3 Penny Stocks To Buy In September?

If You Buy Penny Stocks, These May End Up On Your Watch List This Month

Do you know how to buy penny stocks? If you’re new to trading or just new to micro-cap stocks, then you’ll want to understand a few things. First, you should know that penny stocks carry a lot of risks and in turn, you should be ready to handle volatility. If you thought 10% swings were “crazy” in stocks like Facebook or Twitter, penny stocks can see swings of 50% or greater within minutes. Also, keep in mind that other factors can impact these cheap stocks.

A company like Apple can make an announcement and that may act as a catalyst behind a 3% move in the stock. For penny stocks, positive or negative news can dramatically shift sentiment and see a stock jump or drop exponentially. During the month of August, we saw several penny stocks soar from under $3 to over $10.

This is actually not an anomaly but just another example of how massive these stocks can breakout. Needless to say, some people who invest in penny stocks like to search for ones that have more consistency. And of course, this is opinion based as a “consistent penny stock to buy” has different meanings to different people. In general, consistency has a lot to do with company progress as well as chart trends. But again, this is subjective to the individual.

[sociallocker id=”2174″]

However, if you’re ready to dive into the world of penny stocks, make sure you have a plan, do your research and make lists. With this in mind, here’s a list of 3 penny stocks to watch or possibly, penny stocks to buy in September. The choice is up to you.

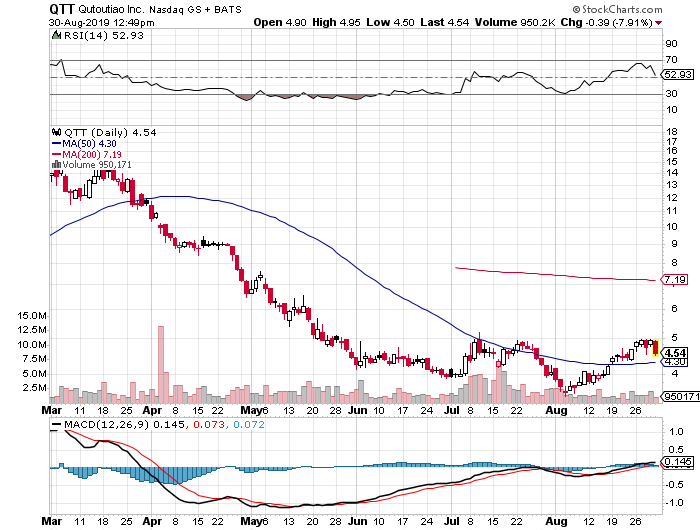

Is Qutoutiao Inc. (QTT) A Penny Stock To Buy Or Avoid In September?

Penny stocks have a lot of speculation involved due to the early-stage companies behind these equities. In turn, some stocks can increase based on anticipation. Qutoutiao (QTT Stock Report) has not had much in the way of recent news but the latest build-up could have something to do with an August 14th release.

Quoutiao announced that it will be releasing its second-quarter financials on September 4 after market close. In spite of the US and China trade war, this penny stock has been on the rise ever since making that announcement. I reference the trade war because Qutoutiao operates a mobile content platform in China. While other Chinese related large-cap stocks have waivered, QTT stock has climbed.

On August 5, the stock hit new 52-week lows. But since then, shares have been on the rise leading up to the September 4th deadline. The big question mark will be placed on the earnings themselves. Earlier this year, Qutoutiao announced a share buyback program of up to $50 million worth of outstanding shares over the 12 months to follow.

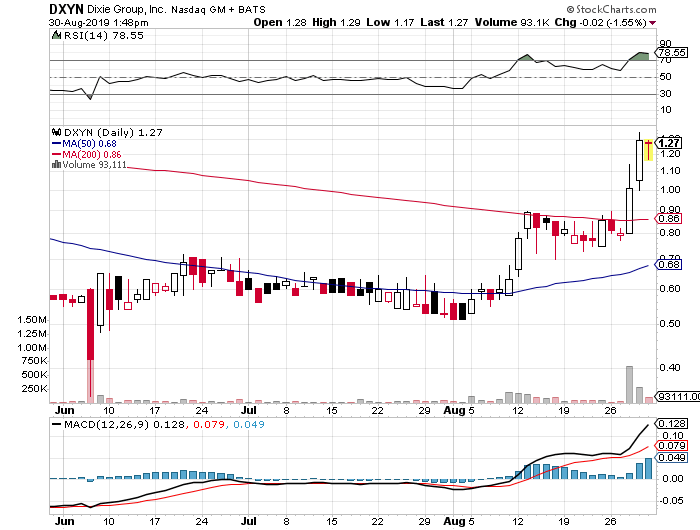

Dixie Group Inc. (DXYN): A Penny Stock To Watch?

