Making Money With Penny Stocks During a Recession, 3 Tips

3 Tips for Making Money With Penny Stocks During a Recession

If you’re looking to make money with penny stocks during a recession, there are a few things you need to know. First, penny stocks are generally much more volatile than the overall stock market, so they may be more likely to go up or down in value during economic downturns.

While this volatility can be scary, it can also lead to big profits if you know how to navigate it. Second, always make sure you understand what is causing the recession. This is important because it will help you predict which sectors may be most affected, and therefore, which penny stocks may be the best bets. Right now, this includes rising inflation, climbing interest rates and much more. So, always make sure to understand what is going on in the stock market and to use that to your advantage.

[Read More] Top Penny Stocks to Buy Now? 3 to Watch in June 2022

Finally, always remember that penny stocks are a high-risk investment. They may go up or down in value very quickly, so you need to be prepared for both. If you’re not comfortable with this level of risk, then penny stocks may not be the right investment for you.

However, if you’re willing to take on the risk, then it could be worth the investment. Because of this, always make sure that you have a proper trading strategy that aligns with your risk tolerance. If you do all of these things, then you may be able to make a lot of money with penny stocks during a recession. With that in mind, let’s take a closer look at three tips for trading penny stocks right now.

3 Tips for Trading Penny Stocks Right Now

- Buying the Dip With Penny Stocks

- Using Volatility to Your Advantage

- Utilizing a Trading Strategy

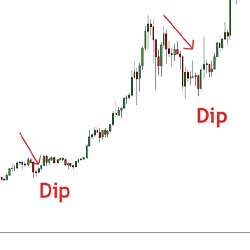

Buying the Dip With Penny Stocks

When it comes to buying the dip with penny stocks, there are a few things you need to know. First and foremost, penny stocks are stocks that trade for $5 per share or less. They’re generally considered to be more volatile and risky than other stocks, but they can also offer big rewards if you pick the right ones.

This means that they can climb and dip substantially over the course of a few seconds, minutes, or hours. And for that reason, many investors choose to buy the dip. This is when the stock price falls and then rebounds soon after.

If you’re thinking about buying the dip with penny stocks, there are a few things you need to keep in mind. First, you need to have a firm understanding of what you’re buying. This means doing your research and knowing the risks involved.

Second, you need to be prepared to lose money. Penny stocks are very volatile, and you could lose all of your investment if the stock price plummets. Finally, you need to have a plan. You should know how much you’re willing to invest, what your goals are, and when you’re going to sell. So, do you think buying the dip is worth doing with penny stocks or not?

Using Volatility to Your Advantage

Using volatility to your advantage is a crucial step when it comes to trading penny stocks. Volatile stocks are those that experience large price swings over a short period of time. A stock may be considered volatile if it fluctuates more than a few percent in a single day. While this may seem like a lot, it’s actually not that uncommon for penny stocks to move by this much or even more.

The key to trading volatile stocks is to buy when the price is low and sell when the price is high. However, this is easier said than done. Timing the market is difficult, even for experienced investors. This is why many penny stock traders use technical indicators to help them make decisions about when to buy and sell.

[Read More] Hot Penny Stocks to Watch as May Ends

In addition, buying and selling penny stocks that are volatile, means utilizing the news to your advantage. You want to be aware of any breaking news that could affect the price of the stocks you are trading. For example, if a company announces a new product, that could cause the stock price to go up. On the other hand, if a company is involved in a scandal, that could cause the stock price to go down. So, it’s important to be aware of the news and use it to your advantage.

Penny stocks are a risky investment, but if you know what you’re doing, they can be profitable. Volatility can be your friend or your enemy, so it’s important to understand how to use it to your advantage.

Utilizing a Trading Strategy

The most important step for trading penny stocks is utilizing a trading strategy. This will help to minimize losses and maximize profits. There are a few different strategies that can be used when trading penny stocks. These are usually categorized by time frame. The longest time frame would be holding a penny stock, hoping that it moves beyond the $5 territory. This could take days, weeks, or even months.

A day trader will hold a penny stock for a shorter period of time, hoping to make small profits off of the stocks quick movement. A scalper is someone who holds a penny stock for an extremely short period of time, sometimes just seconds, in order to make quick profits. While none of these strategies is better than the others, it is important to find the one that best fits your personality.

Some people are more patient than others and can stomach the ups and downs of a longer-term hold. Others may not be able to handle the stress of seeing their stocks fluctuate and prefer the quick in-and-out nature of day trading. No matter what your personality type is, there is a trading strategy for you.

3 Penny Stocks to Add to Your Watchlist This Week

- Uranium Energy Corp. (NYSE: UEC)

- ContextLogic Inc. (NASDAQ: WISH)

- Tencent Music Entertainment Group (NYSE: TME)

Are Penny Stocks Worth Buying in 2022?

With so much going on in the stock market right now, investors need to be more careful than ever when choosing penny stocks to buy. Many investors turn to penny stocks because they offer high volatility and more fluctuations than blue chips. And while this can be a big positive, it can also be a very big negative.

[Read More] Top Penny Stocks Today: What’s Moving AVDL, BKSY, NILE, INO, & ALLR

When it comes to penny stocks, what goes up often comes down just as quickly. So, if you’re not careful, you could end up losing a lot of money in a very short period of time. That’s why it’s important to do your homework before buying any penny stock. With this in mind, do you think penny stocks are worth buying in 2022 or not?