Penny stocks are some of the most volatile in the stock market today and for a good reason. A price change of just a few cents can make a significant difference in percentage change in position value. This high-risk scenario has lent itself to present considerable potential for rewards when traded correctly. Now, I’m not talking about buying meme stocks in 2021 because, hopefully, by now, most know “stonks don’t always go up.”

Thanks to the May Fed Meeting statement and Jerome Powell’s press conference, there’s more uncertainty in the stock market today. But retail traders, ironically, are finding opportunities in higher-risk stocks as opposed to what traditional investment theory suggests, which is buying “safe stocks” ahead of a pending recession.

Generally speaking, penny stocks tend to move in a disconnected manner compared to other stocks. Speculation takes the front seat, with long-term fundamentals being pushed aside. Even with the stock market down today, there are plenty of cheap stocks to watch.

This has been a daily theme as the market jockeys for position. In recent sessions, countless low-float China-based company penny stocks have exploded. Most hadn’t released news or posted an SEC filing in weeks, some even months. Yet shares of their stock surged as speculative trading focused on that niche of the market. Much of the underlying sentiment came from the massive breakout that Top Financial Group (NASDAQ: TOP) stock experienced. Shares exploded from below $5 to over $256 within days. That same trend has continued throughout the week.

How To Find Penny Stocks To Buy

Finding penny stocks to buy is simple, though not easy. The first step is identifying the types of stocks you want to add to your watch list. Are you looking for high-volatility penny stocks, stocks with unusual volume, companies with higher levels of insider trading, penny stocks with high levels of chatter among retail traders, or something else?

One of the quickest ways to assemble your list of penny stocks is to identify trends. In this article, we’re looking at a few of the most active stocks today. We look into what has transpired and triggered the latest moves, then analyze any future events that could be potential catalysts.

Penny Stocks To Watch

Vimeo Inc. (VMEO)

Shares of online video platform company Vimeo made a statement on Thursday. VMEO stock popped over 14% during the early morning session following its latest financial results. Shortly after the stock market closed on Wednesday, Vimeo reported its financials from the first quarter of 2023.

Earnings per share were flat, while sales of $103.6 million beat analyst expectations of $102.09 million. The company sees 2023 posting a loss of between $45 million and $50 million. Its near-term outlook for the second quarter includes $100 million in revenue with a $17 million loss.

“In the first quarter, Vimeo delivered our third consecutive quarter of positive Adjusted EBITDA and Free Cash Flow, and our third quarter of accelerating Bookings growth in Vimeo Enterprise,” said Anjali Sud, Chief Executive Officer of Vimeo. “Importantly, we are seeing encouraging signs that we can return Self-Serve to growth as we get to a more normalized post COVID environment. We believe our results and the momentum behind our initiatives indicate that we’re very much on track to simplify Vimeo and grow efficiently in the future.”

This news has sparked a more decisive move in the stock market today.

IN8bio Inc. (INAB)

Late last month, IN8bio gained attention and saw increased trading action after presenting positive data on its INB-100 in leukemia patients. The data was presented at the European Society for Blood and Marrow Transplantation meeting. All evaluable patients treated with INB-100 were alive and progression-free with “durable complete remission” as of April 21.

– 4 Penny Stocks To Buy According To Insiders This Quarter

With May underway, INAB stock continues as a focus for retail traders, with shares rebounding significantly over the last week. On Tuesday, IN8bio announced more data-related milestones, which helped continue its bullish trend. The company reported plans to present preclinical data from its INB-400 platform in ovarian cancer. This presentation will happen at the mid-May American Society of Cell & Gene Therapy meeting.

Chief Science Officer Lawrence Lamb, Ph.D., also gave insight into early results saying, “These data demonstrate the potential of gamma-delta T cells to target and kill solid tumor cells outside the brain. We are encouraged by these findings and will continue exploring the potential of INB-400 across a broad range of solid tumors where new treatment options are urgently needed.”

If INAB stock is on your watch list right now, keep May 17th in mind. This is when the company will have its poster presented at the event.

Protalix Biotherapeutics (PLX)

Another one of the biotech penny stocks to watch this week is Protalix Biotherapeutics. The company develops therapeutic proteins using its ProCellEx plant-based expression system. Shares of the company have exploded this year from around $1.40 to highs of over $3.20.

One recent development that is helping prompt momentum in the stock is the comapnhy’s Phase 1 trial in PRX-115. This is the company’s treatment candidate for severe gout. Protalix dosed the first patient in the trial at the end of March with plans to enroll 56 patients. CEO Dror Bashan explained the event “highlights our commitment to building and strengthening our pipeline. Given our corporate mission to deliver new medicines to patients with high, unmet needs, we look forward to continued enrollment and dosing of patients in this trial.”

This week Protalix announced its latest financial results and a business update, which seems to have been well-received by the market.

Oramed Pharmaceuticals (ORMP)

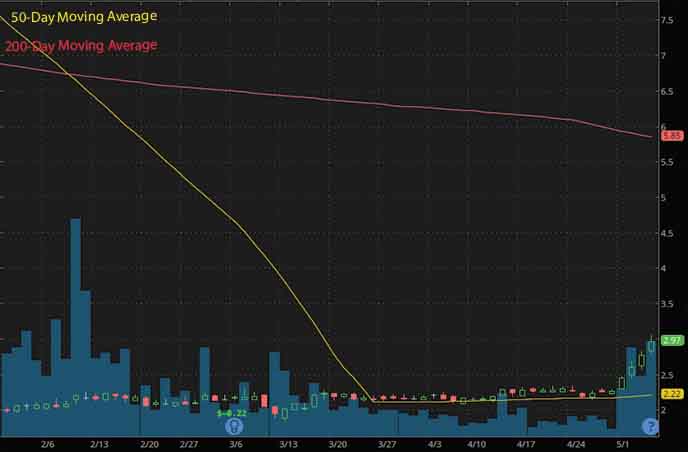

Shares of Oramed are finally trading higher after starting the year on a very harsh note. The company’s diabetes candidate failed in a Phase 3 study, which saw ORMP stock implode. Fast forward to this month, and there are several things traders are focused on.

The company has been exploring strategic alternatives as it analyzes the data from that discontinued Phase 3 trial. One of the more recent highlights bringing attention back to the company is a new board appointment. Oramed appointed Ben Shapiro as an independent director of the company. For those who may not know, Shapiro has become a leading voice among conservatives in the U.S.

In a May 1st update, Oramed Chief Executive Officer Nadav Kidron commented on the latest milestone, “Ben’s unique talents and qualifications are expected to bring real value to the current Oramed Board.”

– The Penny Stock Trader’s Guide to Technical Indicators

Shapiro said he believes Oramed is “in a unique position to utilize its current capital effectively, ” which will benefit shareholders. Shapiro himself beneficially owns over 4% of Oramed’s outstanding stock, making him a significant shareholder in the company.

List Of Penny Stocks

- Vimeo Inc. (NASDAQ: VMEO)

- IN8bio Inc. (NASDAQ: INAB)

- Protalix Biotherapeutics (NYSEAMERICAN: PLX)

- Oramed Pharmaceuticals (NASDAQ: ORMP)