4 Hot Penny Stocks To Watch If You Like Clean Energy In February 2021

4 Clean Energy Penny Stocks to Watch in February

As February gets underway, clean energy penny stocks are heavily in focus. While green energy has been a hot topic for several years, the election of Joe Biden has helped give the industry a major push. It may take decades before green energy replaces fossil fuels, but there are plenty of opportunities in the meantime.

Additionally, clean energy penny stocks can operate in several different areas of the renewables industry. This is because there are many types of renewable energy sources. Within this category, there are several different factors to consider.

One of the most important aspects to keep in mind is which area of the clean energy industry you want to focus on. These companies range from the production of components for the energy industry and other things like resource mining, battery production, electric vehicles, and so many more.

As you begin to see, clean energy is vast in how it relates to penny stocks. And while some companies may be better suited to long term investment strategies, others could see momentum in the short term. Biden has stated that he wants to put a plan in place to bring the U.S. toward net-zero emissions by 2050. This is a large step from where we are in 2021.

With that, investors see a great deal of opportunity for the clean energy industry. Also, it is not just the U.S. that is aiming for clean energy. Rather, the majority of the world sees the urgent need to switch from fossil fuels to renewables. With all of this in mind, clean energy penny stocks continue to be in focus. For some watchlist inspiration, here are four gaining ground in February 2021.

HotPenny Stocks to Watch

- American Battery Metals Corp. (OTC: ABML)

- Torchlight Energy Resources Inc. (NASDAQ: TRCH)

- Tantech Holdings Ltd. (NASDAQ: TANH)

- Ur-Energy Inc. (NYSE: URG)

American Battery Metals Corp.

American Battery Metals Corp. is a company that we’ve been talking about for months at this point. Up around 15% at midday on February 1st, ABML stock is once again in focus. As its name suggests, the company works in the battery metals industry. Specifically, it has three unique parts of its operations.

This includes lithium-ion battery recycling, extraction tech, and primary resources. These three areas of expertise add ABML to the list of clean energy penny stocks. The company is currently working on several new and exciting technologies. This includes new production methods for recycling the primary metals utilized in electric cars, consumer products, and tools. As a whole, ABML works to recycle and produce supplies for almost any industry that utilizes batteries or battery metals.

On Thursday, January 28th, the company made an exciting announcement. This announcement has helped to spark several recent bull runs. On the 28th, the company stated that it had been selected for a $4.5 million grant from the U.S. Dept. of Energy’s advanced manufacturing office.

This is to develop new ways to utilize domestic battery production and resources relating to it. Doug Cole, CEO of the company, states that “we are grateful to have been selected for this award from the Department of Energy. We are fortunate to work with forward-thinking, collaborative partners – including the United States government.”

Torchlight Energy Resources Inc.

Torchlight Energy Resources Inc. may seem odd on this list of clean energy penny stocks. In the past, TRCH has worked as an oil and natural gas exploration company. But, toward the end of last year, the company signed an agreement with Metamaterial to combine the two businesses.

[Read More] Penny Stocks To Buy On Robinhood & 2 Have 50%+ Price Targets

Metamaterial has a long history of working on proven environmentally sound technologies. The company produces a large range of material-science focused products that utilize sustainability and energy at their core. This deal shows the commitment of Torchlight Energy to change with the times as renewables become the future.

Metamateiral currently has several markets that it works in including aerospace, consumer electronics and medical applications. As you can see, the opportunity here is quite broad. Greg McCabe, Torchlight’s Chairman, stated that “Meta’s management, led by George Palikaras, has built an extraordinary award-winning clean tech company whose proprietary advanced technologies address multiple markets and improve their customers capabilities.”

Obviously, it will take some time before this partnership reaches its full potential. But in the meantime, this is definitely an exciting factor to consider. Whether or not it makes TRCH a penny stock to watch is up to you.

Tantech Holdings Ltd.

Another big gainer of the day so far is Tantech Holdings Ltd. At midday, shares of TANH stock were up by around 13% to $1.96. While Tantech does work in the clean energy sector, this is in no way its only business opportunity. The company produces many products for use in China, including branded cleaning products and logistical systems. With that in mind, one of the larger operations that Tantech is involved in is the EV marketplace.

The company produces everything from electric buses and specialty EVs to lithium-ion batteries and solar cells. Currently, China is heavily reliant on coal power. But, the country is on a decades-long journey to becoming clean-energy based. This means that the market for products relating to the clean energy industry is showing very high demand.

During the trading day on February 1st, the company announced that its subsidiary, Zhejiang Tantech Bamboo Charcoal Co, was selected for an international standards creation. This relates to the applications of its bamboo-based charcoal. Wangfeng Yan, CEO of Tantech, states that “we have seen a steady increase in usage for bamboo charcoal as countless products and innovative applications have been developed across environmental and green sectors.”

While this is an exciting announcement, the real excitement for Tantech is with its EV business. With so much demand for these vehicles right now, TANH could be a penny stock to watch.

Ur-Energy Inc.

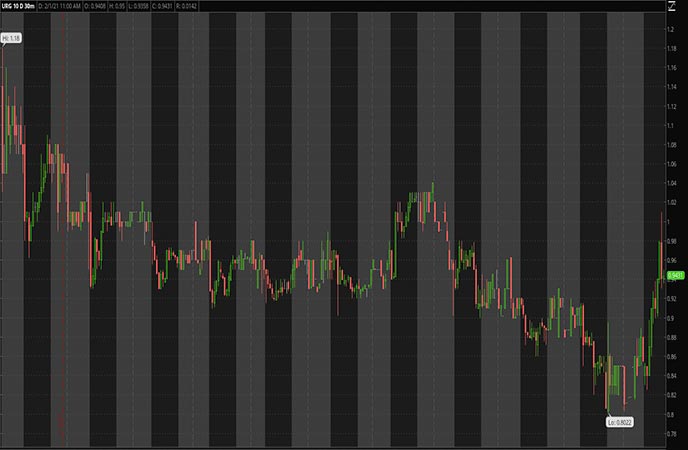

The biggest gainer on this list so far on February 1st is URG stock. By midday, URG shares hit the $1 mark before falling to around $0.94 per share. This represents a 17% gain so far for the day. While the uranium sector that Ur-Energy works in is usually quite stable, today’s trading represents another bullish run caused by new market attention being paid to it. Early in the morning, retail investors had their eyes set on silver stocks.

While uranium and silver are quite different, they both sit in the materials segment of the market. This means that there could be a correlative effect going into play right now. Back in December, the U.S. Senate Committee on Environmental and Public Works approved a bill that would vastly improve the size of uranium reserves in America.

When this was announced, many uranium penny stocks like URG shot up in value. We have to consider that it may take quite some time for production to rise. But, with this large demand increase, investors seem to be increasingly bullish on uranium stocks. Ur-Energy Inc. works directly as an exploration company with 12 projects in operation around the U.S. At these locations, the company produces a high quantity of uranium ore for a variety of purposes.

[Read More] Best Penny Stocks To Buy For February 2021? 4 Energy Stocks To Watch

As the world looks for the best renewable energy sources, nuclear continues to be a front-runner. While it has gotten a bad rap, nuclear is a completely zero-emission source of clean energy. Additionally, nuclear is considered one of the cleanest sources of energy globally, producing carbon-free power for a range of applications. The stigma surrounding nuclear may be high, there’s no doubt that uranium could be a big component of clean energy in the future. With this in mind, is URG a penny stock to watch?