The Impact of Market Trends on Penny Stocks Performance

3 Ways That Market Trends Impact Penny Stocks Performance

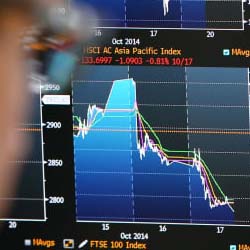

Market trends can have a significant impact on the performance of penny stocks. Understanding these trends can help investors identify opportunities and make informed investment decisions.

One way that market trends can impact penny stock performance is through economic conditions. When the economy is strong, companies tend to perform well and their stock prices may rise. Conversely, when the economy is weak, companies may struggle and their stock prices may fall. This can be particularly true for penny stocks, which are often more sensitive to economic conditions than larger, more established companies.

Another way that market trends can impact penny stock performance is through changes in interest rates. When interest rates are low, it can be easier for companies to borrow money and expand their operations, which can lead to growth and stock price appreciation. When interest rates are high, it can be more difficult for companies to borrow money and expand, which can lead to stagnation and stock price depreciation.

[Read More] 4 Penny Stocks To Watch With High Short Interest In January 2023

Sector-specific trends also play a big role in the penny stock performance. For example, a technology penny stock will be more affected by the technology market trends and developments. Similarly, a healthcare penny stock will be more affected by healthcare sector trends.

Additionally, market trends can also be affected by changes in regulations and laws. For example, changes in environmental regulations can have a significant impact on the performance of penny stocks in the energy and natural resources sectors.

Overall, it is important for investors to stay informed about market trends and how they may impact the performance of penny stocks. This can help them identify opportunities and make informed investment decisions.

3 Market Impacts to Consider Before Investing in Penny Stocks

- Understanding Market Trends and Their Influence on Penny Stocks

- Using Market Trends to Your Advantage to Make Money With Penny Stocks

- How to Adapt to Changing Market Trends

Understanding Market Trends and Their Influence on Penny Stocks

Understanding market trends and their influence on penny stocks is crucial for any investor looking to profit from this high-risk, high-reward market. Market trends refer to the direction of the stock market as a whole or within a particular sector, and can have a significant impact on the performance of penny stocks.

One of the key ways in which market trends influence penny stocks is through the overall level of investor sentiment. When the stock market is bullish, investors tend to have a positive outlook and are more likely to invest in higher-risk, higher-reward opportunities like penny stocks. On the other hand, when the market is bearish, investors tend to be more cautious and may shy away from penny stocks.

Another way in which market trends influence penny stocks is through the level of volatility in the market. Penny stocks are known for their high volatility, which can be exacerbated by market trends. For example, during a market downturn, penny stocks may experience even greater volatility than blue-chip stocks. This volatility can be both a risk and an opportunity for investors.

Using Market Trends to Your Advantage to Make Money With Penny Stocks

Using market trends to your advantage is a key strategy for making money with penny stocks. Understanding market trends and identifying patterns can provide valuable insights into the performance of penny stocks and can help investors to make more informed investment decisions.

One way to use market trends to your advantage is by identifying sectors that are experiencing growth. By focusing on penny stocks in these sectors, investors can potentially capitalize on the upward momentum and make profitable investments. For example, if the technology sector is experiencing growth, investors may want to look for penny stocks in technology companies that have a strong product or service offering and a solid financial track record.

Another way to use market trends to your advantage is by monitoring the level of volatility in the market. High volatility can create opportunities for investors to buy low and sell high. By monitoring market trends and identifying periods of high volatility, investors can potentially take advantage of these opportunities and make profitable trades.

It’s also important to use market trends to identify potential risks and make adjustments to your portfolio accordingly. For example, if the market is experiencing a downturn, investors may want to consider reducing their exposure to high-risk penny stocks and focus on more stable investments.

How to Adapt to Changing Market Trends

Adapting to changing market trends is a critical part of making money with penny stocks. The market is constantly evolving and what worked in the past may not necessarily work in the future. Therefore, it’s important for investors to stay informed and be able to adapt to new market conditions.

One way to adapt to changing market trends is by staying informed. Keeping up-to-date with the latest market news and analysis can provide valuable insights into current market conditions and help investors to identify new opportunities. This can include following financial news and analysis, tracking market indicators, and monitoring the performance of specific sectors and industries.

[Read More] How To Buy Penny Stocks & 5 Ways To Make Money Doing It

Another way to adapt to changing market trends is by diversifying your portfolio. Diversification can help to mitigate risk by spreading investments across different sectors, industries and even different types of assets. This can help to protect against losses in one sector or industry, by having investments in other sectors that may be performing better.

It’s also important to be flexible and willing to adjust your investment strategy. The market is constantly changing, and what worked in the past may not necessarily work in the future. Therefore, investors should be willing to adjust their investment strategy as market conditions change. This may include reallocating investments, taking profits, or cutting losses when necessary.

3 Good Penny Stocks to Watch in 2023

- Buzzfeed Inc. (NASDAQ: BZFD)

- RedHill Biopharma Ltd. (NASDAQ: RDHL)

- Applied UV Inc. (NASDAQ: AUVI)

Which Penny Stocks Are You Watching?

In conclusion, market trends can have a significant impact on the performance of penny stocks. Understanding how economic conditions, interest rates, sector-specific trends, and regulations can affect a company’s performance can help investors identify opportunities and make informed investment decisions.

[Read More] 7 Top Penny Stocks Under $1 To Watch Before Next Week

It is important to stay informed about market trends and to conduct thorough research when evaluating penny stock investment opportunities. It is also important to diversify your portfolio and to be aware of the risks associated with investing in penny stocks. Remember, investing in penny stocks is a high-risk investment and it is important to only invest what you can afford to lose.