3 Penny Stocks To Buy Or Sell Right Now?

These 3 Penny Stocks Took Off, But Are They Still A Buy?

The potential to make giant profits while trading penny stocks is much higher than most other securities. In addition to their high-profit potential, penny stocks also move rapidly in short time spans. This can be good or bad for investors. It is obviously good if a trade moves upwards but the potential for a sharp decline is also there.

This is why it’s essential for those looking for penny stocks to buy to have a game plan and do lots of research. They should set stop-loss orders and take profits off the table when they earn them. In addition, it is essential to keep up with current market trends in order to get a better “feel” for the market.

To help get you started with the research, here are a few penny stocks to watch right now. They’ve had great moves but would you consider them a “buy” or a “sell”?

Penny Stocks to Buy (or Sell): PG&E Corporation (PCG)

The first company up for discussion is Pacific Gas and Electric Company (PCG Stock Report). PG&E is an energy company that provides electricity and natural gas to customers in the US. On top of its 43,100 miles of natural gas pipelines, the company also owns nuclear, hydroelectric, and solar energy facilities.

On October 26th, the company shut off power to reduce wildfire risk in order to ensure public safety. This news resulted in the penny stock gapping down below $5 during the trading session.

However, as power is being returned, the stock is starting to climb back up. On October 30th PG&E announced it has restored 73% of its customers impacted by the power shutoff. This has resulted in a 71% gain since Monday morning’s opening bell after PCG stock hit premarket highs of $6.50 on Wednesday.

Trending On PennyStocks.com | 5 Best Penny Stocks To Buy Or Sell Before November

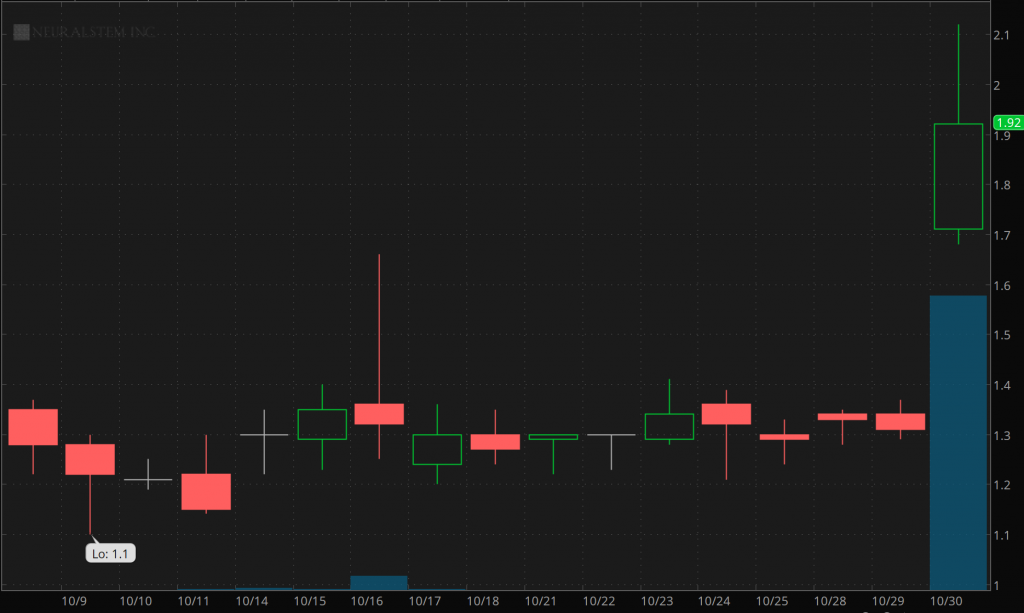

Penny Stocks to Buy (or Sell): Seneca Biopharma Inc. (CUR)

Next up in the spotlight is a company that hails from the lucrative biotechnology sector. Seneca Biopharma Inc. (CUR Stock Report) is a biopharmaceutical company that develops treatments for nervous system diseases. Seneca’s lead product is called NSI-566 is designed to treat Amyotrophic Lateral Sclerosis, chronic spinal cord injury, and ischemic stroke.

The company recently announced that it signed a term sheet with QYuns Therapeutics. This term sheet is for the global licensing of monoclonal antibodies for treating auto-immune diseases.

This news has done a few good things for the biotech penny stock. It has brought in a surge of abnormal volume during premarket hours. In addition, Seneca’s stock price has risen by 61.8% from its previous close on Tuesday. It’s also important to note that if you’re watching CUR right now, its stock will soon trade under the symbol ‘SNCA’ starting on November 1. Given the gap, is CUR stock going to sell off or head higher? Leave a note in the comments section to weigh in.

Penny Stocks to Buy (or Sell): McDermott International Inc. (MDR)

Like PG&E from earlier in this article, McDermott International Inc. (MDR Stock Report) is another energy company making significant moves. McDermott International provides technology, engineering, and construction solutions to energy companies. The company also transports oil and gas products around the world.

McDermott has had some news that is catching investors’ eyes. The company signed a memorandum of understanding with Darwin Clean Fuels. This memorandum is for the development of a Clean Fuels Condensate Processing Plant in Darwin.

[Read More] 5 Penny Stocks That Are Rallying This Week; 1 Up 296% Since January

This plant could provide cleaner fuel that produces 75% lower carbon emissions. This news is building on the penny stock’s success on October 29th, gapping up early on October 30th.