Originally Posted: 2/14/2023 8:30 AM ET

Updated: 2/14/2023 8:38 AM ET

Whether you’re trading penny stocks or large-cap stocks, the highlight of this week is the January CPI inflation data. We’re going to break down the most important things to know about January’s Consumer Price Index report. We also discuss some of the basics of CPI, what it is, and why it’s important. That will come in particularly handy if you’re new to stock market economic data in 2023.

Last CPI Report Recap: Consumer Price Index Report For December 2022 & CPI Numbers

The December CPI inflation report came in line with estimates for both Core and overall CPI. It also extended the year’s declining CPI figures by another month and brought brief optimism to investors. Here’s a recap of the December CPI inflation data:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.

Gasoline & Energy

The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month.

All Items Less Food

The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November. Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month.

– How to Analyze Penny Stocks for Profits

All Items

The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months. The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.

Consumer Price Index Report For January 2023 & CPI Numbers

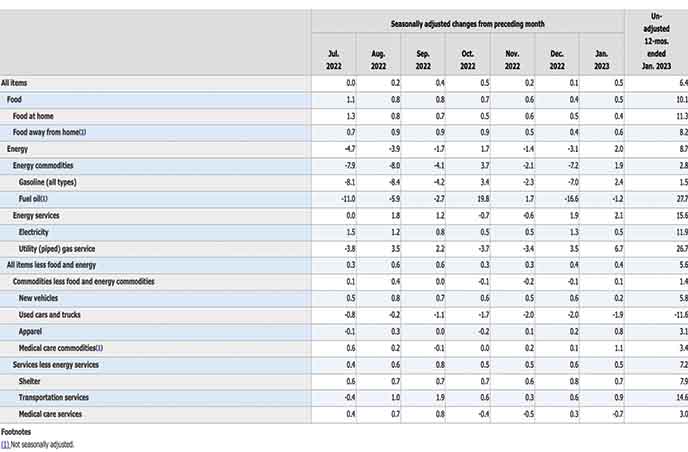

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.5 percent in January on a seasonally adjusted basis, after increasing 0.1 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.4 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for nearly half of the monthly all items increase, with the indexes for food, gasoline, and natural

gas also contributing. The food index increased 0.5 percent over the month with the food at home index rising 0.4 percent. The energy index increased 2.0 percent over the month as all major energy component indexes rose over the month.

The index for all items less food and energy rose 0.4 percent in January. Categories which increased in January include the shelter, motor vehicle insurance, recreation, apparel, and household furnishings and operations indexes. The indexes for used cars and trucks, medical care, and airline fares were among those that decreased over the month.

The all items index increased 6.4 percent for the 12 months ending January; this was the smallest 12 month increase since the period ending October 2021. The all items less food and energy index rose 5.6 percent over the last 12 months, its smallest 12-month increase since December 2021. The energy index increased 8.7 percent for the 12 months ending January, and the food index increased 10.1 percent over the last year.

Breaking Down The CPI Data: Key Takeaways

- CPI increased 6.4% ABOVE ESTIMATES of 6.2%

- Core CPI increased 5.6% ABOVE ESTIMATES of 5.5%

- The food index increased 0.5 percent in January, and the food at home index rose 0.4 percent over the month.

- Four of the six major grocery store food group indexes increased over the month. The index for other food at home rose 0.7 percent in January.

- The food at home index rose 11.3 percent over the last 12 months.

- The energy index rose 2.0 percent in January, as the gasoline index increased 2.4 percent over the month.

- The energy index rose 8.7 percent over the past 12 months. The gasoline index increased 1.5 percent over the span. The fuel oil index rose 27.7 percent over the last 12 months, while the index for electricity rose 11.9 percent, and the index for natural gas increased 26.7 percent over the same period.

- The index for all items less food and energy rose 0.4 percent in January. The shelter index continued to increase, rising 0.7 percent over the month. The rent index and the owners’ equivalent rent index each rose 0.7 percent since December. The index for lodging away from home increased 1.2 percent in January.

- The medical care index fell 0.4 percent in January, as the physicians’ services index declined 0.1 percent. The index for hospital services increased 0.5 percent over the month and the index for prescription drugs rose 2.1 percent in January.

- The index for all items less food and energy rose 5.6 percent over the past 12 months. The shelter index increased 7.9 percent over the last year, accounting for nearly 60 percent of the total increase in all items less food and energy. Other indexes with notable increases over the last year include household furnishings and operations (+5.9 percent), medical care (+3.1 percent), recreation (+4.8 percent), and new vehicles (+5.8 percent).

- The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy, while other components were a mix of increases and declines. Among the other indexes that rose in January was the index for motor vehicle insurance, which increased 1.4 percent over the month, while the index for recreation rose 0.5 percent, and the index for apparel increased 0.8 percent. The household furnishings and operations index rose 0.3 percent in January, and the communication index increased 0.4 percent.