinta Therapeutics. While the company stated that the Melinta offer is “reasonably” expected to lead to a superior offer, the board also stated something else in the filing. “At this time, the Tetraphase Board (1) continues to recommend the AcelRx Merger Agreement with AcelRx to its stockholders, (2) is not modifying or withdrawing its recommendation with respect to the AcelRx Merger Agreement and the merger, or proposing to do so, and (3) is not making any recommendation with respect to the Melinta Proposal or the Melinta Merger Agreement.” Here’s what current analysts think about TTPH stock.

Penny Stocks To Buy [or sell]: Zomedica Pharmaceuticals Corp.

Finally, Zomedica Pharmaceuticals Corp. (ZOM Stock Report) has been on the radar for weeks now. Back in February, we watched ZOM stock zoom to highs of nearly $0.50. This came as the company conducted an offering to continue the development of its diagnostic platform. After pulling back in March, ZOM stock caught attention again. This time, it was after announcing the verification of TRUFORMA™. This is its point-of-care diagnostic biosensor platform, and the first assay, Canine total T4 thyroxine. Fast-forward to this week and ZOM stock has rallied more than 100%.

This week is where things get interesting. In an earnings update, Shameze Rampertab, Interim CEO and CFO of Zomedica made a statement. He said, “We believe our continued progress on our diagnostic platform will enable us to deliver products that make a real difference for clinical veterinarians and the care they provide to our companion animals.”

Much of the building anticipation has focused on whether or not the company could continue seeing progress with its platform. Shortly after the close on May 20, the company dropped another bombshell. Zomedica announced that it completed the final verification of three additional assays for use with its TRUFORMA™. The newly verified assays, feline total T4, and canine and feline TSH, together with the previously verified canine total tT4 assay, represent the completion of the first two assays for both canine and feline of the total of five assays initially planned.

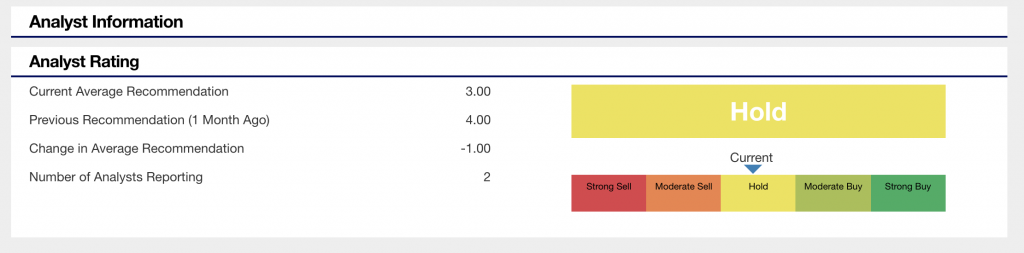

What does this mean? According to the company, a validated species-optimized TSH assay is not currently available for felines at either the point-of-care or at a reference lab. What do analysts think about ZOM stock? On average, the overall rating shows “Strong Buy” currently. Which column do you put it in? Comment below.