Originally Published: December 14, 2022, 2:00 PM ET

Updated: December 14, 2022, 2:48 PM ET

December’s Federal Reserve Meeting concluded with a 2 PM ET Fed announcement. Now, Fed Chair Jerome Powell’s live comments at the 2:30 PM ET press conference are in focus. Whether you’re trading penny stocks or higher-priced shares, this week’s economic news cycle likely plays a role in decision-making. As we learned from the last FOMC meeting, the Fed statement carries weight but not as much as what may get said at the live press conference to follow.

Whether Powell’s comments are once again hawkish or they turn dovish following the latest CPI data from November will surely set the tone for the remainder of the year. Santa Claus rally or stock market crash, traders will be using data from the December FOMC meeting, rate hike decision, and Powell press conference to craft a strategy to capitalize on the ensuing reaction.

December 2022 Fed Rate Hike Announcement

Heading into the December FOMC meeting, expectations are high that the Fed gives a 50 bps hike. Some presumed that this could be out the window thanks to the surprise PPI report. But Consumer Pricing data from last month seemed to have eased concerns in the short term.

Meanwhile, the elephant in the room, employment data, remains a sticky subject for pro-recession investors looking for reasons to start buying up value stocks and dump growth. They’ll likely get more on that topic later this week when the latest round of jobless claims gets reported on Thursday.

There’s been plenty of speculation-fueled choppiness ahead of the December Fed rate hike decision and FOMC meeting. Surely, hopes are that monetary policy leans dovish and markets can gain some much-needed relief heading into 2023 after a wild 2022.

In the last FOMC meeting, the Fed decided to raise the target range for the federal funds rate to 3-3/4 to 4%. It also said it was appropriate to see ongoing increases in the target range in order to attain monetary policy “sufficiently restrictive” to return inflation to 2% over time. But much. of the focus during the FOMC press conference was on the employment market. Job vacancies are still high and the wages were considered a “mixed” picture. Recent comments from Chairman Powell also highlight that smaller interest rate increases may be ahead and could start in December.

“…it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down…The time for moderating the pace of rate increases may come as soon as the December meeting.”

Here’s a breakdown of the hot topics & takeaways from the FOMC announcement & details from the December Fed Meeting:

December Fed Meeting, FOMC Statement, & Interest Rate Hike Top 10 Takeaways

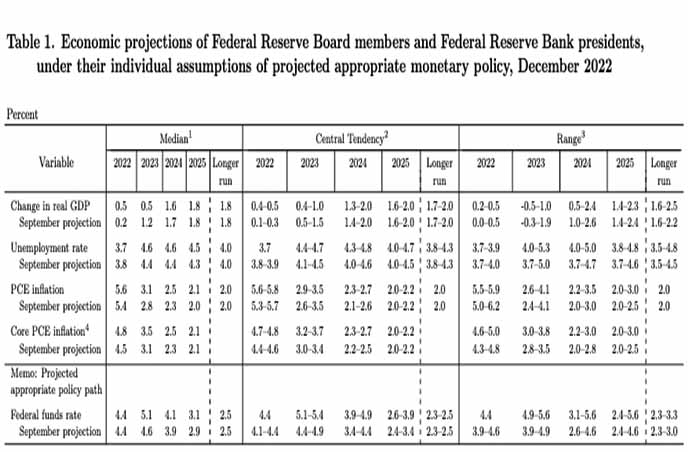

- Target Fed Funds Rate of 5.1% in 2023, 4.1% in 2024, 3.1% in 2025 with Longer run of 2.5%

- The Board of Governors of the Federal Reserve System voted unanimously to raise the

interest rate paid on reserve balances to 4.4 percent, effective December 15, 2022. - In a related action, the Board of Governors of the Federal Reserve System voted

unanimously to approve a 1/2 percentage point increase in the primary credit rate to

4.5 percent, effective December 15, 2022. - Undertake open market operations as necessary to maintain the federal funds rate

in a target range of 4-1/4 to 4-1/2 percent. - Conduct overnight repurchase agreement operations with a minimum bid rate of

4.5 percent and with an aggregate operation limit of $500 billion; the aggregate

operation limit can be temporarily increased at the discretion of the Chair. - Conduct overnight reverse repurchase agreement operations at an offering rate of

4.3 percent and with a per-counterparty limit of $160 billion per day; the percounterparty limit can be temporarily increased at the discretion of the Chair. - Roll over at auction the amount of principal payments from the Federal Reserve’s

holdings of Treasury securities maturing in each calendar month that exceeds a

cap of $60 billion per month. Redeem Treasury coupon securities up to this

monthly cap and Treasury bills to the extent that coupon principal payments are

less than the monthly cap. - Reinvest into agency mortgage-backed securities (MBS) the amount of principal

payments from the Federal Reserve’s holdings of agency debt and agency MBS

received in each calendar month that exceeds a cap of $35 billion per month. - Allow modest deviations from stated amounts for reinvestments, if needed for

operational reasons. - Engage in dollar roll and coupon swap transactions as necessary to facilitate

settlement of the Federal Reserve’s agency MBS transactions.

The Stock Market Today Following FOMC Meeting Announcement & Rate Decision

Initially the broader indexes moved to the downside with the S&P 500 ETF (NYSE: SPY) and Nasdaq ETF (NASDAQ: QQQ) slipping after a more hawkish Fed announcement. However, compared to previous FOMC meetings, the move wasn’t as aggressive (initially) as we’ve seen. The stock market may be more focused on what Fed Chair Jerome Powell says in the 2:30 PM ET press conference than anything else. As we’ve seen sentiment has been mixed when comparing what is said in the last few Press Conferences to what is reported in the actual Fed announcement docs.

Fed Chair Jerome Powell’s December FOMC Press Conference Highlights

Notable comments from Fed Chair Jerome Powell After December 2022 Fed Meeting

- We will discuss specific commentary from the November Fed Meeting Press Conference hosted by Fed Chair Jerome Powell, which begins at 2:30 PM ET. A link to the Video version of that press conference is provided above.

- Price stability is the focus right now

- Policy interest rate raised to anticipate ongoing raises may be appropriate to return inflation to 2% over time

- US economy has slowed significantly from last year

- Growth in consumer spending has slowed

- Activity in housing has weakened significantly

- Labor market is still out of balance

- Full effects of tightening not yet felt though Fed has covered a lot of ground

- October, November inflation numbers showed signs of inflation coming down but it will take substantially more evidence that inflation is coming down.

- Even inflation expectations remain anchored, now isn’t the time to be complacent

- Takes time for rest of economy to catch up to the effects that have already been seen by interest-rate-sensitive sectors, regarding demand

- Decisions will be made meeting-by-meeting and taking forceful steps regarding inflation

- When will rate increases stop? Answered: will be data dependent and Fed has not predetermined size of Fed rate hike

- February decision will be made based on financial conditions, economy & scope of rate raises will depend on inflation, financial conditions but at a certain point policy will be restrictive enough

- Projecting slow growth but not a recession