3 Penny Stocks Investors Are Betting On Big For A Downfall

If you’re thinking about penny stocks to buy, they say the trend is your friend. But what if the movement isn’t in favor of the bulls. There’s a common misnomer when it comes to cheap stocks. That misnomer is you can only make money if stocks go up. But for more than just a few penny stocks, that isn’t the case. How can you make money when stocks drop? The go-to methods for most are to short stocks or trade options. Both strategies carry plenty of risks, but if their “bets” are correct and stocks drop, there could be money to be made. Today we’re looking at some penny stocks with unusual options activity. In this case, they might purport big bearish bets from investors.

Penny Stocks With Big Bearish Bets

- DiDi Global Inc. (NYSE: DIDI)

- Blend Labs Inc. (NYSE: BLND)

- Sientra Inc. (NASDAQ: SIEN)

Are Penny Stocks Worth It?

Traders can and have made a lot of money with penny stocks. Most do so by identifying opportunities and capitalizing on them. They also look for penny stocks to avoid and stay far away from potential downside risks. While options trading is much more complex than buying Calls or Puts, what’s on the surface as far as volume and Open Interest has been used by specific traders to gauge market sentiment. Taking these fundamental factors into consideration, on the surface, are traders placing big bearish bets on some of these penny stocks today?

DiDi Global Inc. (NYSE: DIDI)

Shares of DiDi Global are down by roughly 90% from their 2021 high. The company didn’t match up to the expectation that the market had for it. Even leading ride-hailing companies like Uber (NYSE: UBER) placed high hopes on DiDi’s platform. The company acquired a stake in DiDi after selling its China business in 2016. The popular ride-hailing company posted an unrealized $3 billion loss on its DIDI stock investment in its latest annual report.

Furthermore, troubles with Chinese and North American exchanges concerning listing status have plagued DIDI stock. Shutting down operations in South Africa, mounting revenue declines, and now plans for delisting from the New York Stock Exchange have accelerated the burn for the penny stock.

Next month, shareholders are expected to participate in an extraordinary meeting. A vote will determine the listing status of DIDI stock. Should it go as planned, investors could be looking at a soon-to-be OTC listed company. Leading up to this vote, some traders are betting big on a near-term bearish move in the stock. As of this article, more than 10,000 contracts have been traded in the $2.50 and $2 Put options expiring April 22. Looking further out also shows a bearish stance in the options market. The April 29 $2 Puts are mounting Open Interest with a volume of more than 3,400 contracts.

Blend Labs Inc. (NYSE: BLND)

Like DiDi, Blend Labs has been in a perpetual state of selling since its debut on the NYSE in 2021. The fintech company’s shares reached highs of $21.04 last summer but has done little to reclaim anywhere close to that level since. The company has worked to build a model around expanding its platform to “transform banking experiences” for customers. Whether it’s lending or saving, Blend has set its sights on making banking more accessible and efficient.

Whatever the case may have been for the company, the market hasn’t reacted the same way. Shares of BLND stock are down more than 77% since last July and fell as low as $4.41 earlier this month. The company reported Q4 and full-year 2021 earnings results last month, which seems to have added more pessimism to the company’s outlook in the stock market.

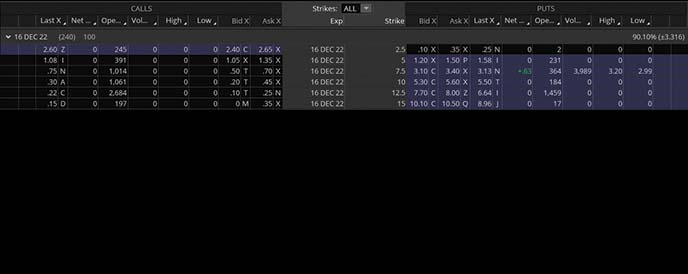

Blend missed Q4 sales estimates reported that it expects modest declines for the first quarter of 2022. Given this guidance, a slew of analyst downgrades added pressure to the stock. One firm, Canaccord Genuity, slashed its $28 target down the just $5. The firm maintains a Buy on the penny stock. Following this trend is the options market. As of this article, the expiration date with the most volume is December 16, $7.50 Puts with nearly 4,000 contracts traded as of this article.

