2 Penny Stocks Hit New 2019 Highs This Week; Can They Move Higher?

When you talk about cheap stocks like penny stocks, 52-week highs may not be exciting. But it depends on who you ask. Think of it this way, a new 52-week high means something’s going on with that company. Are you curious? Well, I am and that’s why I think it’s important to look into certain stocks at 52-week levels; both highs and lows.

Let’s set one thing straight, however. It’s likely that on a daily basis, there are many penny stocks that hit these levels. But you need to take certain things into account, mainly volume. Because so many micro-cap stocks are thinly traded, even lighter volume can send the prices soaring or plummeting. Based on this, you want to be able to tell the difference between a “real move” and one that just showed paper gains. Let me explain.

If a penny stock trades less than 1,000 shares out of the blue and managed to hit new all-time highs, I would consider that “paper gains.” The likelihood of anyone making money with that penny stock is slim. However, if you see a penny stock trading millions upon millions of shares throughout the course of a month and it consistently climbs to reach new highs, I’d consider that a real move. To each their own. Let’s take a look at two penny stocks that just made fresh highs.

Penny Stocks To Watch #1 Nordic American Tankers Limited (NAT)

The Bermuda company, Nordic American Tankers (NAT Stock Report) has been benefiting from the rise in most tanker stocks recently. The company has been benefiting from a strong year in 2019 compared to its 2018 year.

For instance, its time charter equivalent in the first half of 2018 was $10,850/day. The first half of this year showed $20,414 per day per ship. The company also stated that “there are several indicators that the tanker market is going up. The most obvious can be seen in the {…} year-on-year numbers.”

[Read More] Top 10 Penny Stocks On Robinhood To Watch For October 2019

The company has consistently kept the public abreast of its outlook on the market. It has further discussed potential threats like the Saudi oil attack earlier in the year. All-in-all, NAT stock has benefited from a stronger market and a company focusing on growth.

One thing to note, however, is that the recent surge has come swiftly. Shares are up by more than 40% within the first 7 days of the month already. After hitting new highs of 2019, can NAT stock still head higher?

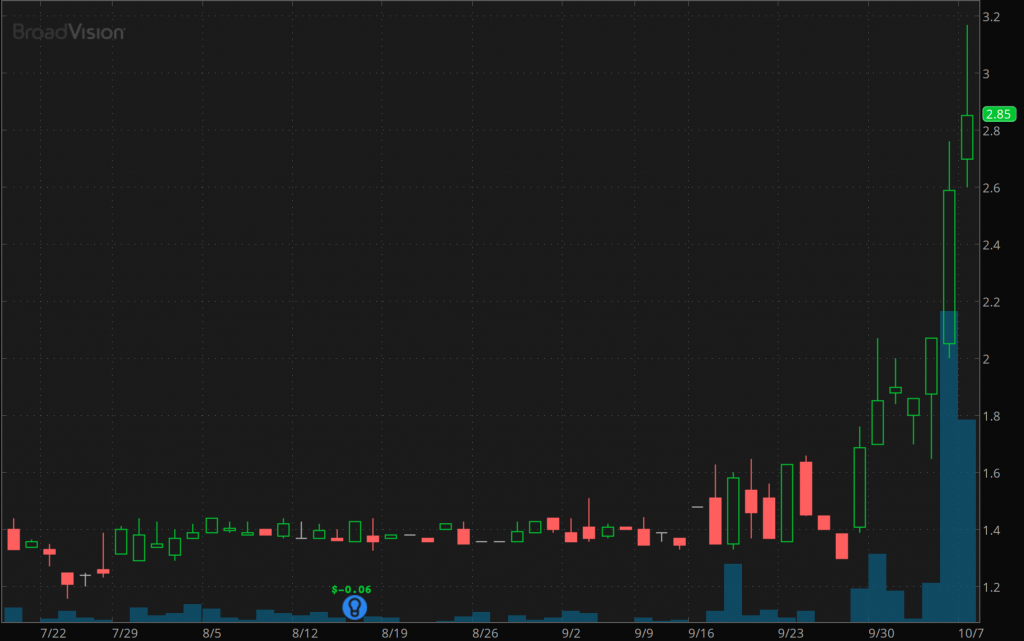

Penny Stocks To Watch #2 Broadvision Inc. (BVSN)

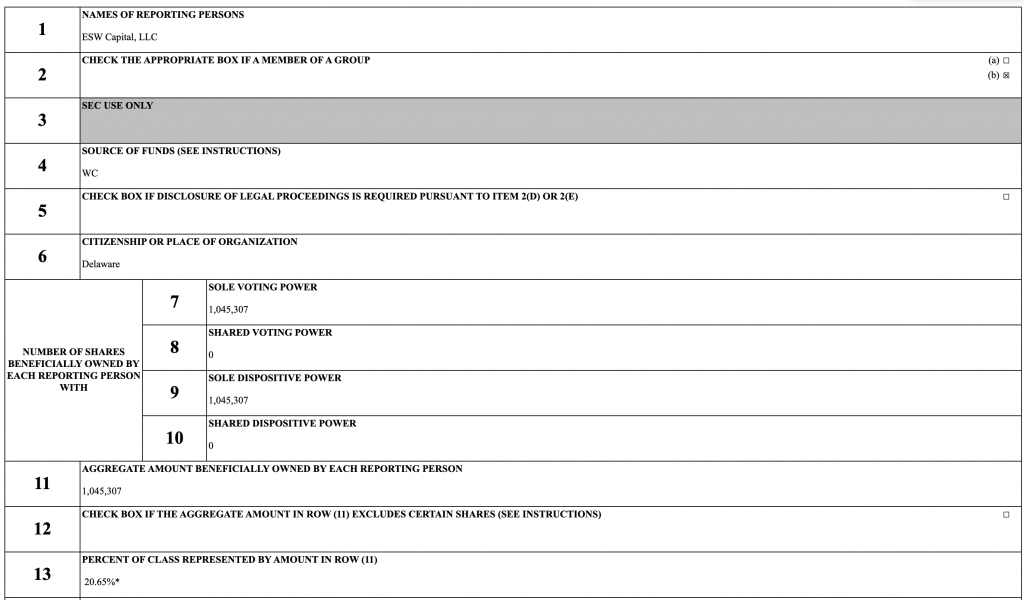

The other company on this list of penny stocks is Broadvision Inc. (BVSN Stock Report). Shares of BVSN stock rocketed to new 2019 highs this week. This came after it was revealed that ESW Capital holds a 20.65% stake in the company according to a 13D filing.

Typically when a capital firm holds such a large position it reiterates a bullish sentiment in a stock. According to FinViz, the float on BVSN stock is just over 4 million shares.

Typically with low float penny stocks, the price action can be even more volatile. The simple reason is that there are fewer shares available for the public to trade. This could have been the outcome that Broadvision saw over the last few days. Similar to NAT, BVSN stock also rocketed swiftly. Since the 13D filing, shares have run up as much as 125%.

Like This Article? Check Out Some Penny Stocks 101 Content: Are Penny Stocks A Good Investment?