3 Penny Stocks On Robinhood To Watch This Week

When it comes to penny stocks to buy, volatility plays a big role.

Trading things like large-cap stocks doesn’t generally mean bringing insane returns very quickly; maybe 5-10% in a week. However, trading penny stocks can bring those returns within a matter of days or even hours. Robinhood has become a popular stock trading application among millennials. Furthermore, when it comes to penny stocks, Robinhood allows access to some of the top companies to trade.

When you mix volatile sectors with small-cap stocks, that breakout potential can be even greater. Take, for instance, biotechnology penny stocks. This sector is known for generating some of the most volatile names around and for good reason. When it comes to biotech and healthcare stocks, innovation is the focus.

With one positive Phase Trial, a company can become one of the top penny stocks to buy overnight. Thanks to penny stocks having crazy volatility, the price action can swing 20-30% or even in the triple digits. However, when we’re talking about “Robinhood penny stocks,” traders are restricted to companies trading on the NASDAQ and NYSE exchanges. With this in mind, here are some penny stocks to watch especially if you use Robinhood:

Penny Stocks On Robinhood To Watch #1: Tiziana Life Sciences (TLSA)

This company was hovering in and out of penny stock territory for most of the year. However, recently Tiziana Life Sciences (TLSA Stock Report) has begun to establish itself as a “former penny stock”. That’s because the biotech company has seen a jolt of trading momentum build during September. As we typically discuss when it comes to penny stocks to watch, corporate events and penny stock news can be key drivers. As far as TLSA stock is concerned, 2 announcements on 2 different phase trial data sets have helped bring more attention to the company.

Why the move from Tiziana? Let’s look back at the beginning of the month when the company made its first announcement of the month. Tiziana reported positive Phase 2a data from the clinical activity of its Milciclib therapy. The specific trial targeted patients with advanced Sorafenib-resistant or -intolerant patients with unresectable or metastatic hepatocellular carcinoma. The second announcement came this week when Tiziana reported Phase 1 clinical data from its nasally administered Foralumab therapy. The aim of this particular trial was to determine tolerability and effects on certain biomarkers.

“This study demonstrates for the first-time that nasally administered Foralumab, at the identified optimal dose of 50 μg, induces immunomodulatory effects capable of providing clinical benefit to treated subjects. This is a major accomplishment providing the scientific rationale to move forward with further clinical development of nasally administered Foralumab in patients with neurodegenerative diseases.”

Dr. Howard L. Weiner, a member of scientific advisory board of Tiziana Life Sciences

Penny Stocks On Robinhood To Watch #2: Community Health Systems Inc. (CYH)

Healthcare penny stock Community Health Systems Inc. (CYH Stock Report) is a healthcare company that buys and runs acute care hospitals in the US. The company operates an impressive 103 hospitals across 18 states, holding 17,000 beds. Ever since August 28th, CYH stock has been thriving. It is up over 82% since the 28th going from $1.82 to $3.48.

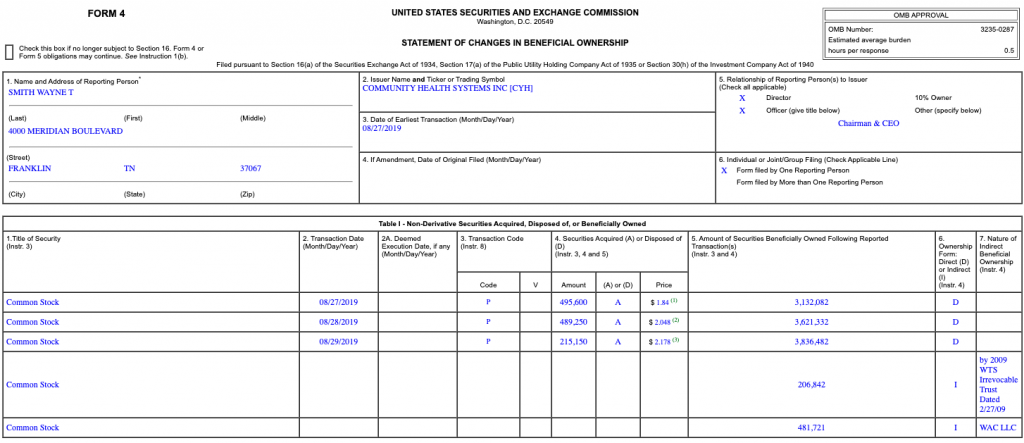

A possible catalyst for this move came on August 30th when the company completed its divestitures of hospitals in Florida. Furthermore, while the price has been increasing, share volume for the stock has also been steadily increasing. Also, keep in mind that Community Health Systems insiders are buying up shares of the stock as well.

From August 27th to August 29th, more than $2 million was spent between Wayne Smith and Benjamin Fordham to pick up more than 1 million shares. The majority of these shares were bought by Smith at an average price between $1.84 and $2.18

Penny Stocks On Robinhood To Watch #3: Can-Fite Biopharma Ltd. (CANF)

Last on this list of penny stocks to watch on Robinhood, Can-Fite Biopharma Ltd. (CANF Stock Report). This biopharmaceutical company aims to create treatments targeting the A3AR protein. The A3AR protein is prevalent in inflammatory and cancer cells. Can-Fite has 3 treatments currently undergoing clinical trials with “CF101” being in stage 3. This biotech penny stock was up by as much as 35% with above-average volume.

But can this move sustain itself beyond 1 day? The chart above is of a 24-hour chart. Though CANF stock jumped from lows of $2.32 to premarket highs of $3.30, shares have consolidated significantly since the opening bell. Regardless, CANF is experiencing this strong push thanks to a recent strategic agreement with Univo Pharmaceuticals.

The agreement will allow Can-Fite to develop cannabis-based treatments. Dr. Pnina Fishman, CEO of Can-Fite, expressed, “This collaboration provides Can-Fite with new and very exciting business opportunities for utilizing our technology platform and expertise.”