4 Penny Stocks To Watch Ahead Of The Snowflake IPO If You Like Tech

Snowflake IPO Has Eyes On Tech Penny Stocks This Week

Whether you’re looking for penny stocks to buy or blue chips, I’m sure you’ve heard about this. One of the most widely anticipated tech IPOs of the year is set for September. If you haven’t heard about it yet, I’m talking about the Snowflake IPO. The company filed for its IPO late last month and plans to list under the ticker SNOW on the NYSE.

What Is Snowflake – The Snowflake IPO?

The company said its Data Cloud platform “enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data,” and, delivers its platform “through a customer-centric, consumption-based business model, only charging customers for the resources they use.”

Earlier this year, the company held a value of roughly $12 billion following a funding round in February. The company plans to raise up to $2.74 billion in its initial public offering. The Snowflake (SNOW Stock Report) could set the tech sector ablaze on Wednesday.

The company’s main focus, on a simple level, deals with cloud-based data management. In its IPO, Snowflake aims to sell some 28 million shares between $75 and $85. Underwriters are set to get an option for another 4.2 million to cover any overallotments. Additionally, stock market heavyweights like Berkshire Hathaway and Salesforce are said to plan on buying hundreds of millions of dollars in stock. Furthermore, the current CEO, Frank Slootman has a strong track record of success when it comes to taking companies public. These include Data Domain and ServiceNow with Snowflake becoming his 3rd.

Read More

- 5 Biotech Penny Stocks To Watch In September 2020

- Are These Beaten Down Penny Stocks A Buy Right Now? 4 To Watch

When you talk about sympathy trading, SNOW stock IPO could give rise to a little bit of momentum in my opinion. Where that momentum directs itself is yet to be seen. However, here are a few tech penny stocks that have started trending during the month.

Penny Stocks To Watch #1: Exela Technologies Inc.

Exela Technologies Inc. (XELA Stock Report) focuses on business process automation. It’s also one of the companies we’ve actively discussed this year. For the most part, XELA stock has been a strong performing penny stock under $1. It has been on the watch list since May and at the time, Exela was working with certain institutions to implement payee platforms. The company was also pushing attention to contactless solutions.

Learn, Trade & Profit Today! True Trading Group is the fastest growing & highest rated trading educational community. Right now they’re offering access to a brand new platform called TTGThree, teaching new traders how to become consistently profitable in the stock market. Click Here for More Info

Earlier this summer you might remember (if you’ve followed XELA stock) the company announced Mastercard’s confirmation of enrollment of its Request to Pay solution by Pay.UK. This is a leading retail payment authority in the UK. Exela Technologies co-developed The Mastercard Request to Pay solution. What’s more, the company was also working on its general cloud-based technology platform. Obviously, this is a hot topic ahead of the Snowflake IPO and one that Exela touched on this week.

On Tuesday, the company announced the launch of a cloud-based claims processing gateway for the healthcare sector. According to Exela, the platform – PCH Global – enables healthcare providers to “streamline the submission of healthcare claims, and enables payers to more efficiently process” claims and related payments. After a month-long downtrend in XELA stock, Tuesday marked the first clear, green day the penny stock has experienced. Will this trend continue throughout the remainder of Q3?

Penny Stocks To Watch #2: Conduent Incorporated

Conduent Incorporated (CNDT Stock Report) is one of the penny stocks we began following in early August. The company focuses on business continuity technology as well. Specifically, Conduent handles business process services in things like transaction-intensive processing, analytics, and automation. In fact, on August 6th we watched as the company’s shares began to catch some noticeable momentum. The activity followed Conduent’s update that its Conduent Transportation unit implemented phase 1 of its fare collection system across the De Lijn public transportations network in Belgium. This enabled De Lijn to launch contactless payment on public transports.

What ended up sparking the bigger move was the company’s surprise earnings results after the close. This subsequently ended up triggering a huge gap up on August 7th, which continued into the following week where CNDT stock reached highs of $4.79. Since then, things had calmed down, yet the penny stock rested mostly along its 200 Day Moving Average as a relative level of support.

