Penny stocks have become synonymous with high-stakes trading. Whether it’s about playing a one-day volatility trend or investing in penny stocks “at the ground floor,” these cheap stocks have a storied past with plenty of market participants. But a growing trend in the stock market today has to do with a different “ground floor” strategy: the IPO.

The last few years have seen a surge of new companies making their public debut. Whether it’s the latest SPAC transaction or a new listing, there’s no shortage of traders hunting for lightning in a bottle. The good: when IPOs work out, they can work out incredibly well. Look at companies like Rivian (NASDAQ: RIVN) and even Digital World Acquisition Corp. (NASDAQ: DWAC). While both are trading much lower right now, their public debuts were nothing short of spectacular. DWAC stock exploded from under $10 to $175 within a matter of 3 days. RIVN stock went public at a previously set IPO price of $78. Within about a week of trading, shares traded above $175.

OST Stock Sends Investors For A Loop

The latest name in the IPO saga is Ostin Technology Group, Co. (NASDAQ: OST). It is becoming a cautionary tale to IPO investors who may simply expect these fresh pubco’s to “only go up.”

Earlier this month, the company announced a $13.5 million initial public offering. Ostin IPOd with 3,375,000 shares with OST stock opening for trade at $10.10 on April 27, 2022. On its first day of trading, shares surged to highs of $40 and continued to reach $47.79 on its second day of stock market action, a 370%+ move in two days? Who wouldn’t love a move like this?

What Does Ostin Technology Group Do?

Ostin Technology Group supplies display models and polarizers in China. Its products are mainly used in consumer electronics, outdoor LCDs, and automotive displays. According to public filings, during the fiscal years ended September 30, 2021, and 2020, Ostin’s revenues were $167,744,801 and $140,073,917, respectively. Its net income was $3,295,507 and $2,831,286, respectively.

Ostin also provides display panel repair services at extra charges. This includes product sales and the replacement of individual parts. According to the company, “the repair services are originally offered to a limited number of customers at their request and represent only a small portion of our revenues.”

However, the company appears to have extended its repair services customer base to people who did not purchase its display panel products. As a result, Ostin reported revenues from repair services increasing by roughly $6.06 million, or 204%, to approximately $9.03 million for the fiscal year ended September 30, 2021. This was up from roughly $2.97 million for the fiscal year ended September 30, 2020. Furthermore, Ostin reported that it had two significant customers that accounted for 38.2% and 14.7% of our total revenues for the fiscal year ended September 30, 2021.

OST Belly Flops In Post IPO Debut

On Thursday, OST stock was trading at nearly $50 per share. As of the open on April 29th, OST stock hovers around $4 per share after hitting a low of $3.75. Something to consider is that this is a low float (below 20 million shares) issuer, and as we’ve discussed in the past, these types of stocks can become incredibly volatile. In this case, the market gave and took away within a little over two days. What’s more, if you’re looking at trading volumes, week-to-date, OST stock has traded around 20 million shares.

The company hasn’t released any further updates following the IPO, nor has there been any reference to the wild swing the stock has seen. Whatever happens next is likely to have early investors paying very close attention.

IPOs Continue Creating Buzz With Penny Stocks In Focus

Other recent IPOs have captivated traders this year. Tenon Medical (NASDAQ: TNON) is another company that made its public debut in April. Shares IPOd at $5, but when the market opened, the first trade in TNON stock was at more than $22. TNON stock ultimately reached a high of $29.82 by Thursday afternoon and remained around the $20 mark at the end of the week (as of this article).

Best Penny Stocks to Buy Today? 3 to Watch on April 29th

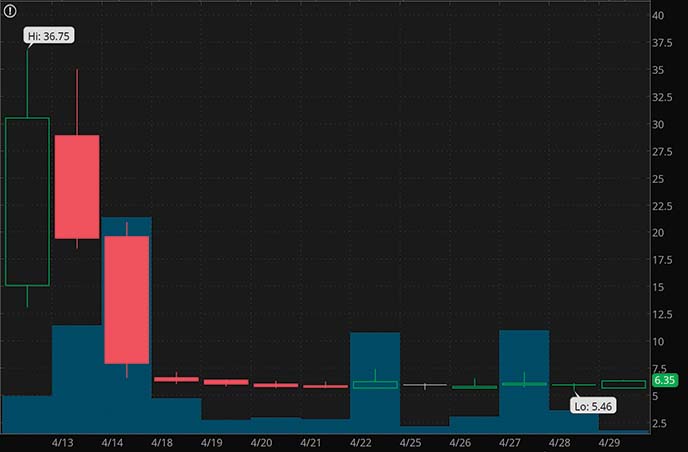

Other IPOs within the last few weeks have also experienced extreme levels of stock market volatility. Many have watched live trading in these new issuers in amazement. Genius Group Limited (NYSE: GNS), an Edtech and education platform, had its IPO on April 12th. Shares were priced at $6, but once the market opened, GNS stock printed at $15.11. It would reach highs of $36.75 during one of the wildest first days of trading for IPOs in April. Since then, GNS stock has nosedived to lower levels than the IPO price.

Expion360 Inc. (NASDAQ: XPON) is another bellyflop IPO that debuted in April. Shares of the lithium battery and RV accessory company were priced at $7. The first trade in the XPON IPO was at $7.9, which sparked a cascade of buying up to highs of $11.29. This week, XPON stock is another name on the list of penny stocks following a botched IPO. It’s trading below $4 per share.

It isn’t just SPACs or fresh S-1s making their way to major exchanges. Other companies that trade Over-The-Counter (OTC) have also made a splash in the stock market. Today, shares of Applied Blockchain Inc. (NASDAQ: APLD) hover around $3.40. While this is higher than where it was trading on the OTC a few weeks ago, it’s over 30% lower than where APLD stock was when it did its NASDAQ IPO on April 13th. The $5 IPO price is in the rearview as of this article.

Hot Penny Stocks For Traders to Watch in May 2022

IPOs Today: Will They Become Penny Stocks?

With wild action in the IPO market, the trend involves quick action. In most cases, those who’ve purchased IPO shares in many of these companies are underwater right now. Is the risk worth the reward? I’ll leave that up to you to decide. While you’re doing that if IPO stocks are a focus, here are two more set to make their debuts before May:

Hillevax Inc. (NASDAQ: HLVX): Initial public offering of 11,765,000 shares of common stock at an initial public offering price of $17.00 per share.

Belite Bio Inc. (NASDAQ: BLTE): Initial public offering of 6 million American Depositary Shares (ADSs) at a public offering price per ADS of $6.00.

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!