If you’re curious about penny stocks, they offer an interesting niche. Whether you’re new to trading these stocks or expanding your investment style, understanding what to look for and how to build a strong watch list is obviously important.

What Are Penny Stocks?

Penny stocks are stocks of small companies that trade at low prices, often below $5 per share. While you can find cheap stocks on major exchanges like the NYSE or Nasdaq, many penny stocks trade over the counter, such as on the OTC Bulletin Board. These stocks have lower prices, with some trading at a fraction of a cent. However, it’s essential to approach them with caution, as they come with unique risks.

Are Penny Stocks Worth It?

Now, you might wonder, why invest in penny stocks? The appeal lies in their potential for significant returns. Unlike established blue-chip stocks, cheap stocks can experience rapid value increases over a short period. They offer high-risk, high-reward opportunities for investors looking to capitalize on emerging trends. Additionally, penny stocks can be attractive to those with limited capital, allowing for portfolio diversification without requiring substantial investment.

Staying informed about the latest stock market news is essential when finding penny stocks to watch. The news serves as a catalyst for driving interest and potentially impacting stock prices. Positive developments like partnerships, product launches, or financial milestones can help identify promising penny stocks.

Penny Stocks To Buy According To Insiders

Monitoring insider buying activity is a strategy employed by some traders. Insider buying occurs when company executives or individuals with inside knowledge purchase shares of their own company’s stock. This activity is often seen as a positive signal, reflecting confidence in the company’s future success. Tracking insider filings can help build a watch list of penny stocks that have captured insiders’ interest.

While penny stocks offer potential opportunities, it’s worth noting that they should be approached with caution. These stocks are known for their high volatility and susceptibility to market manipulation. Thorough research, due diligence, and risk management are essential when venturing into this arena. While insider trading can spark positive sentiment, it’s important to consider it alongside other factors in your investment strategy. Today we continue the list of penny stocks from our article 4 Top Penny Stocks To Buy According To Insiders In May 2023.

Atlus Power Inc. (AMPS)

Atlus Power has been under pressure for most of the year. However, the last few weeks have brought some bullish momentum back to the market. The company announced expansion into Maine earlier this month as the solar company plans to enter its 25th market. In its latest earnings report, Atlus blew by EPS estimates and reported a $0.03 gain compared to the $0.04 loss that was anticipated. Meanwhile, a slight miss in sales dampened the mood slightly.

Atlus also reaffirmed 2023 adjusted EBITDA guidance. It’s expected in a range of $97-$103 million and would be 70% growth over 2022 at the midpoint. This year’s adjusted EBITDA margin is expected to be in the “mid-to-high” 50% range.

– How to Handle Penny Stocks Volatility in 2023

What do insiders think about AMPS stock right now? Co-CEO Gregg Felton recently reported the purchase of 75,000 shares. Based on the Form 4 filing, he purchased shares between $4.37 and $4.50. The traders were conducted through his Felton Asset Management company, bringing its holdings to more than 11.85 million. Felton also directly owns over 3.68 million shares.

Standard Biotools Inc. (LAB)

Small biotech stocks have gained attention recently. Due to their inherently speculative nature, the broader market chop has opened the floodgates to identifying pockets of volatility. Standard Biotools has a portfolio of tools biomedical researchers use to develop medicines more efficiently.

The company announced earnings earlier this month, highlighting the stronger earnings per share loss compared to the previous year’s. Sales were down slightly compared to Q1 2022; however, management appears open to making strides to push forward with a stronger 2023, overall.

“Our focus continues to be the fundamental transformation of our core business into a cash flow positive, self-sustaining enterprise from which we can build organically and inorganically. To that end in the quarter, we were able to reduce operating cash burn significantly and stimulate early but encouraging growth in our core product and service business lines,” said Michael Egholm, PhD, President and Chief Executive Officer of Standard BioTools™.

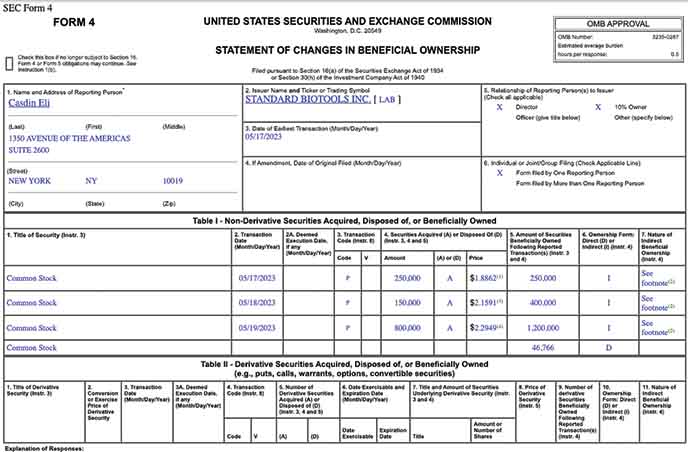

Insiders are buying up shares of LAB stock in May. Director Eli Casdin and CFO Jeffrey Black were the latest to add to their positions. Casdin’s purchases totaled 1.2 million shares at prices ranging from $1.855 to $2.2982. Black’s purchases totaled just under 86,000 shares at prices ranging from $2.14 to $2.32.

Chimerix (CMRX)

Chimerix is another one of the biotech penny stocks to watch this month. The company was in the headlines amid the monkeypox outbreak but cooling concerns over the virus have led to a cooling share price for CMRX stock. Nevertheless, this week has been a different one fo the penny stock. Shares popped back above the $1.20 level as momentum continued building following Chimerix’s earnings beat.

– Best Penny Stocks Today? 4 With Big News To Watch This Week

“2023 is off to a strong start and has been highlighted by multiple presentations of data in support of our imipridone platform during the recent American Association for Cancer Research Annual Meeting (AACR) and our sponsorship at the Canadian Neuro-Oncology Meeting (CNO) this week,” said Mike Sherman, Chief Executive Officer of Chimerix.

Insiders also seem upbeat lately, based on the latest activity. Directors Robert Meyer and Martha Demski, as well as CEO Michael Sherman and CFO Michael Andriole, picked up thousands of shares at average prices between $1.11 and $1.14. The largest purchase was from the company’s CEO, who bought more than 80,000 shares in his Michael A Sherman Trust.

List Of Penny Stocks

- Atlus Power Inc. (NYSE: AMPS)

- Standard Biotools Inc. (NASDAQ: LAB)

- Chimerix (NASDAQ: CMRX)

- Ginkgo Bioworks (NYSE: DNA)

- Porch Group (NASDAQ: PRCH)

- Marqeta (NASDAQ: MQ)

- FiscalNote Holdings Inc. (NYSE: NOTE)