5 Penny Stocks That Are Already Turning Heads Before November

It’s entirely true that investors have the chance of making enormous profits through investments in penny stocks. But it should be noted that one needs to do his research well in order to find winners. Penny stocks are well known for being highly volatile. So, if the wrong pick is made then it can very easily lead to significant losses for investors.

So, it’s highly important for an investor to ensure that he watches the market closely and follows the latest movements being made by penny stocks. Also, don’t forget to take profits when they’re on the table. Sure, can penny stocks continue higher? As you’ll see in this article, definitely. But why risk a 20, 50, or even 100% gain in exchange for a “home run” when that “home run” is less likely?

[Penny Stocks 101] What Are Penny Stocks And Are They Worth Buying?

The fact of the matter is that you need a plan. Find stocks that meet your specific criteria. If you don’t understand the oil and gas market, it may not be best to search for stocks in that sector. I say this because oil and gas can change at a moment’s notice. One bad report or rumors of more production/less production could dramatically shift the market trend.

That goes for other industries too. Cannabis, biotech, and even technology can grow increasingly volatile. But if you’re on the hunt for simple volatility, then penny stocks are usually where you’ll find it. Here is a look at 5 stocks that could be on penny stock watch lists this week.

Avinger (AVGR): Penny Stock Rallies Over 100%

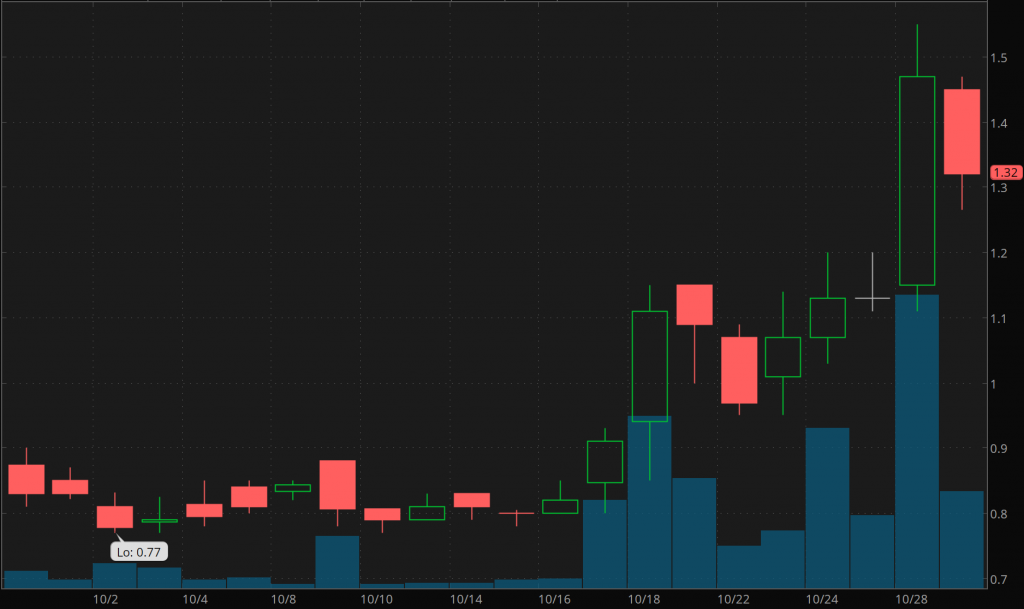

The first on this list of penny stocks is medical device company Avinger Inc (AVGR Stock Report). The penny stock has been on a tear for much of this month. In fact, since lows of $0.77 on October 2, it has gained as much as 101%. On Monday, the company made another major announcement and that saw Avinger stock start its rally for the week.

On Monday, the company announced that it has managed to expand its footprint in the United States by signing up seven new accounts in Q3 2019. The news sparked fresh optimism in the markets and the stock soon climbed. That same momentum carried into Tuesday as well. Will that spark burn hot into November?

Bioanalytical Systems (BASI) Jumps Nearly 300%

The other stock penny stock that made significant gains this month was the Bioanalytical Systems, Inc. (BASI Stock Report) stock. In fact, BASI stock has been on a tear all year long. That being said, it should be noted that there has not been any particular news with regards to the company that could have triggered Monday’s rally.

The last announcement was about the addition of Stewart B. Jacobson, DVM, DACVP, as Vice President, Pathology. Other than that, there has been a slew of FORM 4s filed indicating insider trades in the company’s stock. The company is involved in providing research services and monitoring instruments to pharmaceutical companies. This is definitely a stock that should be watched closely.

