Originally Posted: 6/10/2022 8:30 AM ET

Updated: 6/10/2022 10:40 AM ET

High inflation and interest rate hikes have been two economic factors stoking fear in the stock market this year. Higher energy prices, supply chain bottlenecks, and geopolitical concerns have created a unique situation for investors. But with things like the stock market crash and recent consolidation, opportunities have presented themselves for traders and investors alike.

Today’s Consumer Price Index Data (CPI Data) will be a barometer for the pace of inflation. It could also show whether or not things are finally peaking and if the Federal Reserve’s maneuvers regarding rates and quantitative tightening are worth it. Even though we discuss penny stocks on the site, CPI data and inflation can have a sweeping impact across all areas of the stock market, and good to know if you’re trading stocks today.

What Is CPI Inflation Data?

CPI stands for Consumer Price Index. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index measures “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.”

[Read More] What to Know About Buying Penny Stocks on June 10th

April CPI Inflation Data

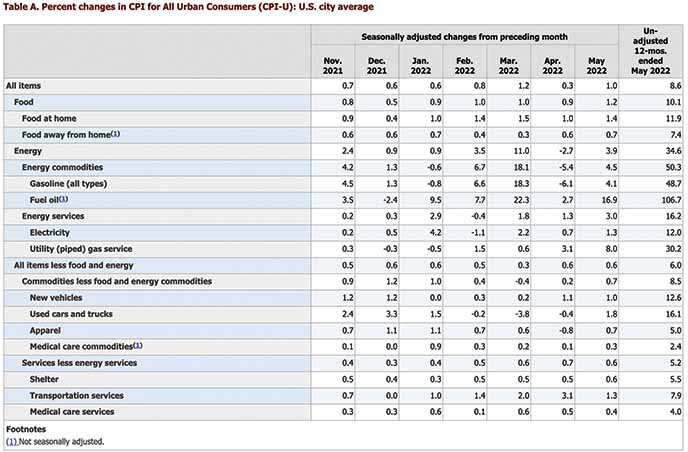

In April, the Consumer Price Index for All Urban Consumers rose 0.3%, seasonally adjusted. It rose 8.3% over the trailing 12 months, not seasonally adjusted. The index for all items minus food and energy jumped 0.6% in April seasonally adjusted; up 6.2% over the year not seasonally adjusted. Meanwhile, the energy index rose 30.3% over the last year, and the food index increased 9.4%. This was the largest 12-month increase since the period ending April 1981.

CPI Inflation Expectations For May

CPI is expected to stay at 8.3% for the trailing 12 months. Core CPI is anticipated to rise 0.5% or 5.9% year-over-year based on Dow Jones estimates.

May 2022 CPI Inflation Results

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.0% in May on a

seasonally adjusted basis after rising 0.3% in April according to the U.S. Bureau of Labor Statistics. Over the last 12 months, the all items index increased 8.6% before seasonal adjustment.

Here’s the breakdown of the specifics:

- The increase was broad-based, with the indexes for shelter, gasoline, and food being the largest contributors.

- The energy index rose 3.9% over the month with the gasoline index rising 4.1% and the other major component indexes also increasing.

- The food index rose 1.2% in May as the food at home index increased 1.4%.

- The all items index increased 8.6% for the 12 months ending May. This was the largest 12-month increase since the period ending December 1981.

- The all items less food and energy index rose 6.0% over the last 12 months.

- The energy index rose 34.6% over the last year. This was the largest 12-month increase since the period ending September 2005.

- The food index increased 10.1% for the 12-months ending May. It was also the first increase of 10% or more since the period ending March 1981.

The Stock Market Today

The stock market reacted immediately after the CPI data was reported. Major market ETFs slipped lower with the S&P 500 ETF (NYSE: SPY) dropping back below $400 to the $396 level. Tech-heavy Nasdaq (NASDAQ: QQQ) dropped back under $299 to the $293 level. Meanwhile, the Dow (NYSE: DIA) traded lower at under $320. Individual stocks like Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) echoed the downbeat sentiment as well. Both traded lower during premarket hours on Friday.

Looking at the chart above, CPI data isn’t showing what investors had hoped, which is inflation tapering. Since the numbers have come in hotter than expected, bullish traders are now reworking their strategies. One of the more glaring points was in energy.

CPI Energy Data

The energy data from the May CPI report showed that the energy index rose 34.6% over the past 12 months. The gasoline index increased 48.7% over the period. Meanwhile, the index for fuel oil more than doubled, rising 106.7%! This was the largest increase in the history of the series, which dates to 1935. The index for electricity rose 12.0%, the largest 12-month increase since the period ending August 2006. Finally, the index for natural gas increased 30.2% over the last 12 months, the largest such increase since the period ending July 2008.

[Read more] Top Penny Stocks to Buy in June 2022? 3 to Watch Right Now

CPI Food Data

Whether you ate in or out, you likely have felt the price crunch. The food at home index rose 11.9% over the last 12 months and was the largest 12-month increase since the period ending April 1979. This was a sweeping price rise. All six major grocery store food group indexes jumped over

the span, with five of the six rising more than 10%. The index for meats, poultry, fish, and eggs increased the most, rising 14.2%, with the index for eggs increasing 32.2%. The rest of the groups saw increases ranging from 8.2% (fruits and vegetables) to 12.6% (other food at home).

The index for food away from home rose 7.4% over the last year. This was the largest 12-month

change since the period ending November 1981. The index for full-service meals rose 9.0%

over the last 12 months, and the index for limited-service meals rose 7.3% over the last

year. However, the index for food at employee sites and schools actually fell 30.5% over the last 12 months, which, the Bureauxplained was a result of widespread free lunch programs.

CPI Inflation Take-Aways

Economic data is important when it comes to determining your trading strategy and approaching the stock market today. While many had hoped CPI data for May would show slowing inflation, details of the month’s report have brought some caution looking ahead to the rest of the year. When will inflation begin turning a corner? Is the Federal Reserve’s pace of interest rate hikes unacceptable? At the end of the day, we await the next round of rate hikes and CPI data for June in the coming month.

This is a breaking story and will be updated as more details emerge.