Best Penny Stocks Under $1? 3 For Your Watch List Today

Are These Cheap Penny Stocks Worth The Risk Right Now?

Most traders understand that penny stocks are shares of companies trading for less than $5. But that leaves a lot of “wiggle room” when it comes to putting your watch list together. Where some traders look for specific trending sectors, others solely focus on price. One of the more popular groupings of penny stocks is those that fall below the $1 threshold.

Even a small shift in price by 10 cents can mean a move of 10% or more. The lower the price, the higher the intrinsic volatility as a result. So before you dive right in and start blindly throwing darts at your “stocks under $1” dartboard, strategize. When it comes to trading, nothing needs to be set in stone. I mean that even if you wanted to buy penny stocks under $1, it’s ok to look for trending industries. For example, we’ve got a lot of action in energy stocks right now. We also see plenty of momentum behind other industries like biotech and, of course, marijuana penny stocks.

Penny Stocks Under $1 & Risks Involved

You’ve definitely got your pick when it comes to trending stocks. But let’s not forget the other risks in buying these cheap stocks, especially if you’re using an app like Robinhood or Webull. Since these platforms mostly allow Nasdaq & NYSE-listed names only, the $1 mark is a staple for most companies. These larger exchanges require stocks to meet a minimum threshold bid price, usually $1.

[Read More] 4 Robinhood Penny Stocks For Your February 2021 Watch List

Once a listed stock dips below that threshold, the exchange can send a notice of delisting and give the company a window of time to regain its compliant bid price. Should it not make it in time, the stock could face delisting, and then it’s uncertain if you’ll even be able to access that stock on your trading app.

If you’re looking for penny stocks under $1 to buy, keep that in the back of your head. In the mean time, here are a few that’ve experienced strong, bullish trends in February.

Best Penny Stocks Under $1

- Northern Dynasty Minerals Ltd. (NYSE: NAK)

- Gran Tierra Energy Inc. (NYSE:GTE)

- Acasti Pharma Inc. (NASDAQ: ACST)

Northern Dynasty Minerals Ltd.

We talked about Northern Dynasty Minerals in our article last night. In fact, it’s been one of the more popular penny stocks under $1 for several weeks. This came after several months of uncertainty surrounding not only the company but the future of its Pebble Project, altogether. Northern’s former leadership, specifically, unethical business practices by the former CEO.

Once the dust settled there, the focus was back on its Pebble Project in Alaska. The US Army Core of Engineers had issued a negative Record of Decision for the proposed Pebble copper-gold-molybdenum-silver-rhenium mine in southwest Alaska. But shortly after, Northern made a push to appeal this decision. The Request for Appeal challenges a key finding of ‘significant degradation’ according to the company. The Pebble Partnership argues “the ‘more than trivial’ standard employed by the USACE is not the correct test for assessing a project’s impact on aquatic resources” or making a ‘significant degradation’ finding.

The company has also said that certain aspects of the previous decision are “contrary to law, unprecedented in Alaska and fundamentally unsupported by the administrative record.”

In light of this appeal, NAK has seen a strong boost of interest during the last few months.

Gran Tierra Energy Inc.

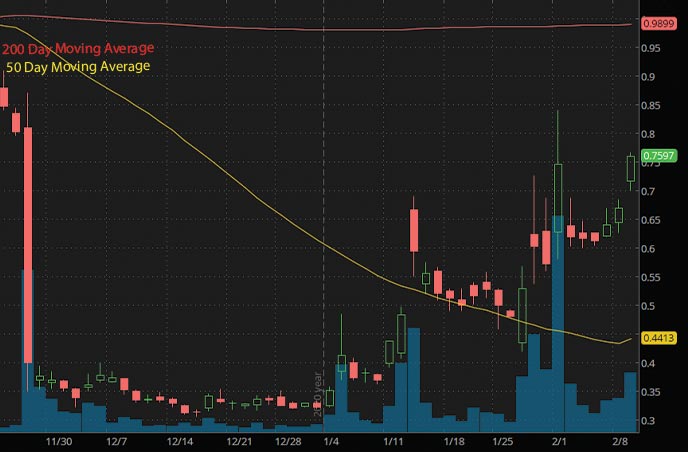

One of the energy penny stocks to watch this year has been Gran Tierra Energy. Shares of the stock have climbed immensely since the start of the year. When 2021 began, the GTE stock price was hovering around 37 cents. Since then, it has rallied to highs of over $0.90. The company is focused on oil and natural gas exploration and production. Despite the push for green energy, your “traditional” energy resources have continued climbing. One of the ideas behind this is that infrastructure still needs to be built to support this green energy future.

Read More

- High Volume Penny Stocks To Watch Right Now

- 5 Cheap Penny Stocks To Buy Under $5, Are They Worth The Risk?

The Biden Administration has set to “pursue a historic investment in clean energy innovation” with a commitment to increase federal procurement by $400 billion in his first term. This year, consultants at Rystad Energy said, “Any ‘green’ focus of the infrastructure bill will be mostly additive to overall short-term oil products demand due to construction activity, with risks mostly limited to medium-term oil demand, depending on the scope and success of the projects.”

In this light, it makes sense that oil and gas stocks have continued gaining steam in the short-term. Gran Tierra had obviously faced challenges along with the rest of the industry thanks to the pandemic. “We have already increased production approximately 24% from our third quarter 2020 average, which we believe reflects the strength of our Proved reserves,” explained Gary Guidry, President, and CEO of Gran Tierra, in a January update. “We forecast 2021 average production of 28,000 to 30,000 bopd for the Company.”

Acasti Pharma Inc.

Finally, Acasti Pharma Inc. has been on the move as well. Since the start of the year, ACST stock has climbed from around 34 cents to highs this week of just over 90 cents. During that time, as well, ACST managed to jump above $1 briefly. The company’s recent fiscal 2021 Q3 results helped continue to spark this trend. Of note, Acasti reported quarterly losses of $0.03 per share. This was a 78.57% jump over losses of $0.14 per share from the same period last year.

If you haven’t been following the company recently, I’ll give you some context. Acasti engaged Oppenheimer & Co. Inc. to help with identifying strategic alternatives. This came shortly after the company had reported Phase 3 data of its CaPre hypertriglyceridemia treatment last year. After that, the company decided not to move ahead in filing a New Drug Application with the FDA.

As far as the strategic alternative process goes, Acasti’s exploring potential mergers, acquisitions, or other initiatives. These could involve the company and/or its current pipeline, including CaPre. In the meantime, speculation has helped fuel momentum in the penny stock.

Final Thoughts On Cheap Penny Stocks

Again, the cheaper the stock, the higher the inherent risk simply due to price. While there are plenty of other risks to be concerned with, this is one we know is present. When it comes to day trading or investing in penny stocks, make sure you’re aware of current trends and always remember that nobody ever went broke by taking profit off the table. In any case, these stocks under $1 a trending this week, so it will be up to you to decide if they’re worth taking a closer look at or if they’re just the “flavor of the week.”