Are These 4 Names On Your List Of Penny Stocks To Watch Right Now?

When it comes to penny stocks, having a proper list put together is helpful. Many pro traders still use a pen and paper to write out ideas and record certain penny stocks that interest them. While there are different ways to classify your penny stocks, technical indicators are more frequently the reason. Whether it’s certain chart patterns or momentum catalysts, most day traders look at all penny stocks for quick breakouts. Does this mean you should only trade penny stocks?

Not necessarily. Obviously, if you’ve been a long-time reader of the site you know how cheap stocks can go on to run for months. All it might take is a little progress and good news over time. We have seen this first hand with a number of coronavirus penny stocks this year. The tale of Novavax (NVAX Stock Report) and others will go down in the history books. This was one of the stocks under $5 in January.

Today it trades above $50 and has seen highs of over $60. Now, not all penny stocks will encounter such a big move. But, that’s the beauty of these low-priced shares. Think about this, the move that NVAX stock saw equated to roughly 1,160%. By all means, that’s a huge win. But it took a $56 move to see such a rally. The crazy part is, a $0.25 stock would only need to jump a few dollars to record the same type of percentage gains.

[Read More] Are These Penny Stocks On Your List To Buy Or Sell Right Now?

Theoretically and mathematically it makes sense. But when it comes to actually trading penny stocks live, other things like emotions will factor in. Furthermore, the lower the price, the higher the likelihood that volatility will play a big role. Then again, if you can handle such dramatic swings in stock price, then maybe it’s time to get that list of penny stocks put together.

Best Penny Stocks To Watch: GNC Holdings

Right now, cities are loosening quarantine restrictions. This includes some allowing access to shopping malls. GNC Holdings (GNC Stock Report) was one of the top penny stocks to watch in April. While that move might have been a bit premature based on early speculation of reopening, this latest move could have a bit more to lean on. GNC stock price and volume have been increasing this month. After pulling back from April highs, shares have recovered by as much as 105%.

Having a large footprint in shopping centers and malls has hurt brick and mortar retailers this year. J.C. Penney, Pier 1, and many others have had to resort to bankruptcy options to either restructure or unwind. In GNC’s case, it may have kept afloat for now. The company recently reached an agreement with required lender groups to extend the springing maturity dates for certain loans.

As previously disclosed, GNC’s Tranche B-2 term loan, FILO term loan and revolving credit facility feature springing maturities that were to become due on May 16, 2020. That’s if certain conditions were not satisfied. Due to COVID-19 related impacts on its business, GNC expected it would not be able to reduce the amount outstanding under the convertible notes to less than $50 million by May 16. That was a requirement to avoid the springing maturity.

As a result of discussions with its lenders, GNC entered into amendments to its loan agreements. This extended the springing maturity dates for the term loan facility, FILO credit facility and revolving credit facility until August 10, 2020. If certain conditions aren’t met it could cause the extended springing maturity date to move forward to June 15, 2020. Could this latest move have resulted from this development or is there something else at play right now? Speculation has become a big driver of retail penny stocks so keep that in mind if GNC is on your list of penny stocks right now.

Best Penny Stocks To Watch: Party City Holdings

Potentially in sympathy with retailers, Party City Holdings (PRTY Stock Report) has been on the move. Tuesday saw share prices rise even higher with PRTY stock making a new Q2 high of $0.9207 in the morning. Consumer cyclicals have gotten some attention recently as states begin reopening.

While the future remains unclear right now, a little speculation doesn’t seem to have hurt retail penny stocks. The most recent rating by Morgan Stanley, on Mar 17, is at Equal-Weight, with a price target of $1 for PRTY stock. We’re also entering summer when the impact of coronavirus is thought to be slowing due to changes in warmer weather.

Will people be throwing post-pandemic parties soon? That’s still up in the air in my opinion. But it’s worth taking things like that into consideration. Of course, play close to the cuff with any speculation-fueled move. So far it seems to be working for PRTY stock traders this month.

Read More

- Penny Stocks To Watch This Week; 1 Up 286% This Quarter

- What Are The Best Penny Stocks Right Now? 4 Names To Know

Shares have climbed over 100% since May 14th. But it’s also important to keep a few other things in mind. While we haven’t seen any new updates from the company by way of headlines, we have seen disclosures filed. In its most recent, Party City made a motion to approve an amendment to the Company’s Second Amended and Restated Certificate of Incorporation to effect a reverse stock split. Will this signal that the party’s over for PRTY stock?

