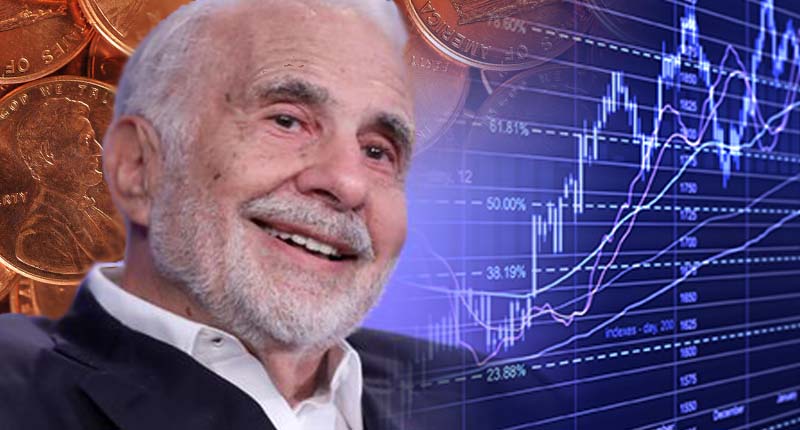

So maybe Carl Icahn doesn’t have all of these penny stocks on his list. But at least one of them is near and dear to him. The billionaire has been known to dabble in the world of cheap stocks. If you remember a few years back, Icahn was a large investor in a penny stock, Voltari Corp. He’s also been cited as grabbing a stake in Cloudera, another penny stock at the time.

[Read More] The Biggest Market Opportunity Of 2020: Coronavirus

The fact price doesn’t matter as much as potential should suggest to new and “experienced” traders that penny stocks are more than just a few letters that are volatile stocks. Many of these penny stocks might actually have an opportunity to do something good.

At the very least, they may have a shot at making it “halfway there” and in that case, it might see certain penny stocks go from “development stage” to something a bit more.

What Names Will Be On Your List Of Penny Stocks?

While this has been a topsy turvy week in the market, it doesn’t change the fact that people are making money with penny stocks every day. The fact that some investors consider penny stocks a “complete gamble” seems a bit absurd. Let’s not get overly optimistic, many penny stocks don’t make it.

But the success or failure of the company versus the success or failure of the stock are two different things in many cases. This week we saw it first hand with countless penny stocks. How many times did you see stocks under $5 trading like crazy yet no news was anywhere to be seen?

These low-priced stocks, fueled with momentum, don’t usually need a massive catalyst to see big gains. The share structures alone can lead to opportunity if (and a big if) there’s activity in the market. Just because stocks trading under $1 “could move” doesn’t mean they will, based on price alone. There must be a market and its a good idea to find penny stocks with some sort of momentum. With this in mind, here are some penny stocks to watch heading into the weekend. Will they top your list next week?

Aytu Bioscience Inc. (AYTU)

Shares of Aytu Bioscience Inc. (AYTU Stock Report) have been off and on our list of penny stocks this year. While it has become a fan-favorite among day traders, investors are still watching closely to see if it can deliver on its previously set goals. The specialty pharmaceutical company picked up an opportunity to get involved with the testing side of the coronavirus pandemic.

Shares have had their time in the sun. But after reaching highs of $2.22 in March, the overall trend has been bearish. Have there been days where the stock jumped 15% or more, yes but in general, it’s been a rough last few weeks for the penny stock.

Earlier this week that trend continued. But on Friday the tune changed a bit after the company’s latest update. Aytu Bioscience reported results of its 2020 Annual meeting. This included the election of Joshua Disbrow, Steven Boyd , Gary Cantrell , Carl Dockery, John Donofrio, Jr., Michael Macaluso, and Ketan Mehta to the Company’s Board of Directors for one-year terms. But what seems to have struck a chord is a recent deal the company struck and what the U.S. President has recently praised.

The company signed an exclusive worldwide license from Cedars-Sinai to develop and commercialize the Healight Platform Technology. The Healight technology employs proprietary methods of administering intermittent ultraviolet A light via a novel endotracheal medical device. Thanks to Donald Trump’s favor of UV rays to combat coronavirus, this could be another speculative, momentum-fueled focus on AYTU stock. What will next week bring? Comment below.

Hertz Global Holdings (HTZ)

It’s crazy to think but at one point this year Hertz Global Holdings (HTZ Stock Report) traded as high as $20.85 this year. While the last month or so has seen shares of the car-rental company bounce back as high as $9.04, it’s still one of the stocks under $4.

On April 24th the penny stock saw its highest share volume day of the year with more than 45 million shares traded. The stock came within 24 cents of testing its 2020 low but managed to draw a line in the sand at $3.42 before bouncing to a close of $3.71.

The coronavirus has certainly taken its toll on travel companies. While the initial focus was on airline stocks, investors soon figured out that if no one’s flying, not many are staying in hotels or renting cars. Even with the low price of gas, travel is nearly at a standstill right now. But Hertz made headlines late this week and it could give rise to some focus by its investors; one of the largest of which is Carl Icahn.

[Read More] Top Penny Stocks Today; 3 Up Over 100% In April 2020

The company apparently has hired debt restructuring advisers at White & Case LLP and Moelis & Co. The goals is to explore financial options amid falling car rental demand due to the COVID-19 pandemic as reported by Reuters, citing people familiar with the matter. While there hasn’t been much commentary following his stake, Icahn simply said to the New York Times, “we are on the board there.” Are you on board with Icahn and Hertz or is this one of the penny stocks not on your list right now?

Plug Power (PLUG)

Energy stocks have been in the limelight this week. After a number of oil and gas names fell to record lows (including negative values), the sector seemed to have popped back into place at the end of the week. As speculative trading could be a big proponent, some are looking to alternative energy as an option. Sure, you have the likes of Tesla and others gaining ground. But as far as industry is concerned, big businesses are looking toward the future.

Plug Power (PLUG Stock Report) has come back in focus this quarter. The penny stock reached highs of $6.05 earlier this year. However, thanks to the massive market sell-off, PLUG stock dropped as low as $2.53. Since rebounding back above $4 there could be a few things to take into account right now. One of which is a very recent deal (not with Plug specifically) that could focus some attention on fuel cell stocks in general.

Transport giants Volvo Group and Daimler Truck recently teamed up to focus on fuel-cell technology. The Volvo Group and Daimler Truck have announced plans for a collaboration focusing on hydrogen fuel-cell technology, in the latest example of major transportation firms taking steps to push the technology into the mainstream.

“Using hydrogen as a carrier of green electricity to power electric trucks in long-haul operations is one important part of the puzzle, and a complement to battery electric vehicles and renewable fuels,” said Martin Lundstedt, the Volvo Group’s president and CEO. Will this have a positive or negative impact on companies like Plug Power?