Published: April 12, 2023, 8:30 AM ET

Updated: April 12, 2023, 10:28 AM ET

Whether you’re trading penny stocks or large-cap stocks, research is essential for navigating stock market trends. This week, the focus is on inflation data, with March’s CPI figures hitting the stock market. In this article, we’ll outline the key takeaways from the March Consumer Price Index report and provide an overview of CPI, its significance, and its relevance to stock market economic data in 2023.

Today we look to uncover the importance of CPI inflation data in stock market trends and how it can affect your investments. Read on to become well-informed.

CPI Inflation Data & The CPI Report Defined

CPI inflation data ignited a fleeting surge of bullish optimism toward the end of the year last year. However, volatility reemerged due to PPI results, making the final CPI report of 2022 a critical factor for those anticipating a Santa Claus rally. If you’re new to economics or stock market trading, you may be unfamiliar with CPI inflation data and what to watch for in the March CPI report.

What Is CPI Inflation Data? CPI stands for “Consumer Price Index.”

The U.S. Bureau of Labor Statistics explains it as“The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors’ and dentists’ services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).”

CPI is designed to measure “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas.”

– Swing Trading Penny Stocks: Short Term Success Strategies

Consumer Price Index Report For March 2023 & CPI Numbers

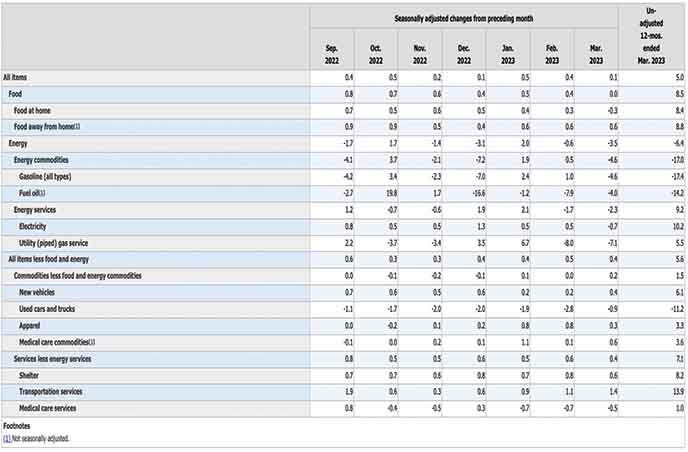

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. The food index was unchanged in March with the food at home index falling 0.3 percent.

The index for all items less food and energy rose 0.4 percent in March, after rising 0.5 percent in February. Indexes that increased in March include shelter, motor vehicle insurance, airline fares, household furnishings and operations, and new vehicles. The index for medical care and the index for used cars and trucks were among those that decreased over the month.

The all-items index increased 5.0 percent for the 12 months ending March; this was the smallest 12-month increase since the period ending May 2021. The all items less food and energy index rose 5.6 percent over the last 12 months. The energy index decreased 6.4 percent for the 12 months ending March, and the food index increased 8.5 percent over the last year.

Breaking Down The CPI Data: Key Takeaways

- CORE CPI Month Over Month: 0.4%, IN LINE with expectations

- CPI Month Over Month: 0.1%, BELOW expectations of 0.2%

- CPI Year Over Year: 5%, BELOW expectations of 5.2%

- The food index was unchanged in March

- The food at home index rose 8.4 percent over the last 12 months

- The energy index fell 3.5 percent in March after decreasing 0.6 percent in February

- The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy.

Other Inflation Data From March 2023

The medical care index fell 0.3% in March, after falling 0.5% in February. The index for hospital services fell 0.4% over the month, after being unchanged in February. The index for physicians’ services continued to decline, falling 0.2% after declining 0.5% in February. The prescription drugs index increased 0.1% in March.

The shelter index increased 8.2% over the last year, accounting for over 60% of the total increase in all items, less food and energy. Other indexes with notable increases over the last year include motor vehicle insurance (+15.0%), household furnishings and operations (+5.6%), recreation (+4.8%), and new vehicles (+6.1%).

The Stock Market Today

Immediately following the latest CPI inflation data from March 2023, the stock market rose. Broad index ETFs, including the S&P 500 (NYSEARCA: SPY), Nasdaq (NASDAQ: QQQ) and the Dow (NYSEARCA: DIA). Cryptocurrencies also rose with sector leader, Bitcoin holding firmly above the $30,000 mark and the lower-priced Ethereum hovering above $1,900.

Shares of Big Tech and other growth stocks followed suite with the likes of Meta Platforms (NASDAQ: META) and Snowflake (NYSE: SNOW) popping during premarket hours. Shares of more value-based stocks, including Ford (NYSE: F), Kraft Heinz (NASDAQ: KHC) and Caterpillar (NYSE: CAT), mimicking the bullish trend. Now eyes will be on the 2 PM ET Federal Reserve meeting minutes from the March meeting to offer a glimpse into what Fed members are thinking about current and future monetary policy measures.

CPI Report Live: Consumer Price Inflation Report Shows Lighter Than Expected Results Now What?

In March, inflation experienced a slowdown as the Federal Reserve’s interest rate hikes began to take effect, according to a report from the Labor Department on Wednesday.

The consumer price index (CPI), a commonly used gauge of the prices of goods and services in the U.S. economy, saw a 0.1% increase for the month, compared to the Dow Jones prediction of 0.2%. The year-over-year increase was 5%, which was slightly below the anticipated 5.1%.

When excluding food and energy, the core CPI rose by 0.4% and 5.6% annually, both in line with expectations. The data indicate that although inflation remains significantly above the level the Federal Reserve considers comfortable, it has been consistently decelerating. The central bank aims for an inflation rate of around 2% as an ideal and sustainable growth rate. The most recent headline CPI increase was the lowest since June 2021. An important area the Fed has been focusing on is the labor market. A worker shortage had previously contributed to rising wages and prices, but this situation has somewhat improved in recent months.

CPI Excitement Cools Ahead of Fed Meeting Minutes From March 2023

Wednesday’s gap-up was shortlived by the time the stock market opened at 9:30 am ET. The S&P 500 SPY slipped from premarket highs of $413.75 back down to the $410 area. Meanwhile, the tech-heavy Nasdaq QQQ dipped back down to the $315 area from its premarket high of $319.85. Now that inflation is out of the way, next on the list will be the FOMC meeting minutes from March. If you recall the March Fed meeting, the feared 50 basis point hike was avoided when the Fed determined that a 25 basis point hike was the right strategy at the time. The Federal Reserve explained that recent indicators pointed to modest growth in spending and production. Job gains were seen as having picked up in recent months and running at a robust pace. The Fed also pointed out that the unemployment rate remained low while inflation remained elevated.

This also happened at a time when the banking and financial markets were in turmoil thanks to Silicon Valley Bank and the bank runs that ensued after. Fed Chair Jerome Powell said that this wasn’t a worry as it was determined to be “an outlier” to the current economic conditions. Powell also said that the Fed expects slow growth and supply/demand rebalance with inflation moving down. Participants do not see rate cuts this year. Something that may have markets pausing right now is speculation on what else was said, which is where Wednesday’s FOMC meeting minutes will clearly factor in once they get released at 2 PM ET.