You might not think rug sales are big business. However, Dixie Group (DXYN Stock Report) has found a way to build a business around it. The company manufactures and markets rugs to higher-end residential and commercial customers. They do this via Fabrica International, Masland Carpets, Dixie Home, Atlas | Masland Contract and Dixie International Brands.

Read More

Penny Stocks To Buy Or Sell: Nio Inc. (NIO)

2 Penny Stocks To Buy Or Avoid This Month: FNMA & FMCC

3 Marijuana Penny Stocks To Buy Or Sell Before 2020?

Believe it or not, the company recorded second-quarter net sales of over $100 million. The company is also expanding its flooring options beyond rugs. In fact, its strongest residential sales growth came from its hard surfaces line of luxury vinyl flooring. The company also realized an increase in receivables to $3.9 million during the quarter. Inventories also umped $343,000 from normal fluctuations during the season.

Since early August, shares have been on the rise. From about $0.50 at the start of the month, DXYN stock has climbed to highs of $1.34 heading into the new month. As the company has shown quarterly progress, will it continue to be a penny stock to buy in September?

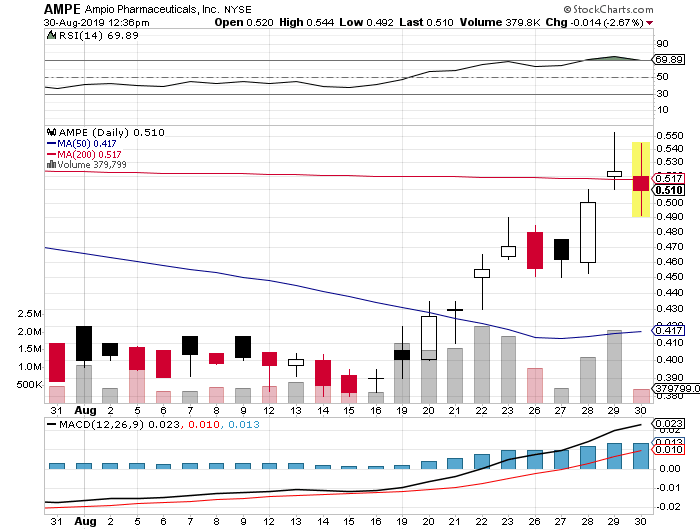

Is Ampio Pharmaceuticals (AMPE) A Penny Stock To Buy Or Watch?

Biotech stocks always gain attention in the fall and Ampio Pharmaceuticals (AMPE Stock Report) has been no different. Ever since mid-August, shares of AMPE have been climbing. The company has been conducting a phase 3 clinical trial titled, “A Randomized, Controlled, Double-Blind Study to Evaluate the Efficacy and Safety of an Intra-Articular Injection of Ampion in Adults with Pain Due to Severe Osteoarthritis of the Knee.”

[Related Content] Penny Stocks Getting Special Attention: India Globalization (IGC) Avadel (AVDL), Ampio (AMPE)

As of the last update in July, the company had enrolled over 250 patients with nearly half having been dosed. August was slated to see the rest of the clinical sites for the trials enrolling patients.

Thanks to updates like this, Ampio Pharmaceuticals gained attention from analysts. ThinkEquity initiated coverage on the company in mid-August. They gave it a buy rating and a $5 price target. In addition to this, the company is beginning to make strategic moves to be ready in the event of potential commercialization. In August, Ampio appointed people to the positions of a financial advisor as well as forming a Transaction Advisory Committee.

Essentially, these are steps taken for when and if it comes time to file a Biologics License Application for lead drug, Ampion. Michael Macaluso, Ampio’s CEO, explained in a press release that, “We are at a pivotal moment in the Company’s transition from a development stage company to the filing of a Biologics License Application (BLA) and subsequent commercialization of our lead drug, Ampion. As such, we are now upgrading the expertise level primarily devoted to further evaluating our near term strategic options in a rapidly evolving healthcare market place.”

Like This Article? Check Out 2 Penny Stocks That Made Big Money In 2019

[/sociallocker]