Sientra Inc. (NASDAQ: SIEN)

Sientra Inc. isn’t a newly minted public company, and up until mid-2021, it was on an epic rise. SIEN stock skyrocketed from May 2020 until July 2021 from around $1.53 to highs of over $9. However, since then, it has been unable to stop the bleeding in the stock market.

The company specializes in medical aesthetics concerning plastic surgery. Sientra’s portfolio includes products like breast implants and scar gel, among other items. The market remains unimpressed despite reporting record plastic surgery revenue for Q4 and full-year 2021. In the latest earnings update, CEO Ron Menezes even said, “With strong momentum behind us, we have many exciting catalysts on the horizon. In 2022, we expect to continue to expand our market share and number of accounts in both reconstruction and augmentation as we further progress towards our goal of becoming a leader in aesthetics focused on plastic surgeons.”

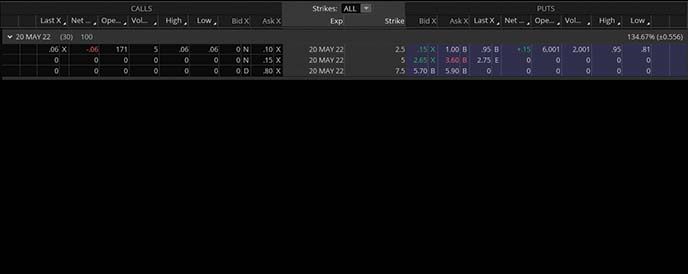

The market remains bearish on the stock. That stance was echoed in a similar fashion based on a quick glance at the SIEN stock options chain. In particular, the May 20th $2.50 Puts gained the most attention with over 2,000 contracts traded. Meanwhile, there were just over 6,000 contracts showing for Open interest compared to fewer than 200 contracts of Open Interest in the corresponding Calls.

How To Buy Penny Stocks

When it comes to buying penny stocks, you want to have a good understanding of how to trade. In most cases, know that you’re dealing with highly volatile market conditions and lower liquidity stocks (on average). In many cases, breakouts can happen instantaneously with breakdowns coming into play just as swiftly. If you’re just beginning to learn how to trade, here are a few articles to help you get the basics down, first:

Trading Options 101: A Beginner’s Guide

“What is an option?” This may be a question you’ve asked yourself before. If so, options trading might be a suitable investment for you! – Keep Reading

10 Secret Ways To Find The Best Penny Stocks To Buy In 2022

Penny stocks are high-risk, high-reward investments. If you’re looking to take a risk on the stock market to make some serious money, then penny stocks might be for you. However, finding the best penny stocks to buy can be challenging. Today we’ll show you ten different ways to help you find the best penny stocks to buy this year! – See Full Article

How To Make Money In A Recession When There’s An Inverted Yield Curve

What does an inverted yield curve mean for the stock market today, and does it signal a stock market crash? With plenty of geopolitical uncertainty & headlines prompting wild volatility, you must have a trading game plan! There’s no better time than now to get involved in the stock market for beginners and advanced traders & investors. One stock market live stream will discuss which stock market news headlines you should be paying attention to right now. – Read More

Dark Pools: What They Are & How To Use Them To Your Advantage

Dark pools are defined as alternative trading systems (ATS) designed to handle large transactions for institutional investors. These “dark pools” were created to take trades of larger buyers and sellers prepared to trade blocks of stock instead outside traditional markets. The goal was avoiding dramatically impacts on the market. Ideally, dark pools focus on lessening the blow that a large retail order could have if it was made in the open market. – Continue Reading

If you enjoyed this article and you’re interested in learning how to trade so you can have the best chance to profit consistently then you need to checkout this YouTube channel. CLICK HERE RIGHT NOW!!