[Read More] Top Penny Stocks To Watch Today Following Key Updates

During the last month or so, Conduent has also achieved other milestones. This includes a deal with the City of Santa Monica to continue providing intelligent parking and curbside management systems and services. Conduent was also named as an overall market segment leader for Cloud-Based HR Transformation by analyst firm Nelson Hall. Considering a focus on cloud technology stocks, will CNDT be on your list amid all of the buzz surrounding the Snowflake IPO?

Penny Stocks To Watch #3: Support.com Inc.

Support.com Inc. (SPRT Stock Report) is a newcomer to the list of penny stocks. The company provisions cloud-based software and services enabling technology support for a connected world. Specifically, Support.com offers “turnkey, outsourced support services for service providers, retailers, internet of things solution providers, and technology companies.”

SPRT stock has managed to experience a pretty incredible year if you think about it. Since the start of 2020, shares climbed from $1.12 to highs this quarter of $2.40. What’s more, SPRT stock never had a huge fall-out like so many other stocks did in March. There was some consolidation but nothing to the extent of the rest of the market. The penny stock has a relatively lower float – under 20M O/S. It also usually trades a hundred to a few hundred thousand shares a day. Tuesday, however, SPRT stock trade its highest, single-day share volume of 2020. There wasn’t any news or updates to go along with it.

Aside from announcing the availability of its latest version of SUPERAntiSpyware Professional late last month, there hasn’t been much to speak of. Last week the company filed an 8-K showing it appointed a new COO, Christine Kowalczyk. But again, nothing this week that would suggest that September 8th would be such an active session.

One of the biggest drivers for Support.com could be the dynamic shift in virtual work. Things like Zoom and other video conferencing apps are likely sources of troubleshooting requests. Could this be one of the catalysts behind the recent surge in SPRT stock?

Penny Stocks To Watch #4: Canaan Inc.

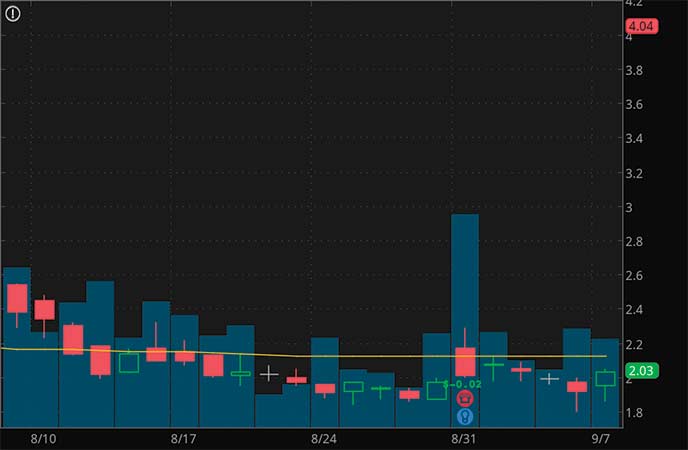

Canaan Inc. (CAN Stock Report) has the exact mirror-opposite in terms of charts compared to SPRT stock’s trend. Since the start of 2020, shares have gotten a beat down. While 52-week lows still sit around $1.76, CAN stock isn’t that far off from those levels. However, on Tuesday, CAN stock did come up for a little air during the session. The penny stock closed up over 5% after its latest update.

Read More

- Looking For Penny Stocks To Buy Now? 4 Biotech Names To Watch

- Top 5 Penny Stocks On Robinhood To Watch For September 2020

The company announced that its board of directors authorized a share repurchase program for up to $10 million worth of its outstanding American depositary shares, each representing 15 Class A ordinary shares, and/or Class A ordinary shares over the next 12 months starting from September 22, 2020.

Canaan is also coming off of a strong earnings report at the end of August. Canaan is a chip-maker and is currently focused on things like AI chips, AI algorithms, AI architectures, system on a chip integration and chip integration. The total computing power sold was 2.6 million Thash/s. This represented a year-over-year decrease of 18.2% from 3.2 million Thash/s in the same period of 2019.

However, it was a quarter-over-quarter increase of 198.5% from 0.9 million Thash/s in the first quarter of 2020. Furthermore, gross profit increased by 302.5% year over year and 1,711.5% quarter over quarter to RMB43.3 million (US$6.1 million) from RMB10.8 million in the same period of 2019 and RMB2.4 million in the first quarter of 2020.

In light of the recent buyback update, quarterly results, and upcoming Snowflake IPO, will CAN stock be on a tech penny stocks watch list this month?