Best Penny Stocks To Watch: Heat Biologics

Shares of Heat Biologics (HTBX Stock Report) are on the move again. Over the last week or so, Heat Biologics gained steam following a tweet about its platform and relationship to COVID-19. The tweet said “Our #COVID19 vaccine candidate and #CancerTherapy developments are both designed to stimulate the #ImmuneSystem to attack disease-related material whether #ViralInfection or tumor growth.”

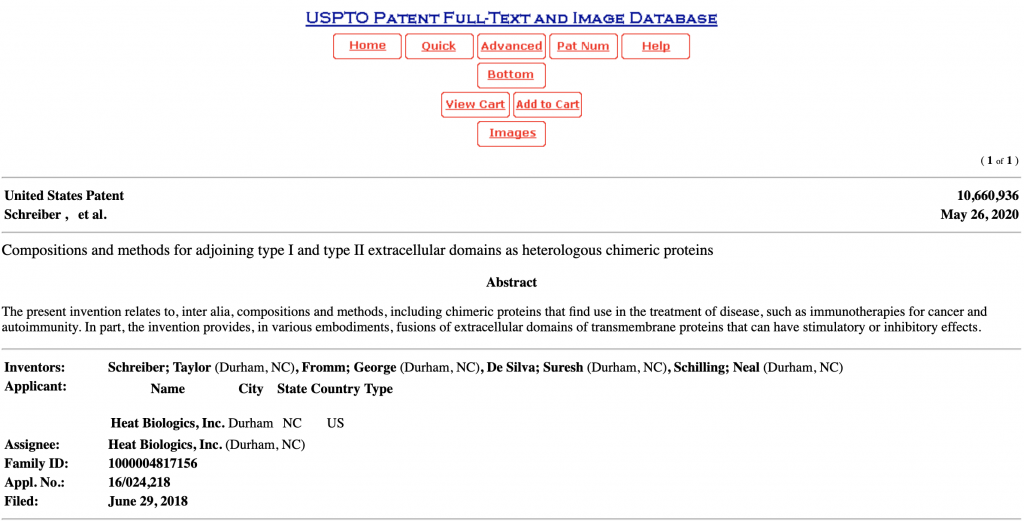

However, over the last few days eve more momentum was gained after 2 key developments. First, Heat Biologics came out with another tweet stating that it’s preparing for “any scenario by working on a #vaccine candidate that may be especially effective in maintaining long-term #ImmuneMemory”. Further to this, the US Patent website revealed another big development for the company.

Heat Biologics won a U.S. patent. The title of this patent is “Compositions and methods for adjoining type I and type II extracellular domains as heterologous chimeric proteins”. It provides for compositions and methods that are useful for cancer immunotherapy. For example, manipulating or modifying immune signals for therapeutic benefit. Following these latest updates, HTBX stock reached highs of $1.04 just as the afternoon session began. Its current 52-week high remains at $1.25.

Best Penny Stocks To Watch: Genius Brands International

We talk a lot about penny stocks to watch. Genius Brands (GNUS Stock Report) has been one of them since January. At the time, GNUS stock traded around $0.31. Over the last 5 months, we’ve watched as new developments helped spark momentum. But nothing trigger a rally as big as the updates we’ve seen this month. At the beginning of May, shares of GNUS stock went aggressively higher.

First, Genius Brands will see its Rainbow Rangers Toys from Mattel debut in Walmart stores this summer. In addition, the company announced the launch of a new network brand, Kartoon Channel, going live on June 15, 2020. In a corporate update, CEO Andy Hayward said, “This is an extraordinarily exciting time for Genius Brands and its assets. More than ever we are being thoughtful on how to harness the momentum of increasing viewership, and the accompanying advertiser revenue, alongside the power of the brands we have and are bringing forth.”

Despite shares dropping last week, GNUS stock has weathered the pressure well. The penny stock dropped after announcing a $9 million offering at $1.20. Given the fact that the money is slated for more than just “general working capital” it could have had a more positive spin on the discounted raise.

The net proceeds of the financing will be used to grow its newly-announced digital network for children, Kartoon Channel! on demand and subscription free, launching June 15, to fund production of additional episodes of its series Rainbow Rangers, and repayment of certain outstanding debt. Of course, some will also be for working capital. Is GNUS stock set for another run or will it slide before June? GNUS stock is up 377% month to date.