What Are The Best Penny Stocks To Watch? Start With This One

After weeks of messages from readers, last week we released our first penny stock alert ever, IMC International Mining (IMIMF)(CSE:IMCX). We believed that based on the timing of the gold market and the current trend, this junior gold stock was one that we thought showed potential. And potential it has delivered.

[Breaking News – April 9, 2020] IMC International Mining Corp. Announces There Will Be No Delays In its Prospecting & Exploration Amidst Covid-19 Pandemic

Our report was released on the evening of April 1 and from the opening bell on April 2 through today, we’ve seen IMC International Mining (IMIMF)(CSE:IMCX) make a big move; 69% for those paying attention at home. This was from $0.36USD to highs of $0.61USD. In our opinion, what we saw today was signs of some profit-taking. But let’s not get things confused, profit-taking doesn’t kill a rally and as we saw on April 8, it opened the door for its next move; let’s explain:

If you look at the IMIMF chart, you’ll see that the previous level of resistance that the stock couldn’t break above was around $0.40. Now, why is this important? In simple terms, if and when a stock breaks through a solid level of resistance, you would ideally like to see that level become strong support. How would you identify support? In most cases, it happens to be where a penny stock rebounds from.

Take a look at the IMIMF chart again. Where did Wednesday’s low, print? If you said $0.40, you’d be correct and look what happened after hitting $0.40; shares strongly bounced back 17.5% by the close. We think that this reinforces our original focus on finding a potential level of support after a stock pulls back. After a 69% rally, there’s always a chance that early investors – especially those who saw IMIMF when it was still below $0.40 – would take profit.

But beyond that, for those looking at IMIMF as it has rallied, the next point of focus again is where does the profit-taking end and the next move begin? Too many times, I’m sure, you’ve seen penny stocks run and then drop without any type of bounce at all. It’s definitely one of the fears that penny stock traders have. In our case, however, it would appear that right now, IMIMF’s previous resistance around $0.40 may have just become its new level of potential support after seeing the 17.5% bounce back by the close.

The Best Is Yet To Come

Unlike many of the “alerts” you’re probably used to, ours are a bit different. We like to alert companies that could have real potential. IMC International Mining (IMIMF)(CSE:IMCX) is a junior exploration company that has quite literally just completed a multi-million dollar acquisition of a company, Thane Minerals, and its Cathedral Property. When it comes to mining and gold stocks, the real excitement comes as new findings are reported on, during phases of exploration and drilling.

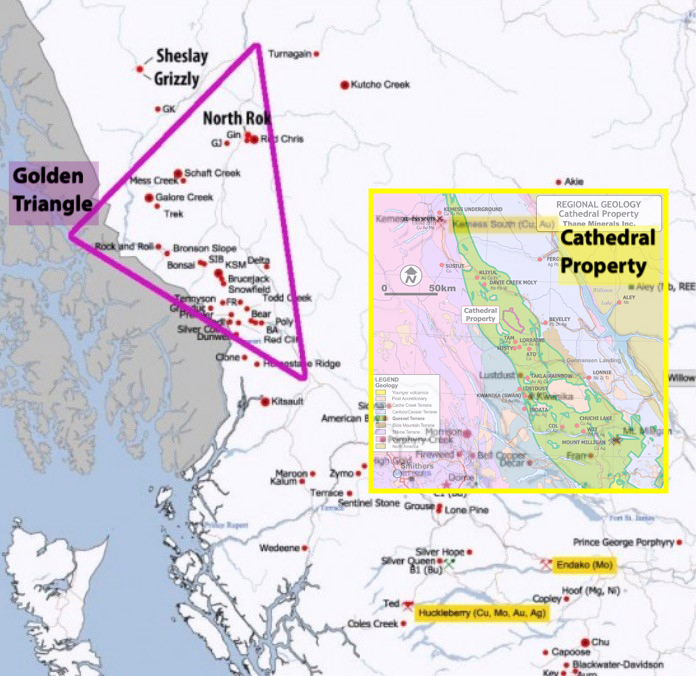

We haven’t seen anything yet, as this acquisition is still just days old. If you listened to the corporate conference call on April 7, you would have heard CME Consultants’ Chris Naas explain why the location of the Cathedral Property is so important and how he feels that based on early data, it could become a hot spot for gold discovery. Better yet is that it’s one of the few virgin pieces of land in the area known as the Quesnel Terrane. This area hosts past and planned production.

Rider: It is noted that the results of nearby or adjacent properties are not necessarily indicative of the potential of the Cathedral property and should not be understood or interpreted to mean that similar results will be obtained from the Cathedral property.

Other proven claims have been worked on by some of the biggest names in the mining industry including Royal Gold via a streaming deal with Centerra. For reference, Cathedral is between the Mt. Milligan and Kemess mines.

The Centerra-owned Mt Milligan copper-gold porphyry deposit contains a combined Measured and Indicated Mineral Resource of 243.9 million tons at 0.134% Cu and 0.226 grams per ton of gold, containing 717.7 million pounds of copper and 1,769,000 ounces of gold. Meanwhile, Kemess produced approximately 3 million ounces of gold and 700 million pounds of copper over the life of the mine.

Rider: It is noted that the results of nearby or adjacent properties are not necessarily indicative of the potential of the Cathedral property and should not be understood or interpreted to mean that similar results will be obtained from the Cathedral property.

Right Place, Right Time, Right Alert

Is IMC International Mining (IMIMF)(CSE:IMCX) in the right place at the right time? Considering the proven resources of the surrounding mines and the fact that gold prices just hit new 7-year highs this week, how would you answer that question?

Right now the gold sector has a lot going for it and during times where gold is hot, junior gold stocks are the ones that have outperformed. Case in point, while Barrick Gold jumped about 10.6% from April 2 to April 8, IMC International jumped nearly 70%. On top of this, both gold stocks pulled back this morning.

But when looking at the recovery, Barrick bounced back 2%; IMC jumped 17.5%! We believe that there could be much more to this developing story, which continues to strengthen our focus on IMC International Mining (IMIMF)(CSE:IMCX) and its Cathedral Property.

We were asked for a stock alert and we think this has been a great way to get the ball rolling. Ready for what’s next?

Click Here To Start Your Research On IMC International Mining