Will These 2 Penny Stocks Continue Their Trends In July?

When it comes to finding penny stocks to buy, you have some decisions to make. One of the best ways of consistently making good decisions as an investor is by keeping an eye on the market. It would also be smart to track categories of stocks in which one might be interested.

This is an approach that should help people when they are looking for the next big penny stock to breakout. More often than not, this sort of approach can prove to be effective. With that in mind, it is interesting to have a look at two penny stocks that made significant moves last week on the back of important news. And when it comes to big moves with penny stocks, those can be in either direction. So keeping this in mind, here are two penny stocks that have made big moves in July:

Penny Stock #1: J.C. Penney Company (JCP)

Iconic American departmental store J.C. Penney Company Inc. (JCP Stock Report) has been in immense trouble over the past few years. This has been due to its large debt burden in addition to colossal losses. In an exclusive article, Reuters reported that the company has met with investment bankers and lawyers who are experts at debt restructuring. This was in order to better manage its $4 billion debt load. In Q1 2019, the company posted losses of $154 million. At this point in time, J.C. Penny has to pay $300 million in interest payments alone, every year.

| Read More | J. C. Penney: Penny Stock Plunges to New Lows, What’s The Buzz?

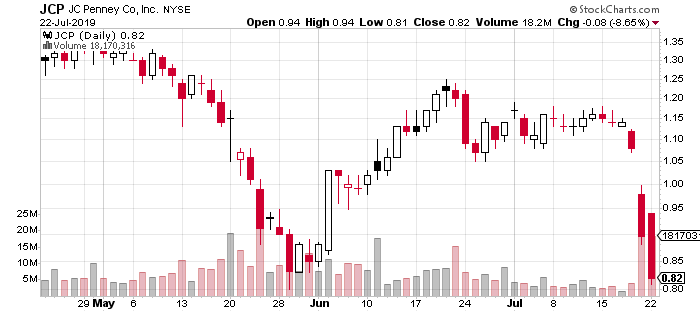

The current state of the retail industry could prove to be a problem for any such restructuring deal. This is why investors now feel that the company is likely heading towards inevitable bankruptcy. Shares dropped below $1 after the news broke and on Friday was down 16% at $0.90. Unfortunately, this drop didn’t end at the close of the week either. Shares of the penny stock dipped even further to lows of $0.81 on July 22 to begin the week. As shares continue to tumble, with JCP stock be setting new, all-time lows soon?

Unfortunately, this drop didn’t end at the close of the week either. Shares of the penny stock dipped even further to lows of $0.81 on July 22 to begin the week. As shares continue to tumble, with JCP stock be setting new, all-time lows soon?

Penny Stock #2 Flower Holdings (FLWR) (FFLWF)

On the other hand, cannabis company Flowr Holdings Corp. (FLWR Stock Report) (OTCPK:FFLWF) had a great few days on the market. Much of the trading volume has come in for the Canadian marijuana penny stock. This was after it decided against going forward with a share offering it previously announced.

The company wants to acquire a European outfit, Holigen Holdings Ltd. Holigen develops cannabis production facilities in Australia and Portugal. The penny pot stock wanted to raise C$125 million for the acquisition. Furthermore, it already has a 19.8% stake. The company announced that current market conditions are not conducive to raise money through a share offering. For this reason, Flowr expressed concern about the interests of the shareholders.

This is a unique event for such a penny stock. Most micro-cap companies will elect to raise funds no matter the market conditions. However, Flowr has taken an ethical directive to protect its shareholders. Following this news, shares skyrocketed by as much as 21.50%. Shares dipped on July 22, however, so it will be interesting to see how the week works out.