What Is A Reverse Stock Split – Pros, Cons, Definition & More

Why Do Stocks Split?

Whether you’re trading penny stocks or higher-priced stocks, there are certain things to be aware of as a trader. Corporate filings, news, and technical analysis are all great things to understand. However, there are other things that can influence the market and, specifically, share prices even without a fundamental catalyst.

Thanks to the stock market crash in 2022, plenty of stocks have plummeted in share price. Due to listing requirements of the NYSE and Nasdaq, companies need to make significant changes in order to maintain listing requirements. That includes trading at a minimum share price.

In most cases, this minimum is $1. If a company cannot get to that level following a sell-off, they have to make a decision. Either get delisted to the Over-the-Counter exchange or effect a reverse stock split. But what actually goes into reverse stock splits, and are they good or bad for stocks?

What Is A Reverse Stock Split?

A reverse stock split is an action taken by a company to reduce the number of outstanding shares. The result is an increase in the stock’s trading price. This corporate action involves reducing the number of available shares while proportionally increasing the price per share. It’s important to note that the market value of the company or the value of the shares changes (unless prices climb or fall after the split is complete).

Reverse Stock Split Example

A company has 10 million outstanding shares and announces a one-for-two reverse stock split. After the split is completed, the company would have 5 million outstanding shares. The price per share would be doubled as well.

Upside Of Reverse Stock Splits

The primary benefit of a reverse stock split is that it can make a company’s stock more attractive to larger investors. These investors may have otherwise been scared off by lower share prices. When smaller investors are redistributed among fewer larger shareholders, this can also help a company boost its capitalization for listing on bigger exchanges.

– 5 Top Brokerages For Trading Penny Stocks In 2023 – Pros & Cons

Additionally, with fewer shares circulating, the trading volume may decrease. However, this isn’t always the case, as we’ve seen with several recent reverse-split stocks. In fact, since the initial float is smaller following the reverse, it can mean the opposite. Volatility can dramatically increase and make for a wild trading scenario in the short term.

Downside Of Reverse Stock Splits

On the downside, there are some potential disadvantages of reverse stock splits. They involve diluting shareholder equity and raising the cost per share. This can potentially drive away smaller investors who would be priced out of buying into or holding the security after the split takes place.

Furthermore, there is no guarantee that higher stock prices will result in improved performance regardless of whether or not there is actual growth in underlying business prospects. Finally, if traders look at reverse splits as signs of financial distress or insecurity due to their association with struggling companies, it could damage investor confidence. It may actually prevent increased demand for shares even after the split has occurred.

AMC Stock News

GME and AMC stocks have been leaders in the meme stock space since the start of the pandemic. However, during that time, share prices slowly dropped. This week AMC Entertainment (NYSE: AMC) became a penny stock for the first time since early 2021. This week’s AMC stock news has both meme stocks and reverse splits in focus.

AMC Entertainment announced that it will raise $110 million of new equity capital through the sale of APE units. The sale will be to Antara Capital, LP, in two tranches at a weighted average price of $0.660 per share. AMC stated that it now seeks to convert APE units into AMC stock, and then plans are to reverse split the number of AMC stock at a 1 for 10 ratio.

CEO Adam Aron said that APE units achieved “exactly their intended purposes,” which he explained was to allow AMC to raise cash, among other things. Now, via this multi-step transaction, Aron explained, “Given the consistent trading discount that we are routinely seeing in the price of APE units compared to AMC common shares, we believe it is in the best interests of our shareholders for us to simplify our capital structure, thereby eliminating the discount that has been applied to the APE units in the market.”

Top 5 Benefits Of A Reverse Stock Split

- Making a company’s stock more attractive to larger investors.

- Boosting capitalization for listing on bigger exchanges.

- Decreasing trading volume and reducing volatility levels.

- Enhancing liquidity in the stock market.

- Offering an alternative to traditional methods of raising capital, such as issuing new shares or taking on debt.

Top 5 Risks Of A Reverse Stock Split

- Diluting shareholder equity and raising the cost per share.

- Risk of pricing out small-time investors who can’t afford to buy into or hold the security after the split takes place.

- No guarantee that higher prices will lead to improved performance regardless of underlying business prospects.

- Potentially damaging investor confidence due to association with struggling companies.

- Possibility of increased demand for shares not materializing even after the split has occurred.

What Is A Forward Stock Split?

There are other methods of splitting stocks. The other popular method for higher priced stocks is to effect a forward stock split.

A forward stock split is a corporate action taken by a company in which the total number of shares outstanding is increased while the overall value of the equity stays the same. This type of split gives companies greater control over their stock price and can provide several advantages, such as helping to make their shares more attractive to smaller investors. The goal of a forward stock split is to increase the total number of shares issued, creating a decrease in share prices and making them more inviting to investors.

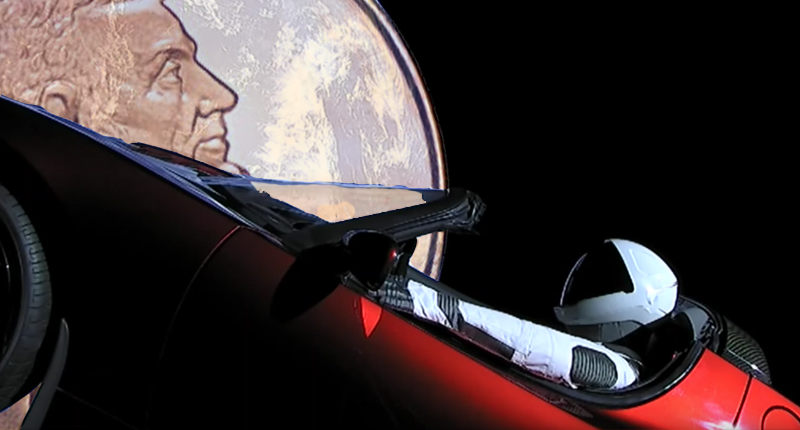

Generally, it’s done when current prices are high due to favorable market conditions or a favorable perception of a company’s business prospects. We saw this most recently with companies like Tesla (NASDAQ: TSLA), Alphabet (NASDAQ: GOOGL), and Amazon (NASDAQ: AMZN).

Forward Stock Split Example

To achieve this goal, the company increases its total number of shares and exchanges each share for more but lower-valued shares. For example, if a company has 10 million outstanding shares and announces a two-for-one forward stock split after the split is completed, the company will have 20 million outstanding shares. The price per share would be reduced by half as well.

– Trading Penny Stocks? Top Technical Analysis Tips

In addition, forward splits allow companies to avoid having too few publicly traded shares since they generally have restrictions on how many they can issue without undergoing additional regulatory paperwork. Trading volumes can also help become more active so shareholders won’t be discouraged by sudden price drops—a further benefit for both shareholders and potential investors alike.

Overall, despite some benefits associated with forward splits—such as making a company’s stock more attractive even for smaller investors – there are still some risks associated with them. This includes diluting shareholder equity and lowering costs per share. There’s no guarantee that lower prices will lead to improved performance regardless of underlying business prospects. Meanwhile, there’s a risk that increased supply may not attract enough investor attention even after the split has occurred.

Reverse Stock Splits vs. Forward Stock Splits

The primary difference between reverse and forward stock splits is the number of shares issued. In a reverse stock split, the total number of shares outstanding is reduced. But the overall value of equity remains the same. This reduces the number of small-time investors in the company’s stock as well as raises share prices.

On the other hand, a forward stock split increases the total number of shares outstanding. Like a reverse, it also keeps its overall value unchanged. Share prices decrease as a result which can make them more attractive to smaller investors.