December CPI Report Live: Consumer Price Inflation Report Is Out, Here’s What It Shows

Originally Posted: 1/12/2023 8:30 AM ET

UPDATED: 8:39 AM ET

This week has already been a volatile one for everything from penny stocks to mega-cap tech stocks. That isn’t likely to subside anytime soon, either. The latest round of CPI inflation data from December came out today, and in this update, we’re going to break down the most important things to know about December’s Consumer Price Index report. We also discuss some of the basics of CPI, what it is and why it’s important. That will come in particularly handy if you’re new to stock market economic data in 2023.

Last CPI Report Recap: Consumer Price Index Report For November 2022 & CPI Numbers

The November CPI inflation report came in below estimates for both Core and overall CPI. It also extended the year’s declining CPI figures by another month and brought optimism back to investors. However, comments from Fed members and global central bankers essentially squashed bullish hopes for a Santa Claus rally at the end of 2022. Here’s a recap of the November CPI inflation data:

November CPI For All Urban Consumers

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1% in November on a seasonally adjusted basis, after increasing 0.4% in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 7.1% before seasonal adjustment.

Shelter, Food, & Energy

The index for shelter was by far the largest contributor to the monthly all-items increase, more than offsetting decreases in energy indexes. The food index increased 0.5% over the month with the food at home index also rising 0.5%. The energy index decreased 1.6% over the month as the gasoline index, the natural gas index, and the electricity index all declined.

All Items Less Food & Energy (Core CPI)

The index for all items less food and energy rose 0.2% in November, after rising 0.3% in October. The indexes for shelter, communication, recreation, motor vehicle insurance, education, and apparel were among those that increased over the month. Indexes that declined in November include the used cars and trucks, medical care, and airline fares indexes.

All Items Index

The all-items index increased 7.1% for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021. The all items less food and energy index rose 6.0% over the last 12 months. The energy index increased 13.1% for the 12 months ending November, and the food index increased 10.6% over the last year; all of these increases were smaller than for the period ending October.

December CPI Inflation Expectations

What does Wall Street expect of this latest round of December CPI inflation data? The forecast for CPI is a decrease of 0.1% month-over-month and a 6.5% increase from the prior year. Meanwhile, Core CPI is expected to come in, up 0.3% in December (MoM) and gain 5.7% year-over-year.

Now let’s look at what the actual December CPI inflation report shows.

Consumer Price Index Report For December 2022 & CPI Numbers

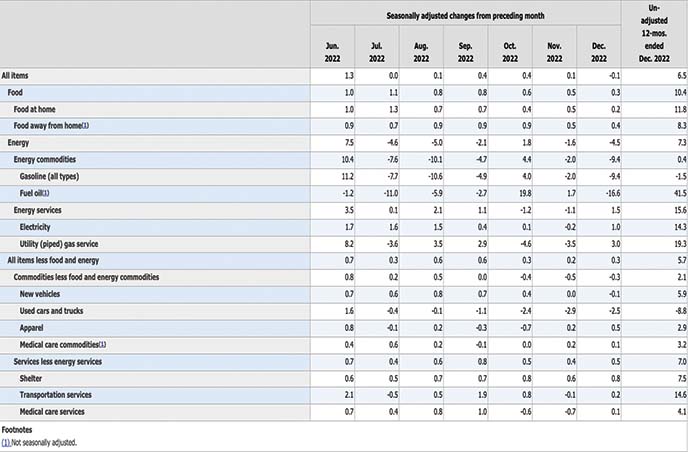

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.

The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month.

The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November. Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month.

The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months. The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.

Breaking Down The CPI Data: Key Takeaways

- CORE CPI YoY is 5.7%: IN LINE WITH EXPECTATIONS

- CPI YoY 6.5%: IN LINE WITH EXPECTATIONS

- The food index increased 0.3% in December following a 0.5% increase in November. The food at home index rose 0.2% in December.

- The energy index fell 4.5% in December after falling 1.6% in November. The gasoline index declined 9.4% over the month, following a 2.0% decrease in November.

- The energy index rose 7.3% over the past 12 months. The gasoline index decreased 1.5% over the span. The fuel oil index rose 41.5% over the last 12 months, the index for electricity rose 14.3%, and the index for natural gas increased 19.3% over the same period.

- The index for all items less food and energy rose 0.3% in December, following a 0.2% increase in November.

- The shelter index was the dominant factor in the monthly increase in the index for all items less food and energy, while other components were a mix of increases and declines.

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 6.5% over the last 12 months to an index level of 296.797 (1982-84=100). For the month, the index decreased 0.3% prior to seasonal adjustment.

Stock Market Today

While CPI and Core CPI came in with expectations, it’s important to note that the actual figures that were expected had recently been revised ahead of this latest CPI inflation data. Nevertheless, the first move was to the downside for the S&P 500 (SPY) and Nasdaq (QQQ). However, that quickly remedied as markets reset and tech companies including Tesla (TSLA), Amazon (AMZN), and TSMC (TSM) turned bullish.

Other companies releasing premarket headlines saw a compounded impact on price. American Airlines (AAL) for instance, raised its Q4 revenue growth guidance as it now expects to report EPOS of $1.12-$1.17 compared to the $0.60 estimates. The company also has plans to decrease its debt by $15 billion by the end of 2025.