CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Originally Published: October 12, 2023, 8:30 AM ET

Updated: October 12, 2023 8:39 AM ET

The latest Consumer Price Index (CPI) data for September will be released today, providing critical insights into the current state of inflation. This highly anticipated economic indicator tracks changes in the prices paid by consumers for goods and services. The CPI serves as a key inflation barometer, influencing everything from Social Security benefits to interest rates.

In recent months, inflation has emerged as a pressing economic concern. The August CPI report revealed a 3.7% annual increase. Although inflation has come down over the last year, persistently higher prices have eroded consumer purchasing power and prompted an aggressive policy response from the Federal Reserve. The Fed has enacted a series of bumper interest rate hikes in an effort to cool demand and restrain runaway inflation.

Markets are keenly focused on whether the September data will show inflation continuing to moderate or if price increases have proven stubbornly persistent. Consumer spending patterns also remain in flux due to factors like high gas prices and rising borrowing costs. The trajectory of inflation holds enormous implications for Fed rate policy and the growth outlook.

Analysts project the September CPI report will reveal a 3.6% year-over-year increase. This would represent a modest step down from the prior month and reinforce hopes that the crest of inflation has passed. However, core CPI, which excludes volatile food and energy categories, is expected to show a decline to 4.1% from 4.3% in the previous month. The contrast highlights the complex dynamics currently at play. Even if headline inflation slowly recedes, the battle is far from over.

What Is CPI Inflation Data?

But what exactly is the CPI? In essence, it is a comprehensive measure of the average price level of goods and services commonly consumed by households. By tracking changes in the prices of these items over time, CPI can give insight into the trajectory of inflation. It also allows economists and investors to gauge the purchasing power of consumers, and make informed decisions.

The U.S. Bureau of Labor Statistics explains it as“The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).”

The Consumer Price Index (CPI) is like a window into what’s going on in the economy. It shows what’s happening with supply and demand, costs, and how people are spending their money.

In 2023, with everything going on in the world, the CPI and stock market are tightly connected. Will inflation keep going up, pushing interest rates higher too? Or will the data show inflation cooling off to more normal levels?

Traders are watching closely to figure out which way things are headed amid all the market ups and downs lately. The CPI offers clues about where we might be headed next.

CPI Data and the September Consumer Price Index report is released at 8:30 am ET today, October 12th.

CPI Report Today: September Inflation Expectations

CPI Inflation Data Expectations For September 2023:

- CPI Expectations (month-over-month): 0.3%, Previous read was 0.6%

- CPI Expectations (year-over-year): 3.6%, Previous read was 3.7%

- CORE CPI Expectations (month-over-month): 0.3%, Previous read was 0.3%

- CORE CPI Expectations (year-over-year): 4.1%, Previous read was 4.3%

The Consumer Price Index Report For September 2023 & PPI Numbers

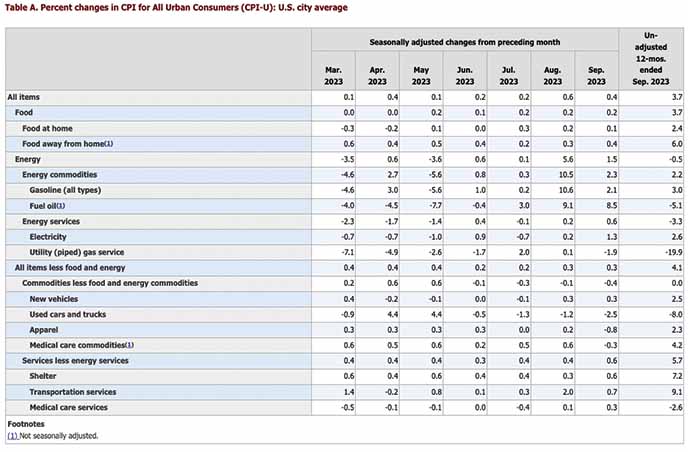

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all items increase, accounting for over half of the increase. An increase in the gasoline index was also a major contributor to the all items monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month. The food index increased 0.2 percent in September, as it did in the previous two months. The index for food at home increased 0.1 percent over the month while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.3 percent in September, the same increase as in August. Indexes which increased in September include rent, owners’ equivalent rent, lodging away from home, motor vehicle insurance, recreation, personal care, and new vehicles. The indexes for used cars and trucks and for apparel were among those that decreased over the month.

The all items index increased 3.7 percent for the 12 months ending September, the same increase as the 12 months ending in August. The all items less food and energy index rose 4.1 percent over the last 12 months. The energy index decreased 0.5 percent for the 12 months ending September, and the food index increased 3.7 percent over the last year.

September CPI Report: Food

The food index rose 0.2 percent in September, as it did in the previous two months. The index for food at home increased 0.1 percent over the month, after rising 0.2 percent in August. Three of the six major grocery store food group indexes increased over the month. The index for meats, poultry, fish, and eggs rose 0.5 percent in September as the index for pork increased 1.6 percent. The index for other food at home increased 0.3 percent over the month and the index for dairy and related products rose 0.1 percent.

September CPI Report: Energy

The energy index rose 1.5 percent in September after increasing 5.6 percent in August. The gasoline index increased 2.1 percent in September, following a 10.6-percent increase in the previous month. (Before seasonal adjustment, gasoline prices rose 0.6 percent in September.)

Despite the September monthly increases, the energy index fell 0.5 percent over the past 12 months, with its components mixed. The natural gas index fell 19.9 percent, and the fuel oil index fell 5.1 percent over the span. The gasoline index increased 3.0 percent over the last 12 months, while the index for electricity rose 2.6 percent over the last year.

September CPI Report: All items less food and energy

The index for all items less food and energy rose 0.3 percent in September, as it did in August. The shelter index increased 0.6 percent in September, after rising 0.3 percent the previous month. The index for rent rose 0.5 percent in September, and the index for owners’ equivalent rent increased 0.6 percent over the month. The lodging away from home index increased 3.7 percent in September, ending a string of 3 consecutive monthly decreases.

The index for all items less food and energy rose 4.1 percent over the past 12 months. The shelter index increased 7.2 percent over the last year, accounting for over 70 percent of the total increase in all items less food and energy. Other indexes with notable increases over the last year include motor vehicle insurance (+18.9 percent), recreation (+3.9 percent), personal care (+6.1 percent), and new vehicles (+2.5 percent).

CPI Report Summary:

CPI Expectations (month-over-month): 0.3%

Actual CPI (month-over-month): 0.4% ABOVE EXPECTATIONS

CPI Expectations (year-over-year): 3.6%

Actual CPI (year-over-year): 3.7% ABOVE EXPECTATIONS

CORE CPI Expectations (month-over-month): 0.3%

Actual CORE CPI (month-over-month): 0.3% IN LINE WITH EXPECTATIONS

CORE CPI Expectations (year-over-year): 4.1%

Actual CORE CPI Expectations (year-over-year): 4.1% IN LINE WITH EXPECTATIONS