If we’ve learned one thing about penny stocks in 2022, it’s that speculation reigns supreme. The slightest whimper of “potential” or a rumor of what “could be coming” has played a big part in the stock market of today.

Thanks, in part, to the meme stonk rally of 2020 and 2021, social media and peer-to-peer sentiment-based trading have become a strategy traders use. But if you want to become part of the “in crowd” before the party starts, what are ways to find names for your penny stocks list?

Some are turning to the options market. Believe it or not, even though penny stocks are cheap, many have options for derivatives trading for even cheap. Today’s article isn’t about finding options to buy. However, as many readers have requested, we will look at the options chains of a few stocks under $5 to see if there’s any truth to “whale trades” coming before a bullish wave in the market.

How To Find Penny Stocks To Buy

Today’s article focuses on irregular options volume and unusual options activity. A quick disclaimer here: nothing that happens in the options market is guaranteed to translate into the stock market. However, since this “follow the money” trend is apparent, let’s see if any of today’s unusual options activity holds weight for traders.

4 Penny Stocks With Unusual Options Activity, Time To Buy or Avoid Entirely?

1. Nu Holdings (NYSE: NU)

Current NU Stock Price: $4.17

Nu Holdings (NYSE:NU) has long been touted as Warren Buffett’s bet on Bitcoin. Despite his cohort, Charlie Munger calling BTC “stupid and evil,” the Oracle of Omaha seems to find some potential in the fintech company. Based on the most recent quarterly filing for Berkshire Hathaway, the company has a 2.3% stake in Nu.

Something that may be attractive to Buffett and the market at large is the exponential growth the company has undergone. Nu posted Q1 revenue growth of 226% at $877.2 million. That also far-surpassed analyst estimates of $653.4 million. In a quarterly update, Nu Founder and Chief Executive David Velez also said, “This is the strongest quarter in Nu’s history. We reached nearly 60 million customers and a record-high activity rate of 78%.”

[Read More] Penny Stocks To Buy Now According To These 4 Analysts In June 2022

Is NU Stock A Buy?

Although there haven’t been any new updates, a quick look at the options market shows that some may be speculating on a bullish move. Looking at the December 16th $7 Calls, you’ll see where the interesting activity is. As of this article, there’s a minimal volume in the options for that expiration. However, at the $7 strike, more than 4,000 contracts were traded today. Is this a bullish bet or a hedge against a larger downside bet? That’s a question to keep in mind because the put side of this chain shows significant open interest at the $5 and $4 strike puts as well.

2. Shift Technologies Inc. (NASDAQ: SFT)

Current SFT Stock Price: $1.09

Another fintech company, Shift Technologies (NASDAQ:SFT), has also turned heads in the stock market this week. It has been on the list of “short squeeze stocks” to watch, thanks to mounting short interest in the name. Today, data from Fintel.IO shows the current short float percentage of SFT stock sitting at 24.35%. Meanwhile, participation in the upcoming Wells Fargo Bricks to Click Digital Conference may be at the top of mind for some.

Shift announced the acquisition of Fair Financial Corp.s listing marketplace technology this quarter. Not much has been touched upon since and could be a source of this speculation right now. In May, Shift reported the deal that it said would welcome new members to its team and speed up its “vision of becoming the destination marketplace for car ownership.”

Is SFT Stock A Buy?

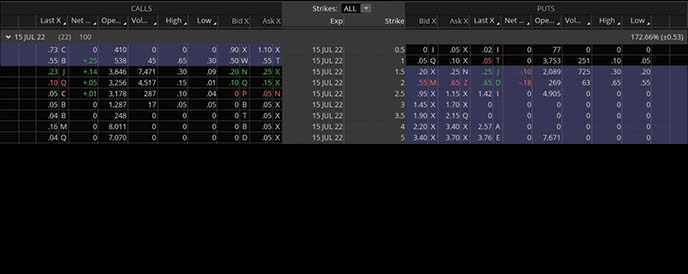

There seems to be some speculation in the near term compared to NU stock. In this case, the SFT options chain shows unusual activity in the July 15 $2.50 calls. More than 4,600 contracts are traded as of this article compared to just 430 contracts showing for open interest. With the upcoming conference next week, it will be interesting to see what the company discusses.

3. Traeger Inc. (NYSE: COOK)

Current COOK Stock Price: $4.81

We’ve discussed numerous household-name stocks that became penny stocks this year. Traeger Inc. (NYSE:COOK), in particular, was one of our featured posts discussing the topic of “will it become a penny stock” this year. When the COOK stock update was posted, shares were trading at over $6.70. This month, the grill and smoker company hit fresh lows of $3.85. But late-June action could be showing a turn in the tides. COOK stock has rebounded the last few days and reached highs of more than $4.80 on June 23rd.

[Read More] What to Know About Buying Penny Stocks on June 23rd

Other than price action, traders may look at COOK stock’s short interest. Fintel data shows the current short float percentage sitting above 14% right now. Something that may be at the top of mind for traders is how Traeger will turn things around this year. Despite beating estimates for Q1 earnings, the company posted lower revenue guidance, taking precedence over the earnings beat.

Management hopes that new platforms launching, including its Timberline and Timberline XL grills, will bolster growth as the company expands its reach with retail partners.

Is COOK Stock A Buy?

Against a bearish market backdrop, some are bullishly speculating on COOK stock. Specifically, the $5 strike Call options for the July 15th expiration are gaining the most attention. There were 919 contracts open today but more than 1,600 in volume. Will the mix of short interest, consumer spending for stay-at-home summertime entertainment, and a hopeful turnaround in the company’s financial stance fire up COOK stock, or are the embers completely extinguished right now?

4. Vroom Inc. (NASDAQ: VRM)

Current VRM Stock Price:$1.49

Like Shift Technologies, Vroom Inc. (NASDAQ:VRM) focuses on the auto retail industry. The company provides an eCommerce platform for buying and selling used vehicles and recently posted more robust than expected earnings for the first quarter.

Vroom beat on earnings per share estimates as well as sales estimates, achieving $923.77 million compared to $878.13 million expected.

“As we look forward, we intend to prioritize unit economics over growth, reduce operating expenses, and focus on four key initiatives to build a profitable business. I would like to thank all of our Vroommates and our third-party partners for their support in serving our customers,” explained CEO Thomas Shortt in his Q1 update.

Meanwhile, we’ve also got some short squeeze attention on the stock. Right now Fintel data shows the short float percentage for VRM stock sitting slightly above 30%.

Is VRM Stock A Buy?

Considering the options activity today, it looks like some bullish speculation might be at play. The July 15th $1.50 and $2 strike Calls saw a higher volume than open interest on June 23rd.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!