3 Ways That Penny Stocks Are Affected by Macroeconomic Factors

Macroeconomic factors play a significant role in shaping the financial markets, and penny stocks are no exception. These low-priced, small-cap stocks have the potential to deliver substantial returns, making them an exciting investment opportunity for those willing to take on the inherent risks. As we delve deeper into the ways macroeconomic factors influence penny stocks, it becomes evident that understanding these dynamics is essential for successful trading.

One key element that shapes the penny stock market is interest rates. Central banks control interest rates as a means to manage inflation and economic growth. When interest rates are low, borrowing becomes more affordable, and businesses have easier access to capital. This can be particularly beneficial for small-cap companies, including those issuing penny stocks, as they often rely heavily on external financing. Low interest rates can also encourage investors to explore alternative investment opportunities, such as penny stocks, in search of higher returns.

[Read More] 3 Hot Penny Stocks To Watch With The Stock Market Down Today

Another critical macroeconomic factor is overall economic growth, typically measured through indicators such as Gross Domestic Product (GDP). A growing economy can inspire investor confidence, leading to increased demand for stocks, including penny stocks. The potential for rapid expansion in small-cap companies can make them an attractive prospect for investors seeking to capitalize on their growth potential during prosperous economic times.

Lastly, currency fluctuations can impact the performance of penny stocks. A strong domestic currency makes imports more affordable, which can benefit small-cap companies that rely on imported goods or services. Conversely, a weaker domestic currency can make exports more competitive, potentially boosting sales for export-oriented penny stock companies. Understanding how currency dynamics can impact the profitability of small-cap firms is crucial for making informed investment decisions in the penny stock market.

In summary, penny stocks are influenced by a variety of macroeconomic factors, such as interest rates, economic growth, and currency fluctuations. By paying close attention to these forces, investors can better navigate the opportunities and challenges that arise in the world of penny stocks, ultimately maximizing their potential for success.

3 Tips for Using Macroneconomic Factors to Trade Penny Stocks

- Consider Market interest Rates

- Utilize Economic Growth Factors

- Look at Currency Fluctuations

Consider Market interest Rates

Market interest rates are an essential aspect to consider when evaluating the potential of penny stocks. Central banks use interest rates as a tool to manage inflation and economic growth, and these rates can significantly impact the performance of small-cap companies, including those issuing penny stocks. Understanding the relationship between market interest rates and penny stocks can help investors make informed decisions and capitalize on potential opportunities.

When interest rates are low, borrowing becomes more affordable, which can be particularly advantageous for small-cap companies. These firms often rely heavily on external financing to fund their operations and fuel growth. Low interest rates can help reduce the cost of capital for these businesses, increasing their profitability and making them more appealing to investors. Additionally, low interest rates can result in higher corporate earnings, which may subsequently lead to increased stock prices.

In an environment of low interest rates, traditional investments such as bonds and savings accounts might offer modest returns, prompting investors to seek alternative investment opportunities with higher potential for returns. This search for higher returns can lead investors to the world of penny stocks, where small-cap companies present the possibility of substantial gains. As more investors turn their attention to penny stocks, increased demand can drive up their prices, resulting in profitable trading opportunities.

Furthermore, low interest rates can stimulate economic growth, which can create a favorable environment for small-cap companies to thrive. With easier access to capital and a growing economy, these businesses have the opportunity to expand their operations, develop innovative products and services, and capture new market share. As a result, the prospects for investing in penny stocks can improve, increasing their attractiveness to investors.

Utilize Economic Growth Factors

Utilizing economic growth factors is essential for investors seeking to capitalize on the potential of penny stocks. Economic growth can have a direct impact on the performance of small-cap companies, and understanding these factors can provide valuable insights into the opportunities and challenges faced by businesses issuing penny stocks.

One of the primary indicators of economic growth is Gross Domestic Product (GDP), which measures the value of all goods and services produced within a country during a specific period. A growing GDP signifies a healthy economy, which can inspire investor confidence and lead to increased demand for stocks, including penny stocks. In times of robust economic growth, small-cap companies have the potential to expand rapidly, making them an attractive prospect for investors looking to capture significant returns on their investments.

[Read More] Best Penny Stocks To Buy This Week? 3 To Watch Now

Another important economic growth factor is employment. When the economy is expanding, companies tend to hire more workers to meet the growing demand for their products and services. As employment levels rise, consumer spending typically increases, which can further stimulate economic growth. This positive feedback loop can create a favorable environment for small-cap companies, as they often rely on consumer demand to drive their revenues. Penny stock investors can benefit from this economic growth by identifying companies that are poised to capitalize on these favorable conditions.

Technological advancements also play a role in economic growth and can directly influence the performance of penny stock companies. Small-cap firms that successfully adopt or develop cutting-edge technologies may gain a competitive edge in their respective industries, leading to increased market share and revenue growth. Investors who recognize the potential of these innovative companies can take advantage of their growth trajectory and potentially reap substantial rewards.

Look at Currency Fluctuations

Examining currency fluctuations is another crucial aspect for investors interested in the world of penny stocks. Currency movements can significantly impact the profitability and overall performance of small-cap companies, and understanding the relationship between currency dynamics and penny stocks can provide valuable insights for investment decision-making.

A strong domestic currency can make imports more affordable for companies, which can be particularly beneficial for small-cap firms that rely on imported goods or services. By reducing the cost of inputs, these companies may be able to improve their profit margins, making them more attractive to investors. A strong domestic currency can also boost the purchasing power of consumers, leading to increased demand for products and services. This increased demand can, in turn, positively impact the revenues and growth potential of small-cap companies, including those issuing penny stocks.

Conversely, a weaker domestic currency can make a country’s exports more competitive on the global market. For export-oriented penny stock companies, a weaker currency can result in increased sales, as their products become more attractive to foreign buyers. This increase in sales can lead to higher revenues and profitability for these small-cap firms, which can translate to better stock performance and potential investment gains.

Currency fluctuations can also influence investor sentiment and risk appetite. When a domestic currency appreciates, investors may feel more confident about the overall economic outlook, which could lead to increased interest in riskier assets, such as penny stocks. Conversely, a depreciating domestic currency may signal economic challenges or uncertainty, potentially causing investors to become more risk-averse and shift their focus away from penny stocks.

3 Hot Penny Stocks to Add to Your Watchlist Right Now

- Secoo Holding Ltd. (NASDAQ: SECO)

- Butterfly Network Inc. (NYSE: BFLY)

- NFT Gaming Company Inc. (NASDAQ: NFTG)

Which Penny Stocks Are You Watching?

In conclusion, macroeconomic factors play a significant role in shaping the performance of penny stocks. Understanding the relationship between these factors and small-cap companies is vital for investors looking to capitalize on the potential of these low-priced stocks. By closely examining market interest rates, economic growth factors, and currency fluctuations, investors can gain valuable insights into the opportunities and challenges faced by penny stock companies.

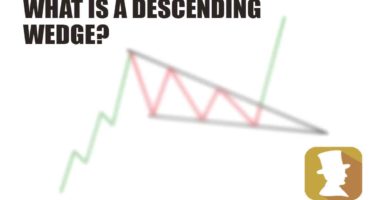

[Read More] Penny Stock Trading: A Guide to Chart Patterns and Indicators

This knowledge can ultimately contribute to a more successful investment strategy, allowing investors to harness the potential of penny stocks while navigating the ever-changing financial landscape. As investors become more adept at analyzing these macroeconomic factors, they can make well-informed decisions, uncover valuable opportunities, and maximize their chances of success in the penny stock market.