Penny Stock Fitbit (FIT) Soars Higher On Google News

The other penny stock that skyrocketed this week is activity tracking device manufacturer Fitbit Inc (FIT Stock Report). It has been one of the most popular penny stocks on Robinhood for months. A report from Reuters stated that the parent of Google, Alphabet Inc. is actively looking to buy out the company. As we discussed yesterday, once the news broke, investors flocked to the stock in droves.

Unnamed sources told news agencies that Alphabet (GOOGL Stock Report) has made an offer to acquire Fitbit. That being said, the source has also stated that the negotiations may not lead to an eventual acquisition from Alphabet.

However, the stock market gave a big thumbs up to the news. Fitbit stock continues to rise this week with a rally of over 45% alone. Since late August, shares of FIT stock have jumped by as much as 124%. Keep in the back of your head that these are moved based on unnamed sources with a blatant disclaimer that the deal may or may not close. So, “cautiously optimistic” has been a phrase thrown around a lot over the last 48 hours.

IVERIC bio Inc. (ISEE); Another Penny Stock With Triple-Digit Moves

IVERIC bio Inc. (ISEE Stock Report) is a biotechnology company that develops treatments for patients with orphan inherited retinal diseases. At the moment, IVERIC has 6 treatment plans in research and preclinical trials and then another 2 treatments in Phase 2 trials. This has been a very big week for the stock.

The company recently revealed some big news that is making the penny stock fly. IVERIC announced that its C5 inhibitor, Zimura, met its primary endpoint in its phase 2b clinical trial. Zimura reduced the rate of geographic atrophy for patients with dry age-related macular degeneration.

This prompted the biotech penny stock to increase from $0.93 to $1.99, a 114% move. Further to this, the company announced the appointment of Abraham Scaria, PhD as Chief Scientific Officer. He was a scientist at Genzume and Sanofi and now brings his experience to IVERIC. But what’s more interesting is the fact that ISEE stock hasn’t completely fallen apart. I don’t mean to be a pessimist but after a gap up and move of over 100%, many penny stocks crumble. This wasn’t the case so far this week.

Endo International plc (ENDP) Battles Back From 52-Week Lows

On October 17th we released an article titled, “3 Penny Stocks To Watch As Biotech Sector Takes Off.” Endo International plc (ENDP Stock Report) was in this article, low and behold the stock has made even more noise. Endo International is a pharmaceutical company primarily focused on developing and selling generic and specialty branded medicines.

As we near the end of October, Endo continues to push upwards as most of the month. Before the trading session on October 28th, the company’s stock price has risen 40%. However, during premarket hours on the 28th, Endo’s stock is up an additional 4%. This is due to the company announcing some penny stock news. Endo is launching a new campaign called “Redefining Scientific Artistry” to educate consumers and physicians about Endo.

“The campaign focuses on Endo Aesthetics’ science-driven approach to viable treatment options for cellulite and will continue to lay the groundwork to credential Endo Aesthetics as a leader in the aesthetic market,” said Robert Catlin, Vice President of Aesthetic Sales and Marketing at Endo.

Which Penny Stock Sectors Are The Best?

Penny stocks are well-known for their volatility. Mash this up with certain penny stock sectors and you could see explosive movement. Pair bullish news there and it could be a dramatic move. Now, this could be in either direction of course. But when it comes to penny stock sectors, it doesn’t necessarily need to be a red-hot sector. It would be best, but as long as it isn’t totally bearish, chances are you can find some strong penny stocks to watch.

Consider some of the most volatile and active sectors:

Thanks to the general makeup of these sectors, news, market momentum, and general buzz can become extreme catalysts. In this case, sectors may not be as important as where the excitement is. Now, that’s if you’re a high-frequency trader.

On the other hand, if you’re looking for certain swing trades, sectors will play a larger role. In the case of some of the stocks listed above like BASI, for instance, sector performance may play a smaller role. Just look at the general trends of biotech over the last few months. You can do this by pulling up the Biotech ETF (IBB ETF Report). That chart is incredibly volatile. Compared to the BASI chart in this example, it’s a stark difference.

Nevertheless, always keep your wits about you. Stick to your plan and try not to get caught in the hype. With marijuana stocks, for instance, it isn’t hard to get that FOMO when the sector is red hot. FOMO or “Fear Of Missing Out” can “force” you to hold positions longer with the hope of a big score.

This can take your trading from plan-based to emotion-based and this can be a dangerous place to be. Revenge trading, giving up moderate gains for big losses, and going in with bigger trades than normal can all result from believing the hype over sticking to a strategy. No matter the sector, always remember that you have a plan.