Are Penny Stocks Worth It? 3 Names to Know Right Now

3 Penny Stocks To Watch This Month

Today’s likely to be tense day for blue-chip stocks. All eyes are focusing on the FOMC meetings that begin later today. So where can investors look for volatility? Penny stocks, of course. The cheap stocks have always been a “safe haven” so to speak. I’m not talking about it in the sense of things like gold stocks, however. What I mean is that when the broader markets don’t fluctuate enough to make for healthy trading, micro-cap stocks and small-cap stocks are where people turn.

That’s for good reason too. Let’s go beyond sector excitement for a moment. Sure, when something big happens in the cannabis industry, for example, many pot stocks run. But beyond that, there are plenty of other penny stocks that simply rally from market momentum and timely corporate catalysts. But it all comes down to risk management.

As many of the top traders on Wall Street discuss, making money with penny stocks is simple but not easy. Most of the time it comes down to how you manage risk. Are you comfortable taking a 20% loss just as much as you are taking 20% or more gain? If you answered Yes, then you might be ok assuming a bit of risk. With this in mind, I ask the question, “Are penny stocks worth it?” In my opinion, that depends entirely on your risk profile.

If you’re bad at managing high-risk situations, these stocks might not be for you and in that case, you should learn how to trade stocks. But, if managing risk comes second nature, then penny stocks are likely a worthwhile thing to look into. This having been said, let’s take a look at a few of the most active penny stocks to watch right now.

Penny Stocks To Watch In December: DPW Holdings, Inc. (DPW)

This was a popular penny stock earlier in the year. DPW Holdings, Inc. (DPW Stock Report) rode the cryptocurrency wave for a bit but has since focused on other businesses. This week DPW announced that it has rebranded and will look to the global defense business for new opportunities. Its business will rebrand under the name “Gresham Worldwide.”

What does that mean for the company now? Well, anyone looking at this penny stock assumes DPW could become a new business. This is something that we’ve more frequently seen with OTC companies. But it sometimes happens with listed penny stocks as well. Today the company presents at the LD Micro Invitational conference and markets assume the company to discuss its new direction.

Read More

- What Are Penny Stocks And Are They Worth Buying?

- Penny Stocks & Popular Technical Indicators For Increasing Profits

- Are These Penny Stocks On Your Watch List? 3 Up Over 70% In Q4

Though this is yet to be seen, the company will see Jonathan Read, CEO of DPW Technology Group, join the Company’s CEO and Chairman Todd Ault, III to address a number of topics. According to DPW, this includes the progress achieved by the Company’s defense and commercial electronics sector. In addition, the two will discuss recent developments with the Company’s strategic investments, including MTIX.

Penny Stocks To Watch In December: Marinus Pharmaceuticals (MRNS)

Before we get into this next penny stock, let’s address something that’s a frequent topic of discussion: capital raising. As it’s referred to, financing activities focus on generating capital for public companies. Usually, it’s in exchange for shares of that company, which can lead to dilution. Many times we’ll see companies announce funding deals and share prices plummet. But herein lies the specifics: look at corporate filings for the full details. You’ll see more in an 8K than you will in the press release that comes with it.

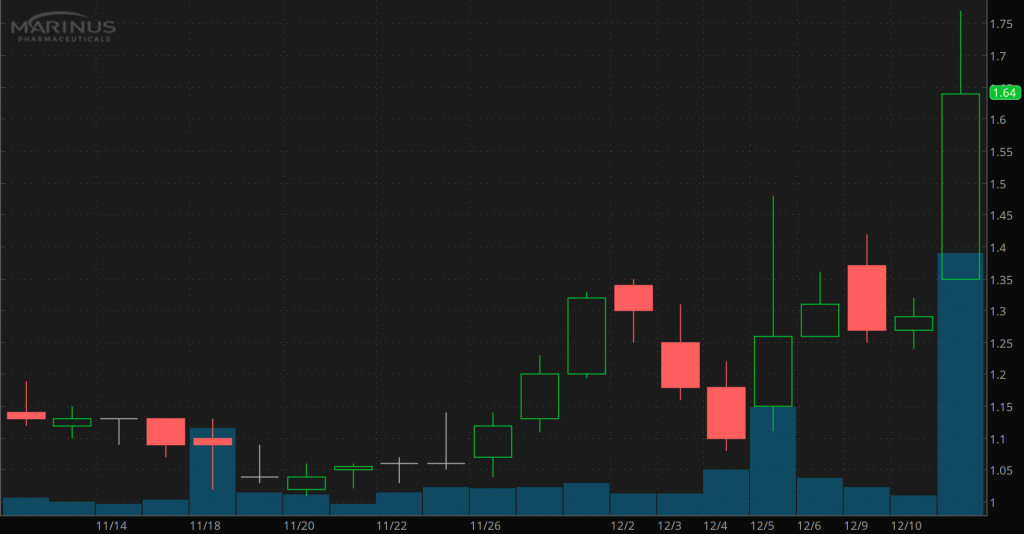

How does Marinus Pharmaceuticals (MRNS Stock Report) fall into this equation? This week the company announced a $65 million public offering but instead of dropping, shares flew. Let’s look at the specifics of this deal. Marinus completed this funding at $1.25 per share, which is nearly at market price. There’s also a deal in place for the company to sell convertible preferred stock that also converts at $1.25 per share.

So with upwards of nearly $100 million in potential proceeds, this could make for a huge opportunity for Marinus to take advantage of a strong cash infusion. The company plans to use the money to further push its development of ganaxolone.

Clinical trials, regulatory expenses, R&D, and more are what Marinus plans to direct funds toward. Needless to say, because the price wasn’t at an extreme discount to market, could this make for a bigger opportunity for MRNS stock before next year?

Penny Stocks To Watch In December: Camber Energy Inc. (CEI)

One of the most popular penny stocks today, Camber Energy (CEI Stock Report) has broken out in a big way over the last 24 hours. After the market closed on Tuesday, shares of CEI stock jumped from $1.21 to early highs on Wednesday of $2.85. This continued a multi-week rally that began after CEI hit 52-week lows of $0.50. So what has sparked such a rally?

[Read More] 3 Penny Stocks to Watch in 2020; 1 Up 42% This Month

Honestly, there hasn’t been much of any news to speak of. But after completing a reverse stock split, the company had roughly 1.5 million shares of stock issued and outstanding. Even if it converts all Series C preferred shares, Camber explained the top end OS would be 5 million shares. This was reported at the start of December in an 8K filing. This could suggest CEI stock is a very low float penny stock to watch.

Again, reading the filings first, instead of what the news wire shows can give you a better understanding of what’s going on inside of a company. Could this latest move simply be due to a tighter share structure?