Most Common Penny Stocks Technical Indicators to Use

3 Technical Indicators for Penny Stocks Traders to Use

When trading penny stocks, it is important to use a variety of technical indicators to help guide your investment decisions. Some of the most commonly used indicators include moving averages, Bollinger Bands, and RSI. Moving averages are simple trend-following indicators that can help you identify both long-term trends as well as short-term price swings in stocks.

They can be calculated using a variety of different time periods, depending on your preference and the type of stocks you are trading. Another popular indicator for penny stocks is Bollinger Bands, which consist of two lines that are plotted above and below a stock’s price chart. These bands serve as support and resistance levels that provide further insight into where the stock might be headed next. Finally, the Relative Strength Index (RSI) is a momentum indicator that helps measure overbought and oversold conditions in stocks.

[Read More] Can I Buy Penny Stocks With My 401(k)?

By using these different technical indicators when trading penny stocks, you can gain a better understanding of the market trends and movements, allowing you to make more informed investment decisions. While trading penny stocks is not easy, incorporating these indicators into your trading strategy can help you improve your chances of success. In addition, research and practice are also key to becoming a successful investor in the penny stocks market.

3 Technical Indicators You Should Be Using For Your Penny Stock Trading

- Using MACD

- Using RSI

- Using Moving Averages

Using MACD

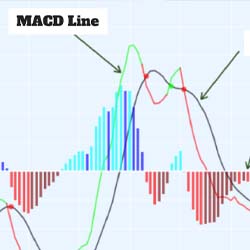

The MACD is a technical indicator that measures the difference between two moving averages. It is used to identify trends and momentum, and can be used to generate buy and sell signals.

There are three main components of the MACD: the fast moving average (FMA), the slow moving average (SMA), and the signal line. The FMA is typically set at 12 days, while the SMA is usually set at 26 days. The signal line is a nine-day exponential moving average (EMA) of the MACD itself. When the stock market is in an uptrend, you will typically see the MACD line above the signal line. Conversely, when the stock market is in a downtrend, you will typically see the MACD line below the signal line.

The MACD can be used to trade penny stocks by identifying trends and momentum. When the stock market is in an uptrend, you can use the MACD to buy penny stocks that are trending up. When the stock market is in a downtrend, you can use the MACD to sell penny stocks that are trending down. You can also use the MACD to generate buy and sell signals.

[Read More] Best Penny Stocks To Buy? 3 To Watch Under $1 Right Now

A buy signal occurs when the MACD line crosses above the signal line. A sell signal occurs when the MACD line crosses below the signal line. The MACD is a powerful tool that can be used to trade penny stocks successfully. By identifying trends and momentum, and by generating buy and sell signals, you can make money in the stock market.

Using RSI

The Relative Strength Index (RSI) is a technical indicator that measures the speed and change of price movements. The RSI is considered to be overbought when it is above 70 and oversold when it is below 30. Penny stocks are generally considered to be high risk, but they can also offer high rewards. When combined with the RSI, penny stocks can be a powerful tool for making money in the stock market.

To find penny stocks that are ripe for investment, look for those with an RSI that is below 30. This indicates that the stock may be undervalued and ready for a rebound. Be sure to do your research before investing, as penny stocks can be volatile. But if you’re willing to take on some risk, penny stocks can be a great way to make money in the stock market.

Using Moving Averages

Moving averages smooth out stock price data to help you better identify stock trends. By analyzing past stock prices, moving averages can give you a good idea of where a stock is headed. There are different types of moving averages, but the most common are simple moving averages (SMAs) and exponential moving averages (EMAs).

You can use moving averages to make money in the stock market in a number of ways. For example, you could buy a stock when its price crosses above its 200-day SMA, or sell a stock when its price falls below its 50-day EMA. You could also use moving averages to help you time your entries and exits in a trade. Of course, no investment strategy is perfect, and moving averages alone won’t make you a millionaire overnight. But if used correctly, they can be a helpful tool in your stock market arsenal.

4 Penny Stocks to Watch Right Now

- Yamana Gold Inc. (NYSE: AUY)

- Ambev (NYSE: ABEV)

- Kinross Gold Corp. (NYSE: KGC)

- Sentage Holdings Inc. (NASDAQ: SNTG)

Are Penny Stocks on Your Buy List or Not?

As traders look to gain an edge in the highly competitive world of penny stocks, they often turn to technical indicators for insights into market trends and trading opportunities. Some of the most commonly used indicators include moving averages, relative strength index, MACD, and Bollinger bands. These technical indicators can provide valuable information about a stock’s performance over time, as well as potential entry and exit points for trades.

[Read More] Biggest Beginner Penny Stocks Trading Mistakes? 3 to Know

By carefully studying these indicators and identifying trends or patterns that emerge over time, traders can gain a better understanding of market movements and use this knowledge to their advantage when trading stocks. Whether you’re a novice investor or an experienced trader, using these common technical indicators is a great way to boost your success in the world of penny stocks. Considering that, are penny stocks on your buy list or not?