Inflation Data Is Out & Here’s What CPI Shows

Investors have been fearful of high inflation all year. Against a backdrop of increased interest rates, energy prices, and continuous supply bottlenecks haven’t helped curb rising prices or increased demand. It has become a very unique situation for consumers and investors alike. Much of the reaction in the stock market this year has been bearish in light of these headwinds.

Year-to-date figures show major indexes are in a bear market territory or, worse, complete crash mode. This week the market is hoping for some help from April’s consumer price index report. Hopes are high that CPI will show inflation has already peaked though economists have warned that prices could remain higher.

What Is CPI?

CPI stands for Consumer Price Index. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index measures “the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.”

March CPI Data

In March, the Consumer Price Index for All Urban Consumers rose 1.2%, seasonally adjusted. It rose 8.5% over the trailing 12 months, not seasonally adjusted. The index for all items minus food and energy jumped 0.3% in March seasonally adjusted; up 6.5% over the year not seasonally adjusted.

CPI Expectations For April

CPI is expected to rise 0.2% in April or 8.1% for the trailing 12 months. Core CPI is anticipated to rise 0.4% or 6% year-over-year.

April 2022 CPI Results

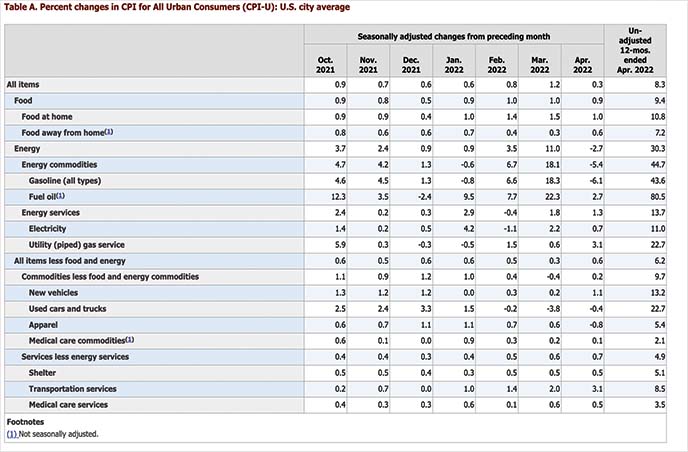

CPI results for April are officially out & here’s what the numbers are:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in April on a seasonally adjusted basis after rising 1.2 % in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.3% before seasonal adjustment.

Here’s a breakdown of some of the specifics:

- Increases in the indexes for shelter, food, airline fares, and new vehicles were the largest contributors to the seasonally adjusted all items increase.

- The food index rose 0.9% over the month as the food at home index rose 1.0 percent. The energy index declined in April after rising in recent months.

- The index for gasoline fell 6.1% over the month, offsetting increases in the indexes for natural gas and electricity.

- The index for all items less food and energy rose 0.6% in April

- Along with indexes for shelter, airline fares, and new vehicles, the indexes for medical care, recreation, and household furnishings and operations all increased in April.

- The indexes for apparel, communication, and used cars and trucks all declined over the month.

The Stock Market Today

The stock market reacted immediately after the CPI data was reported. Major market ETFs slipped lower with the S&P 500 ETF (NYSE: SPY) dropping back below $400 to the $396 level. Tech-heavy Nasdaq (NASDAQ: QQQ) dropped back under $300 to the $297 level. Meanwhile, the Dow (NYSE: DIA) traded right around where it closed on Tuesday around $321.

Looking at the chart above, CPI data isn’t showing what investors had hoped, which is inflation tapering. Since the numbers have come in hotter than expected, bullish traders are now reworking their strategies. One of the more glaring points was in food.

CPI Food Data

CPI data showed a food index increase of 0.9% in April. This was the 17th consecutive monthly jump. The index for food at home jumped a full 1% after increasing 1.5% the prior month. What’s more, on a granular level, five out of six major grocery store food group indexes climbed over the month. Dairy-related products climbed 2.5%, which was the largest monthly increase since July 2007. The index for meats, poultry, fish, and eggs rose 1.4% as the index for eggs increased 10.3% in April.

The food at home index rose 10.8% over the last 12 months. This was the largest 12-month increase since the period ending November 1980. The index for meats, poultry, fish, and eggs increased 14.3% over the last year. The last time there was a 12-month increase was in the period ending May 1979.

Which Penny Stocks Are Investors Buying Right Now? 3 to Watch

CPI Energy Data

But a shining light amid the bearish CPI report could have been in energy. The energy index dropped 2.7% in April after rising 11.0% in March. The gasoline index also dropped in April, falling 6.1% after increasing 18.3% the prior month.

CPI Take-Aways

We mostly write about penny stocks on the site. But economic data is key to determining your trading strategy and approaching markets. While many had hoped CPI data for April would show slowing inflation, details of this month’s report have brought some cautious optimism looking ahead at the rest of the year. Has inflation begun turning a corner? Is the Federal Reserve’s pace of interest rate hikes acceptable? At the end of the day, we await the next round of rate hikes and CPI data for May in the coming month.

This is a breaking story and will be updated as more details emerge.